Please use a PC Browser to access Register-Tadawul

Carvana Short Seller Allegations Put Earnings Quality And Valuation Under Scrutiny

Carvana Co. Class A CVNA | 407.97 407.89 | +1.71% -0.02% Post |

- Short seller Gotham City Research has released a report alleging accounting irregularities and undisclosed related party transactions at Carvana (NYSE:CVNA).

- The report claims Carvana overstated its earnings by over US$1b across 2023 and 2024 through dealings with entities tied to the CEO's family.

- The allegations have drawn regulatory attention, triggered law firm investigations, and prompted a public response from Carvana disputing the claims.

Carvana operates an online platform for buying and selling used cars, a segment that sits at the intersection of e commerce and traditional auto retail. The company has been closely watched as used vehicle demand, financing conditions, and consumer preferences for online car purchases continue to evolve.

For investors following NYSE:CVNA, the new allegations put the focus on disclosures, audit quality, and related party arrangements. How regulators, auditors, lenders, and customers respond to this scrutiny could influence perceptions of the company’s risk profile and financial reporting discipline.

Stay updated on the most important news stories for Carvana by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Carvana.

Quick Assessment

- ⚖️ Price vs Analyst Target: At US$427.44 against a consensus target of about US$483.55, the price is roughly 12% below target, which is relatively close to the range analysts have in mind.

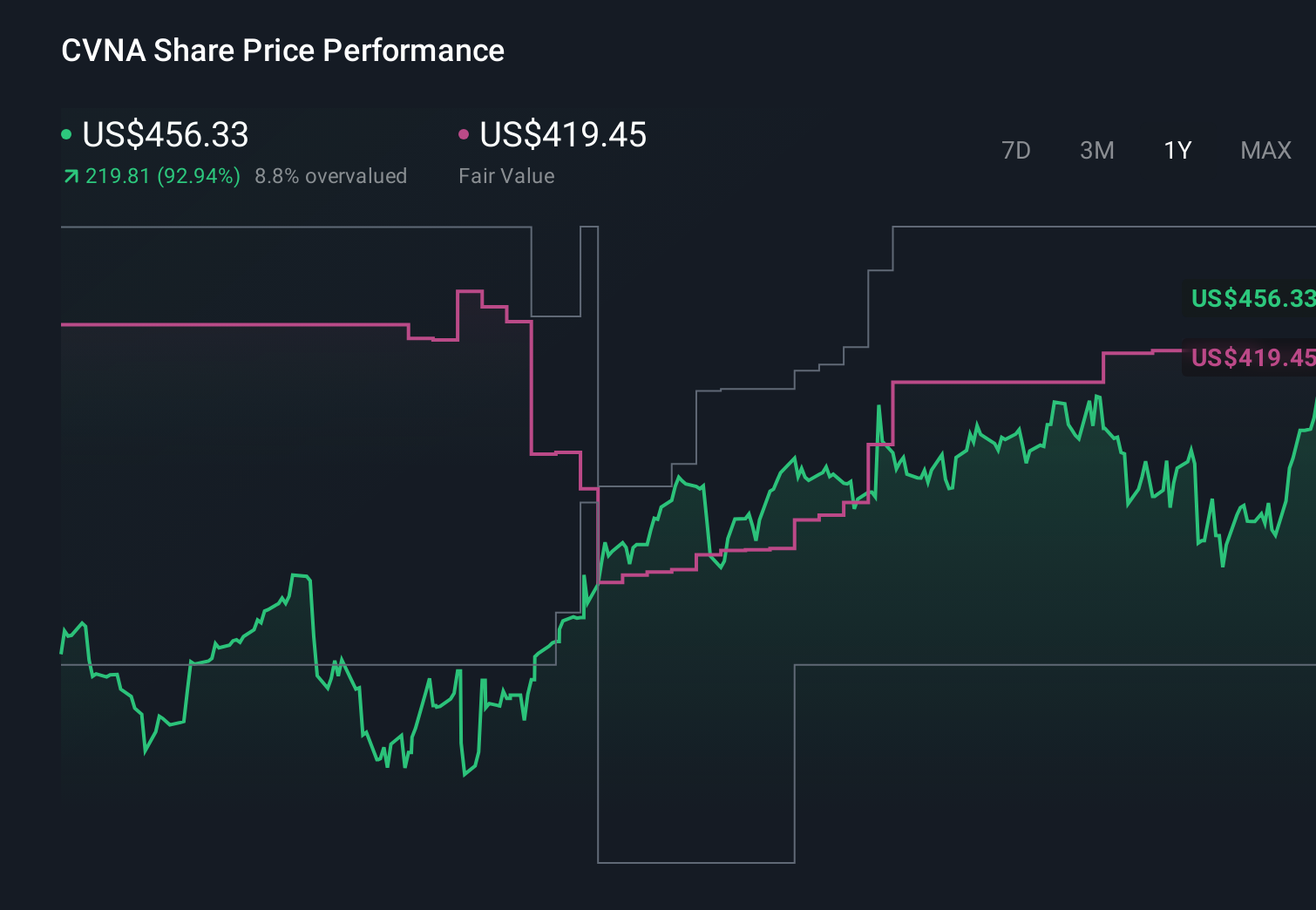

- ⚖️ Simply Wall St Valuation: The shares are described as trading close to estimated fair value, so the valuation signal is neutral here.

- ❌ Recent Momentum: The 30 day return of about a 0.5% decline points to slightly negative short term sentiment.

Check out Simply Wall St's in depth valuation analysis for Carvana.

Key Considerations

- 📊 Treat the short seller allegations as a prompt to re check how much of your thesis relies on past earnings quality and related party transparency.

- 📊 Watch any regulatory updates, auditor commentary, debt covenants and the wide analyst target range from US$330 to US$600 as signals of uncertainty around the story.

- ⚠️ Existing flags around debt coverage and recent insider selling sit alongside the new accounting concerns, which together raise questions about downside risk if the claims gain traction.

Dig Deeper

For the full picture including more risks and rewards, check out the complete Carvana analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.