Please use a PC Browser to access Register-Tadawul

CarGurus, Inc. (NASDAQ:CARG) May Have Run Too Fast Too Soon With Recent 26% Price Plummet

CarGurus, Inc. Class A CARG | 30.17 | +3.32% |

CarGurus, Inc. (NASDAQ:CARG) shares have had a horrible month, losing 26% after a relatively good period beforehand. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 27% share price drop.

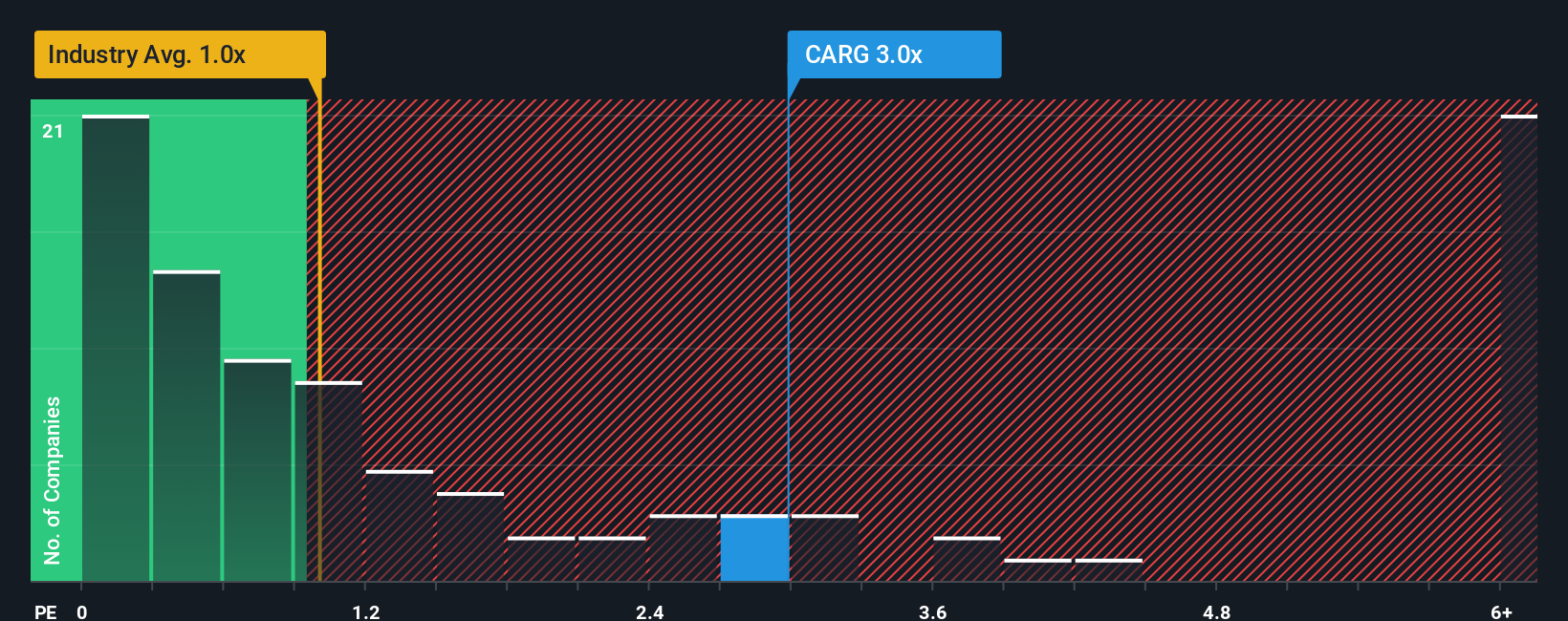

Even after such a large drop in price, you could still be forgiven for thinking CarGurus is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.9x, considering almost half the companies in the United States' Interactive Media and Services industry have P/S ratios below 1x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

What Does CarGurus' Recent Performance Look Like?

Recent times haven't been great for CarGurus as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. If not, then existing shareholders may be very nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on CarGurus.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as high as CarGurus' is when the company's growth is on track to outshine the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 4.2% last year. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 46% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 6.8% per annum as estimated by the analysts watching the company. With the industry predicted to deliver 16% growth each year, the company is positioned for a weaker revenue result.

In light of this, it's alarming that CarGurus' P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

CarGurus' P/S remain high even after its stock plunged. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Despite analysts forecasting some poorer-than-industry revenue growth figures for CarGurus, this doesn't appear to be impacting the P/S in the slightest. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. At these price levels, investors should remain cautious, particularly if things don't improve.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for CarGurus with six simple checks will allow you to discover any risks that could be an issue.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.