Please use a PC Browser to access Register-Tadawul

Cathie Wood's Ark Invest Mulling 'Purpose-Built' Ethereum Investment Tools, Says Analyst After Firm Buys $180 Million Stake In Tom Lee-Led ETH Treasury Company

BitMine Immersion Technologies BMNR | 31.39 31.24 | +1.42% -0.48% Pre |

GRAYSCALE ETHEREUM MINI TRUST ETH | 27.82 27.54 | +0.72% -1.01% Pre |

Robinhood HOOD | 119.40 121.39 | +3.59% +1.67% Pre |

JPMorgan Chase & Co. JPM | 315.55 317.29 | -1.40% +0.55% Pre |

Strategy MSTR | 167.50 167.40 | +3.34% -0.06% Pre |

Cathie Wood-led Ark Invest is betting on the transformative potential of smart contract Layer-1 tokens like Ethereum (CRYPTO: ETH) in decentralized finance, the company’s leading cryptocurrency analyst said on Wednesday.

What Happened: Lorenzo Valiente, Director of Research at Ark, described smart contract Layer-1 tokens as a “distinct and transformative asset class.”

He specifically discussed Ethereum, highlighting some of its properties, such as its ability to secure the on-chain economy via proof-of-stake, enable transactions and act as programmable collateral at the protocol layer.

“Given these unique properties, we're excited to explore purpose-built investment vehicles and strategies tailored to this emerging landscape,” Valiente said. Ark CEO Wood reposted his X post.

See Also: Altcoin Speculation Surges: Is Crypto Headed For A Leverage-Fueled Meltdown?

Why It Matters: Valiente’s remarks come in the wake of Ark’s major equity investment in BitMine Immersion Technologies Inc. (AMEX:BMNR), a Bitcoin (CRYPTO: BTC) mining firm that recently transitioned to an Ethereum-focused treasury strategy. Ark acquired nearly 4.8 million shares, valued at $182 million.

Thomas "Tom" Lee, Chairman of BitMine's Board of Directors, deemed Ethereum “the preferred choice for Wall Street,” citing JPMorgan Chase & Co. (NYSE:JPM) and Robinhood Markets Inc. (NASDAQ:HOOD), which are building stable coin and tokenization infrastructure on the network, respectively.

Notably, the world's largest asset manager, BlackRock, also introduced its Ethereum-powered tokenized U.S. Treasury product, BUIDL, last year.

Price Action: At the time of writing, ETH was trading at $3,650.99, down 1.99% in the last 24 hours, according to data from Benzinga Pro.

BitMine shares closed 2.06% lower at $39.50 on Wednesday. Year-to-date, the stock has exploded 406%.

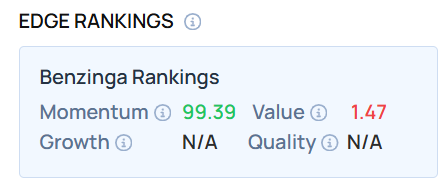

As of this writing, the stock demonstrated a very high Momentum score. Visit Benzinga Edge Stock Rankings to see how Strategy Inc. (NASDAQ:MSTR), the pioneer of cryptocurrency treasury, stacks up.

Photo Courtesy: VPLAB On Shutterstock.com

Read Next:

- Ethereum Treasury Company Trend ‘Will Accelerate’, Says Bitwise’s Matt Hougan—Here’s What It Means For ETH’s Price

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.