Please use a PC Browser to access Register-Tadawul

Capri Holdings (CPRI): Evaluating Valuation Prospects as Turnaround Hopes Meet Market Realism

Capri Holdings Limited CPRI | 25.71 | -1.00% |

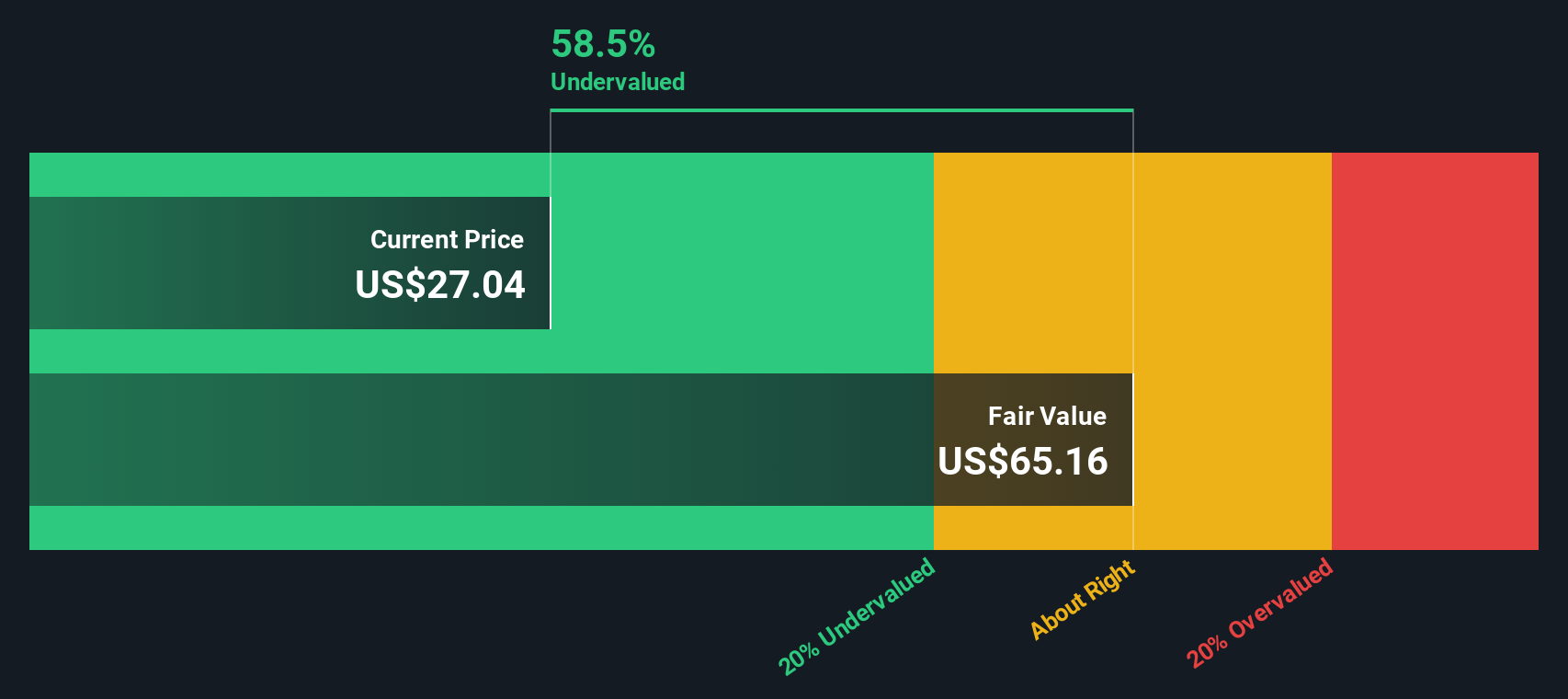

Most Popular Narrative: 45.6% Undervalued

The current narrative, according to n385903, views Capri Holdings as trading at a steep discount to its estimated fair value. This highlights the company's potential for substantial upside if it can execute a turnaround.

It has become more apparent that Capri’s turnaround story has to be done with no moat and rather tiny margins moving forward as it tries to move back to profitability. It can’t currently do buybacks and has to deal with more declining revenue. Projected inflation and a likely case of consumer burnout make the luxury space a significant risk. Their largest brand, Michael Kors, is undoubtedly experiencing a decline and will require crucial strategic understanding to reverse this trend. However, they have shown their brands to be inherently valuable and could sell them off in the future.

Curious why this narrative sees real value even with so many obstacles? The secret is in bold financial assumptions, such as major margin rebounds and a shift in brand strategy. Want to uncover the strategic pivots and numbers behind this fair value call? Dive deeper and get the inside story driving this eye-catching price target.

Result: Fair Value of $37.64 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, declining brand strength or prolonged weakness in key markets could quickly challenge even the most optimistic turnaround assumptions for Capri Holdings.

Find out about the key risks to this Capri Holdings narrative.Another View: Discounted Cash Flow Perspective

Looking through our DCF model, the analysis also sees Capri Holdings as undervalued compared to its fundamentals. However, any valuation is built on forecasts that could shift quickly. Could hidden risks or optimistic assumptions be at play?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Capri Holdings Narrative

If our take doesn't line up with your own view, or if you'd rather crunch the numbers yourself, you can easily craft your own narrative in just a few minutes. Do it your way

A great starting point for your Capri Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Great investors keep their options open. Don’t miss out on the potential hidden in exciting trends. These handpicked ideas let you stay ahead of the curve and uncover tomorrow’s winners today.

- Spot undervalued gems primed for growth with undervalued stocks based on cash flows right now. Unearth solid stocks with strong cash flows and compelling upside before the crowd catches on.

- Tap into the tech frontier with quantum computing stocks, your springboard into companies leading the charge in quantum computing breakthroughs and the next era of innovation.

- Secure your portfolio’s income stream by seeking out dividend stocks with yields > 3% and enjoy reliable returns from companies offering yields above 3%. Don’t miss these high-performing favorites.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.