Please use a PC Browser to access Register-Tadawul

Capricor Therapeutics (CAPR): Reassessing Valuation After Positive Phase 3 HOPE-3 Results for Deramiocel

Capricor Therapeutics, Inc. CAPR | 28.51 | -2.20% |

Capricor Therapeutics (CAPR) just cleared a major clinical hurdle, reporting positive topline Phase 3 HOPE-3 data for its Duchenne muscular dystrophy therapy Deramiocel, and that update is reshaping how investors view the stock.

The news has landed after an extraordinary run, with Capricor’s 30 day share price return of 364.64 percent and year to date share price return of 73.93 percent. Its 1 year total shareholder return of 96.23 percent and 3 year total shareholder return of 593.87 percent point to powerful, if volatile, momentum that recent follow on equity raises and shifting short interest are now testing around the latest close at $26.02.

If this kind of clinical inflection has you thinking more broadly about biotech, it might be a good time to explore other potential opportunities across healthcare stocks.

With shares now hovering just above the recent offering price and trading at a steep discount to bullish analyst targets, investors face a pivotal question: Is Capricor undervalued here, or already pricing in much of Deramiocel’s future upside?

Most Popular Narrative: 41.6% Undervalued

Capricor’s most followed narrative pegs fair value near $44.56 a share, well above the latest $26.02 close. This frames the situation as a deep-value setup built on aggressive growth and margin expansion assumptions.

Advancements in regulatory pathways for rare diseases and cell therapies, along with Capricor's demonstrated manufacturing readiness and quality approvals, set the stage for accelerated approval and commercialization, shortening the path to revenue generation and potentially expanding gross margins earlier than currently reflected in the stock.

Want to see what kind of revenue surge and profit swing are embedded in that view, and what future earnings multiple it quietly assumes? The full narrative unpacks the bold growth, margin, and valuation leap that underpin this fair value call.

Result: Fair Value of $44.56 (UNDERVALUED)

However, even with upbeat assumptions, any regulatory setback for Deramiocel or slower than expected HOPE-3 readout could quickly unravel this undervaluation case.

Another Lens on Value: Rich on Book, Cheap on Story

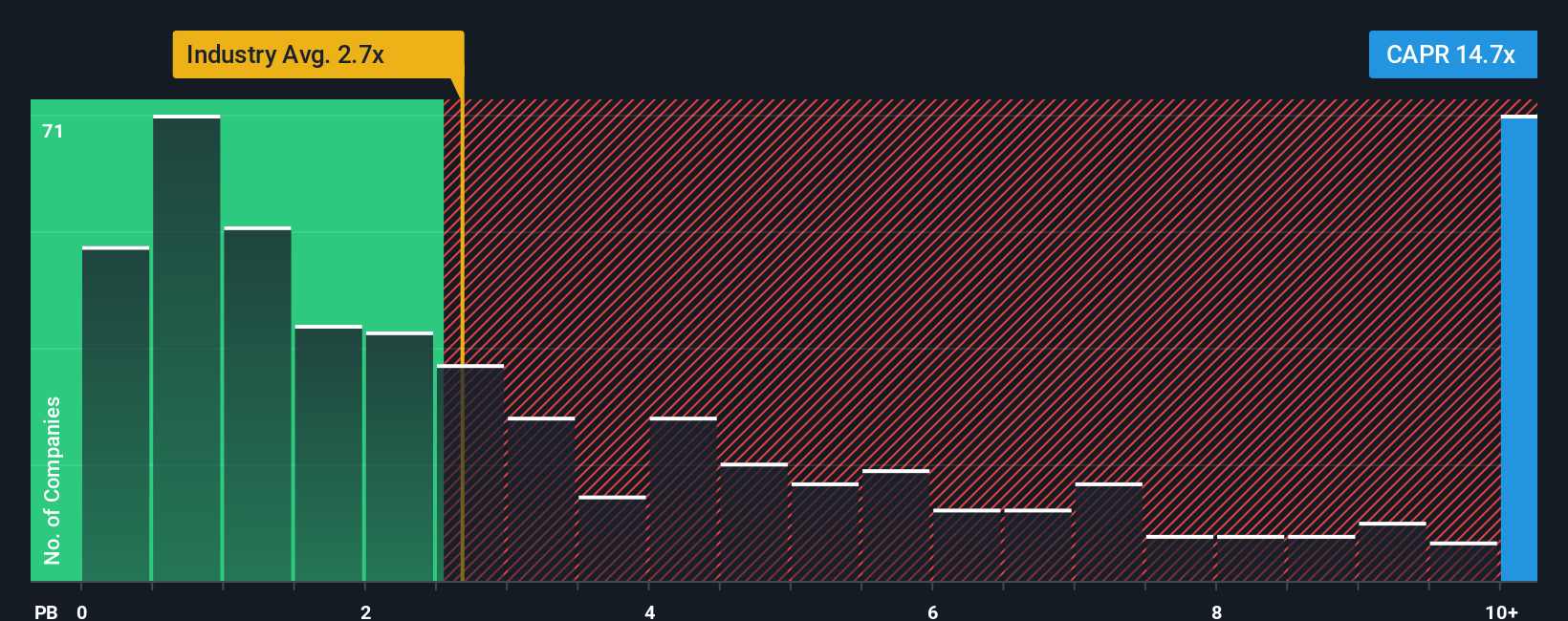

While the narrative driven fair value leans heavily toward upside, the balance sheet tells a tougher story. Capricor trades on a punchy 16 times book value, versus about 2.7 to 2.9 times for US biotech peers, a gap that leaves far less room for error if Deramiocel stumbles.

Build Your Own Capricor Therapeutics Narrative

If you see the numbers differently or simply want to dig into the details yourself, you can build a personalized view in minutes: Do it your way.

A great starting point for your Capricor Therapeutics research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Capricor is exciting, but do not limit your next move to one stock. Use the Simply Wall Street Screener to uncover fresh, data driven opportunities today.

- Explore high potential growth at sensible prices by reviewing these 908 undervalued stocks based on cash flows that strong cash flow analysis suggests the market is still mispricing.

- Gain exposure to powerful technology shifts early by targeting these 26 AI penny stocks positioned at the heart of artificial intelligence adoption across multiple industries.

- Seek income potential while rates and volatility shift by focusing on these 13 dividend stocks with yields > 3% that may support reliable cash yields in your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.