Please use a PC Browser to access Register-Tadawul

Carpenter Technology (CRS): Evaluating Valuation Following Leadership Changes and Analyst Optimism

Carpenter Technology Corporation CRS | 325.49 | +1.20% |

If you’re following Carpenter Technology (CRS), the recent news of executive appointments may have you rethinking your next move. With Tony R. Thene stepping in as Chairman of the Board and Brian J. Malloy taking on the President and COO roles starting October 7, the leadership shuffle arrives just as the company prepares to present at Morgan Stanley’s Laguna Conference. For investors, these events offer fresh insight into the company’s direction and could shift how the market values the stock moving forward.

This changing of the guard comes during a moment of momentum for Carpenter Technology. While the shares have dipped slightly over the past month, the year-to-date return sits at 37 percent. The past year has been even more dramatic, with the stock surging nearly 69 percent. Alongside steady revenue and net income growth, these factors have prompted a mix of bullish and cautious sentiment amid the company’s recent track record and upcoming conference spotlight.

After such a strong run in the past year and important strategy shifts at the top, is there still room for upside or are markets already factoring in Carpenter Technology’s next phase of growth?

Most Popular Narrative: 26% Undervalued

The most closely followed narrative suggests Carpenter Technology is significantly undervalued, with analysts projecting a fair value well above the current share price. This narrative relies on several strong growth and profitability assumptions that could drive substantial future upside for shareholders.

Record demand for power generation materials (with power generation revenues up over 100% year-over-year) and increased electrification (industrial gas turbines and electric motors using advanced alloys and magnetic materials) are driving significant new order flow. This trend is enhancing operating margins due to aerospace-level profitability.

Want to know what is really fueling this optimistic outlook? There is a bold thesis here: a future defined by ambitious profit expansion, margin shifts, and financial projections that would make most industry veterans raise an eyebrow. What hidden levers could justify such a premium? Uncover the critical assumptions behind this valuation and see what might power the next significant move in this stock.

Result: Fair Value of $325.72 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, substantial capital spending or overexposure to cyclical aerospace demand could quickly pressure margins and challenge even the most optimistic forecasts.

Find out about the key risks to this Carpenter Technology narrative.Another View: What If Market Ratios Matter More?

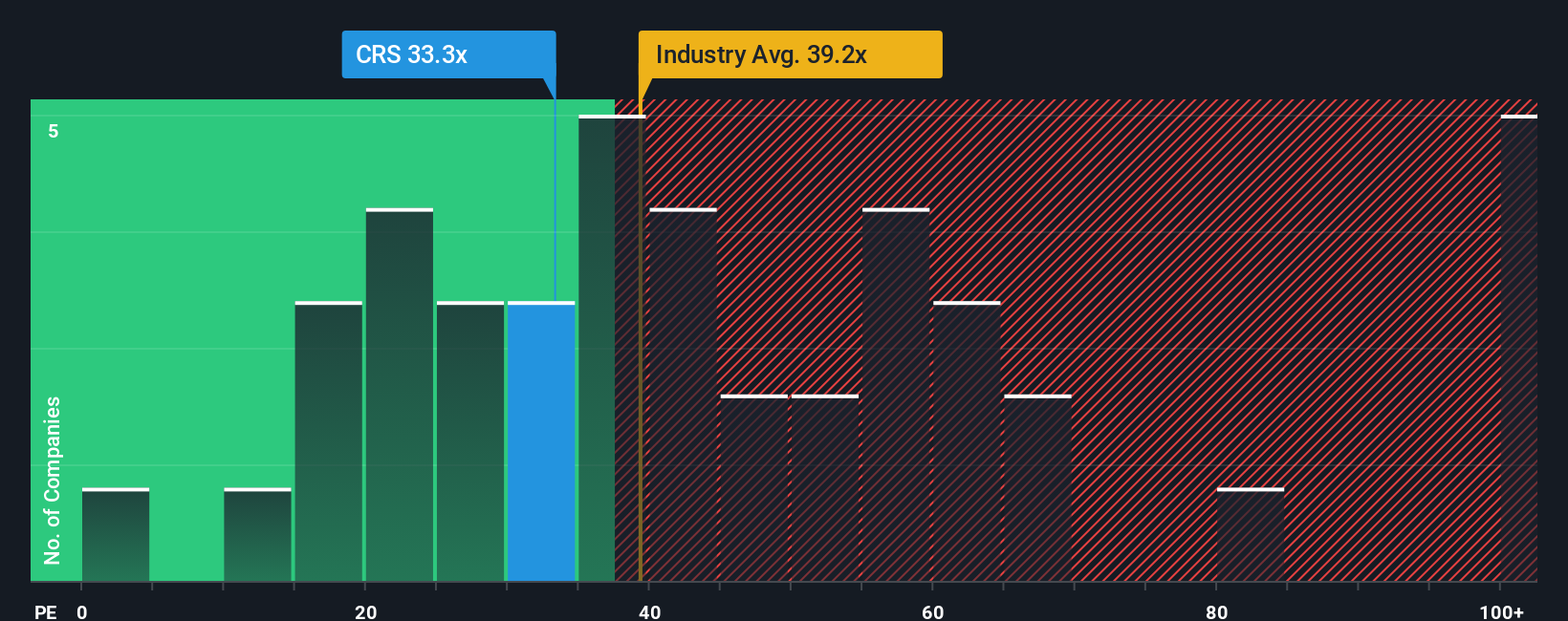

But not everyone agrees with analysts’ growth-driven optimism. When comparing Carpenter Technology to similar US metals companies, its market valuation looks less attractive. This suggests the shares could be more expensive than they appear on future earnings alone. Could this valuation signal a ceiling on further gains?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Carpenter Technology Narrative

If you see these narratives differently or want to dig deeper on your own, shaping your own outlook takes less than three minutes. Do it your way

A great starting point for your Carpenter Technology research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Set yourself apart and take your portfolio in new directions. Don’t let great opportunities slip by when you could be uncovering dynamic, market-beating investments right now.

- Harness the growth potential of tomorrow’s trailblazers by checking out penny stocks with strong financials with solid fundamentals and promise.

- Power up your strategy with innovation by exploring AI penny stocks that are driving advances across industries with artificial intelligence breakthroughs.

- Boost your search for value using undervalued stocks based on cash flows to highlight companies whose true worth might not be fully recognized yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.