Please use a PC Browser to access Register-Tadawul

Carvana (CVNA) Is Down 15.3% After Short Seller Targets Earnings And Related-Party Deals - What's Changed

Carvana Co. Class A CVNA | 336.62 | +1.15% |

- In late January 2026, short seller Gotham City Research published a report alleging Carvana overstated 2023–2024 earnings and relied heavily on undisclosed related-party transactions with affiliates tied to its controlling shareholders.

- The controversy has drawn in Wall Street analysts and shareholder law firms, turning Carvana’s complex relationships with DriveTime and Bridgecrest into a central question about the quality of its reported profits.

- We’ll now examine how these accounting and related-party transaction allegations are reshaping Carvana’s investment narrative and perceived earnings quality.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Carvana's Investment Narrative?

To own Carvana today, you have to believe the company’s online-first used-car model can keep converting strong revenue and earnings momentum into durable, cash-backed profitability, despite a rich valuation and a leveraged balance sheet. Before the Gotham City report, the near-term story revolved around February’s Q4 2025 results, continued profit growth and the validation of recent S&P 500 inclusion. The short-seller allegations around related-party support and potentially overstated 2023–2024 earnings now cut straight into that thesis, because they question how much of Carvana’s rapid margin improvement is truly independent of DriveTime and Bridgecrest. The sharp share-price drop, followed by a partial rebound and vocal analyst pushback, suggests the market has not yet concluded these claims are fatal, but it does likely shift the key short-term catalysts toward Carvana’s upcoming disclosures, auditor stance and any regulatory or legal follow-up.

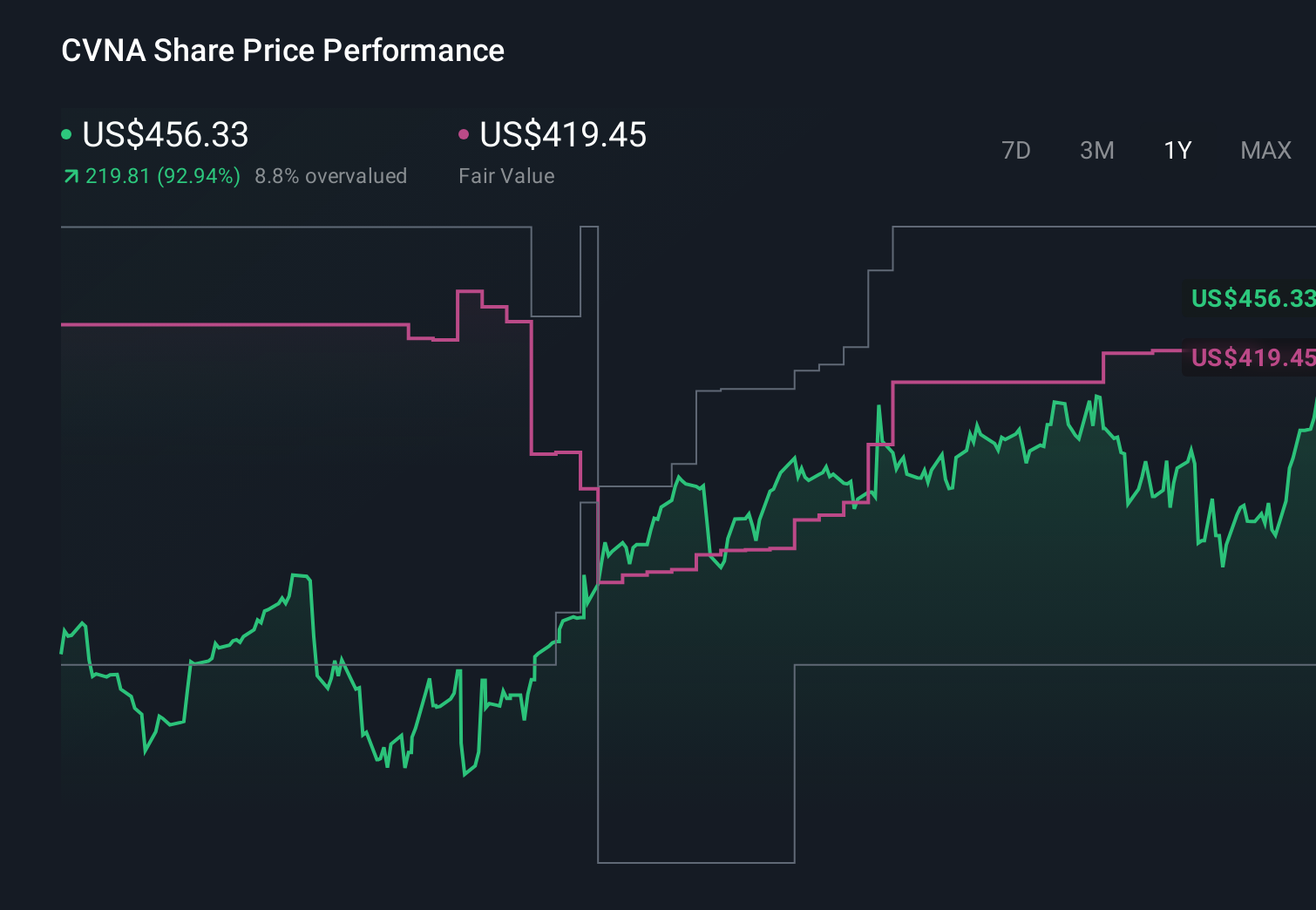

However, investors should not ignore how quickly earnings quality can be repriced. Despite retreating, Carvana's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 17 other fair value estimates on Carvana - why the stock might be worth less than half the current price!

Build Your Own Carvana Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Carvana research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Carvana research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Carvana's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 110 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.