Please use a PC Browser to access Register-Tadawul

Carpenter Technology (CRS) Valuation After NYSE Composite Inclusion and Strong Recent Share Price Performance

Carpenter Technology Corporation CRS | 314.84 314.84 | -1.18% 0.00% Pre |

Carpenter Technology (CRS) just earned a spot in the NYSE Composite index, a move that puts this specialty metals manufacturer on more investors’ radar as index-tracking funds realign their portfolios.

The timing could hardly be better, with a 90 day share price return of 34.77% and a powerful 1 year total shareholder return of 93.22% indicating clear positive momentum behind the $327.15 stock.

If Carpenter’s surge has you rethinking your watchlist, this might be a good moment to explore aerospace and defense names using aerospace and defense stocks.

Yet even after an index bump, double digit growth in earnings, and a share price brushing analysts’ targets, the key question remains: Is Carpenter Technology still mispriced, or is the market already discounting years of future growth?

Most Popular Narrative: 14.4% Undervalued

With Carpenter Technology last closing at $327.15 against a narrative fair value of $382.37, the story leans toward upside that is not fully priced in yet.

The brownfield expansion project is set to add high-purity melt capacity, allowing Carpenter to further leverage the industry supply-demand imbalance over the medium to long term. This will support higher volumes and sustained pricing power, translating into increased revenue and operating income beginning FY28.

Curious how a single capacity build out helps justify a premium valuation multiple, ambitious profit margins, and steady growth assumptions over years, not quarters? The most followed narrative maps out a detailed runway of rising earnings power and still argues the current share price has room to run. Want to see the specific growth and margin targets that underpin that $382 fair value call?

Result: Fair Value of $382.37 (UNDERVALUED)

However, this upside case could unravel if aerospace demand rolls over, or if the $400 million expansion delivers weaker returns and squeezes free cash flow.

Another View: Rich on Earnings

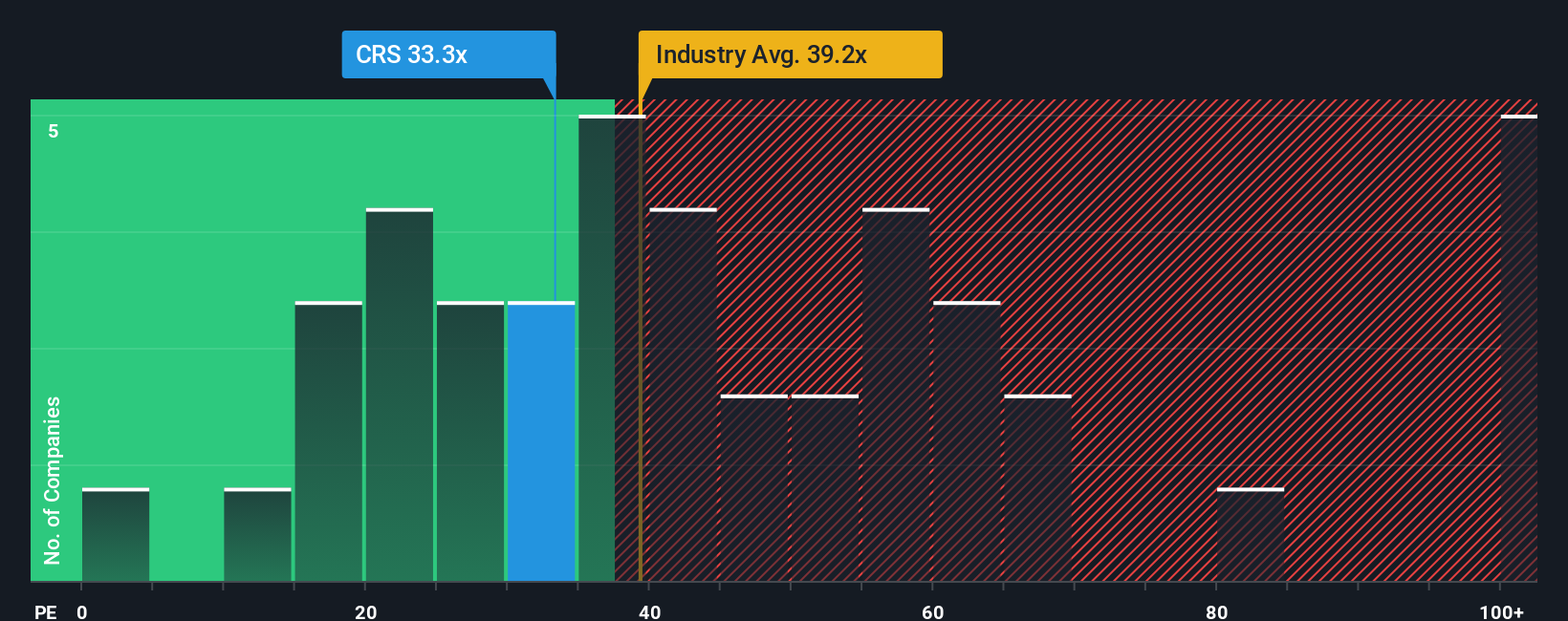

On earnings, the picture looks very different. Carpenter trades at about 39.4 times profits, richer than both the Aerospace and Defense group at 37.3 times and its peers at 36.9 times, and well above a 32.5 times fair ratio. Is the market overpaying for growth that might slow?

Build Your Own Carpenter Technology Narrative

If you see things differently or would rather dig into the numbers yourself, you can build a custom narrative in minutes, Do it your way.

A great starting point for your Carpenter Technology research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Before you move on, put your research to work by lining up tomorrow’s winners today using targeted stock ideas built from real fundamentals and market clues.

- Capture potential bargains early by scanning these 914 undervalued stocks based on cash flows where strong cash flows may not yet be fully recognized in share prices.

- Position for the next wave of innovation by targeting these 24 AI penny stocks that could transform entire industries with intelligent automation.

- Lock in more dependable income streams by reviewing these 12 dividend stocks with yields > 3% offering higher yields without abandoning quality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.