Please use a PC Browser to access Register-Tadawul

Capital One (COF): Assessing Valuation After Steady Momentum and Analyst Optimism

Capital One Financial Corporation COF | 237.87 237.87 | -0.59% 0.00% Pre |

Most Popular Narrative: 10.7% Undervalued

According to the most widely followed narrative, Capital One Financial is currently seen as undervalued by analysts, with plenty of room for upside based on future earnings and growth projections.

The combination with Discover positions Capital One to leverage proprietary payments network infrastructure. This allows Capital One to migrate debit and some credit card volume to the unregulated Discover network. This transition is expected to generate substantial incremental fee income and interchange revenue over time as scale, acceptance, and brand investments are realized.

Why is Capital One’s fair value trending so much higher than today’s price? Analysts have built unusually bold assumptions into their models. Could this be a blueprint for explosive growth or just an optimistic forecast? The numbers behind this narrative, centered on big bets in network synergies, technology, and margin expansion, are worth a closer look for anyone thinking long term.

Result: Fair Value of $250.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, integration challenges from the Discover merger or heavy tech investment costs could threaten Capital One’s projected growth if synergies do not materialize.

Find out about the key risks to this Capital One Financial narrative.Another View: SWS DCF Model’s Take

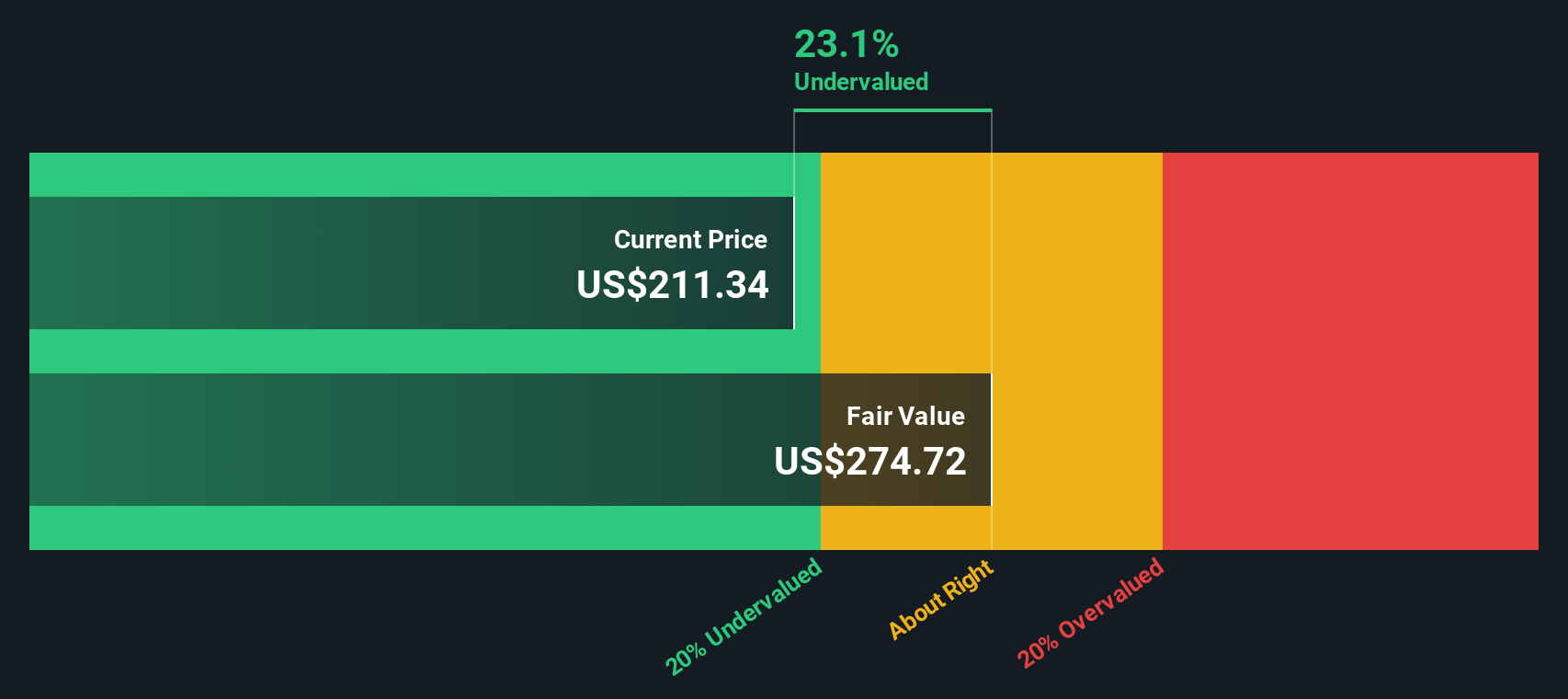

While the analyst consensus relies on optimistic growth and profit assumptions, our SWS DCF model tells a similar story and suggests Capital One Financial still appears undervalued. But could reality turn out differently?

Build Your Own Capital One Financial Narrative

If you want to dig deeper or see things differently, you have the tools to build your own perspective in just a few minutes. Do it your way

A great starting point for your Capital One Financial research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never wait for opportunity to knock twice. If you want to broaden your approach and find your next winning idea, let these powerful screeners guide your search and help you spot tomorrow’s best investments before the crowd does.

- Unlock untapped value by hunting for companies that are trading below their potential. Use our undervalued stocks based on cash flows to find hidden gems others might overlook.

- Turbocharge your portfolio returns with steady income from shares offering solid yields. Get started with the dividend stocks with yields > 3% to pinpoint stocks delivering strong cash flows.

- Step into the frontier of innovation and shape your strategy around transformative trends with the healthcare AI stocks. See which companies are reimagining the future of health and medicine.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.