Please use a PC Browser to access Register-Tadawul

Cardlytics (CDLX) Is Up 16.0% After Citron Flags Major Partnership Potential – What's Changed

Cardlytics CDLX | 1.08 | -7.69% |

- Earlier this week, Cardlytics saw increased public attention after Citron Research released a report highlighting the company's potential upside if it secures a major customer for its rewards platform.

- This analysis by Citron points to the potential for Cardlytics to transform its business model and broaden consumer benefits if a significant publisher partnership materializes.

- We'll review what Citron Research's focus on a possible major customer announcement might mean for Cardlytics' investment outlook.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Cardlytics Investment Narrative Recap

To be a Cardlytics shareholder, you need to believe in the company’s ability to secure and scale meaningful publisher partnerships for its rewards platform, which could unlock sustained growth and improved margins. The Citron Research news has drawn attention to this “major customer” catalyst, but unless such a partnership is confirmed, risk factors like ongoing financial losses and partner concentration remain the most important near-term concerns for investors.

Of the recent announcements, the May launch of the Cardlytics Rewards Platform ties most directly to the catalyst spotlighted by Citron. This product aims to attract both consumers and new non-bank publisher partners, enhancing the platform’s relevance ahead of any possible large-scale partnership news, and reinforcing the importance of broadening distribution channels for future growth.

By contrast, investors should be particularly aware of the risk tied to potential content restrictions by a major financial institution partner and how quickly this could alter Cardlytics' revenue profile if things don't go as planned...

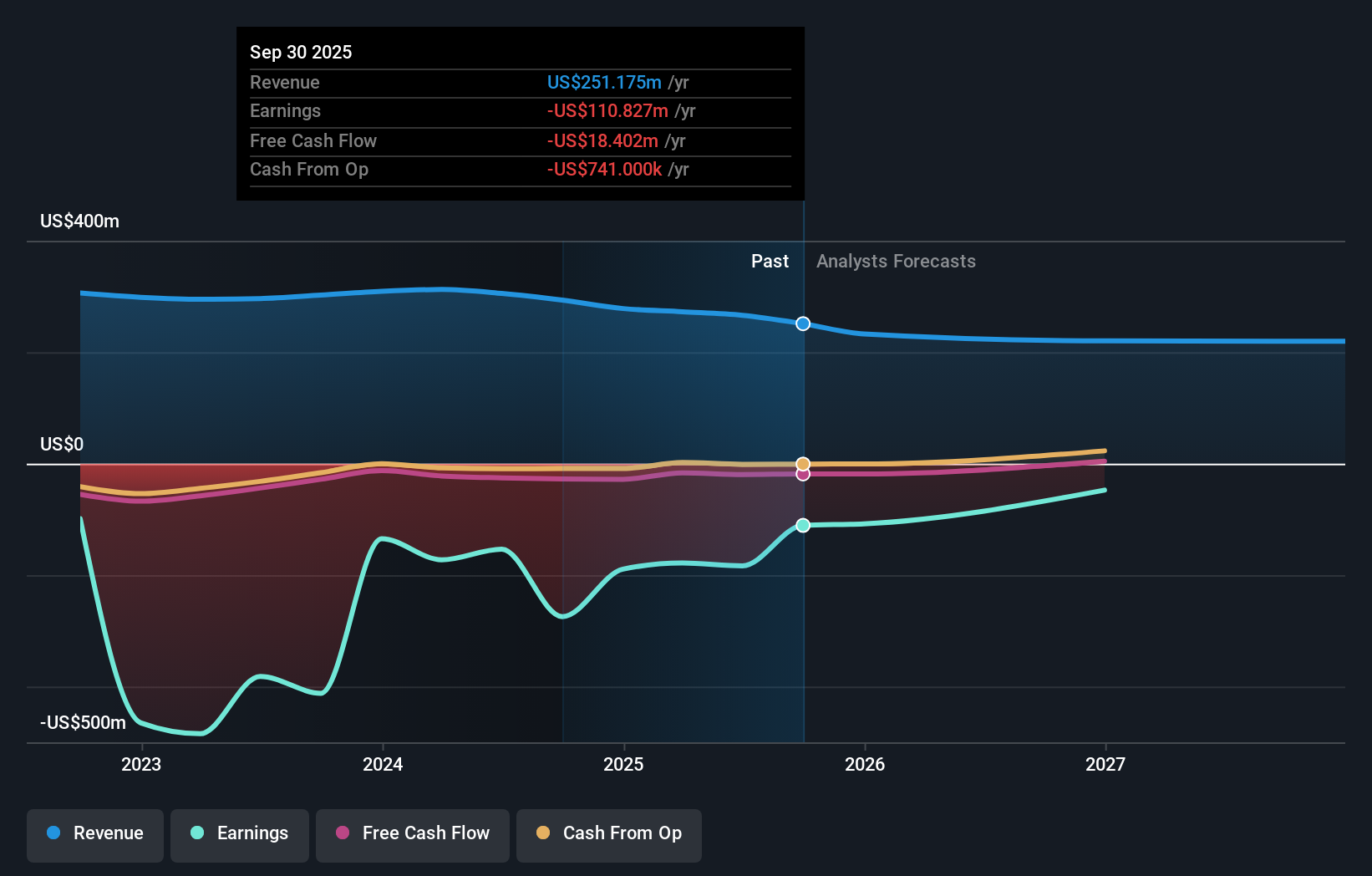

Cardlytics' narrative projects $191.8 million in revenue and $19.4 million in earnings by 2028. This assumes a yearly revenue decline of 10.3% and an earnings increase of $202.7 million from current earnings of -$183.3 million.

Uncover how Cardlytics' forecasts yield a $1.62 fair value, a 42% downside to its current price.

Exploring Other Perspectives

Two community members on Simply Wall St offered fair value estimates for Cardlytics ranging from US$1.63 to US$70 per share. While opinions are diverse, many are weighing the potential for a major publisher partnership to reshape the company's future and challenging short-term revenue risks, so be sure to review the many viewpoints available.

Explore 2 other fair value estimates on Cardlytics - why the stock might be worth 42% less than the current price!

Build Your Own Cardlytics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cardlytics research is our analysis highlighting 2 important warning signs that could impact your investment decision.

- Our free Cardlytics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cardlytics' overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.