Please use a PC Browser to access Register-Tadawul

Can Vistra (VST) Balance Legislative Momentum and Near-Term Earnings Pressure for Long-Term Gains?

Vistra Energy Corp. VST | 170.48 | +1.32% |

- Recently, Vistra Corp has attracted significant attention due to ongoing discussions about acquiring Comanche Peak, supported by the Texas SB6 bill, and the company is furthering its renewable energy and AI-driven efficiency initiatives.

- While analysts have shown optimism based on these growth strategies, current earnings forecasts anticipate a notable year-over-year decline for the current quarter, despite expectations of revenue growth ahead.

- We will now examine how Vistra's potential Comanche Peak acquisition and legislative support could influence its investment outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Vistra Investment Narrative Recap

To be a shareholder in Vistra, you need to believe that the company’s push into renewables, energy storage, and potential nuclear expansion gives it an advantage as electricity demand evolves. The recent news surrounding the Comanche Peak acquisition and supportive Texas legislation could serve as a key short-term catalyst by expanding capacity, but doesn’t materially change the most important risk right now: elevated debt levels that could limit Vistra’s financial flexibility if market conditions tighten.

Among recent company announcements, the expansion at Moss Landing Energy Storage Facility is especially relevant. This project highlights Vistra’s execution risk as it scales up capital-intensive assets, delays or cost overruns could eat into promised returns and offset progress from regulatory support or acquisitions.

On the other hand, investors should be aware that even with new legislative backing and growth initiatives, Vistra’s reliance on high leverage means its flexibility could quickly shift if...

Vistra's narrative projects $24.5 billion revenue and $3.4 billion earnings by 2028. This requires 9.8% yearly revenue growth and a $1.2 billion earnings increase from $2.2 billion currently.

Uncover how Vistra's forecasts yield a $218.24 fair value, a 4% upside to its current price.

Exploring Other Perspectives

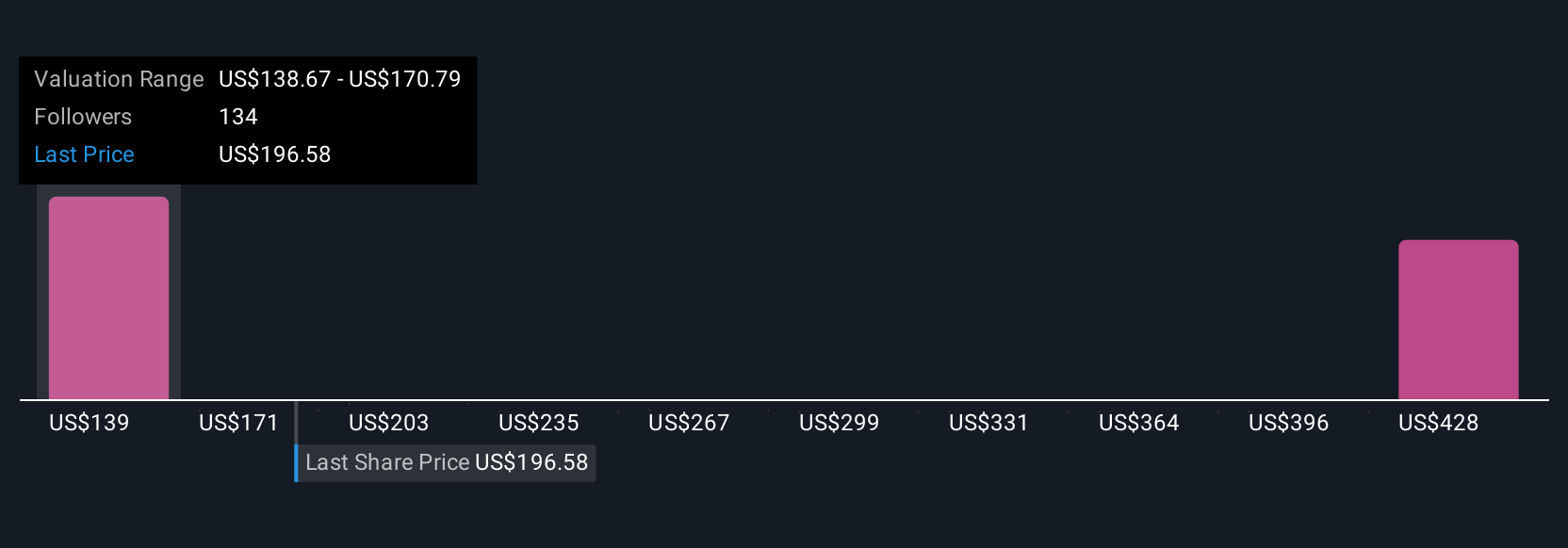

Fifteen members of the Simply Wall St Community estimate Vistra’s fair value from US$138.67 to US$404.79 per share. As you consider these different valuations, remember that execution and integration risks tied to the Moss Landing expansion could have broader effects on near-term results.

Explore 15 other fair value estimates on Vistra - why the stock might be worth as much as 93% more than the current price!

Build Your Own Vistra Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vistra research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Vistra research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vistra's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Explore 25 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.