Please use a PC Browser to access Register-Tadawul

Celcuity (CELC) Is Up 176.2% After Positive Phase 3 Breast Cancer Results — Has the Bull Case Changed?

Celcuity Inc. CELC | 100.39 | -1.75% |

- Celcuity Inc. recently announced positive topline results from the Phase 3 VIKTORIA-1 trial, where its investigational drug gedatolisib, combined with fulvestrant with or without palbociclib, significantly reduced the risk of disease progression or death in HR+/HER2- advanced breast cancer patients.

- This breakthrough included a 76% improvement in disease progression risk reduction for the triplet therapy group and is expected to form the basis for a New Drug Application submission to the FDA in late 2025.

- We’ll examine how the successful Phase 3 results for gedatolisib may shift Celcuity’s investment narrative in cancer therapeutics.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Celcuity's Investment Narrative?

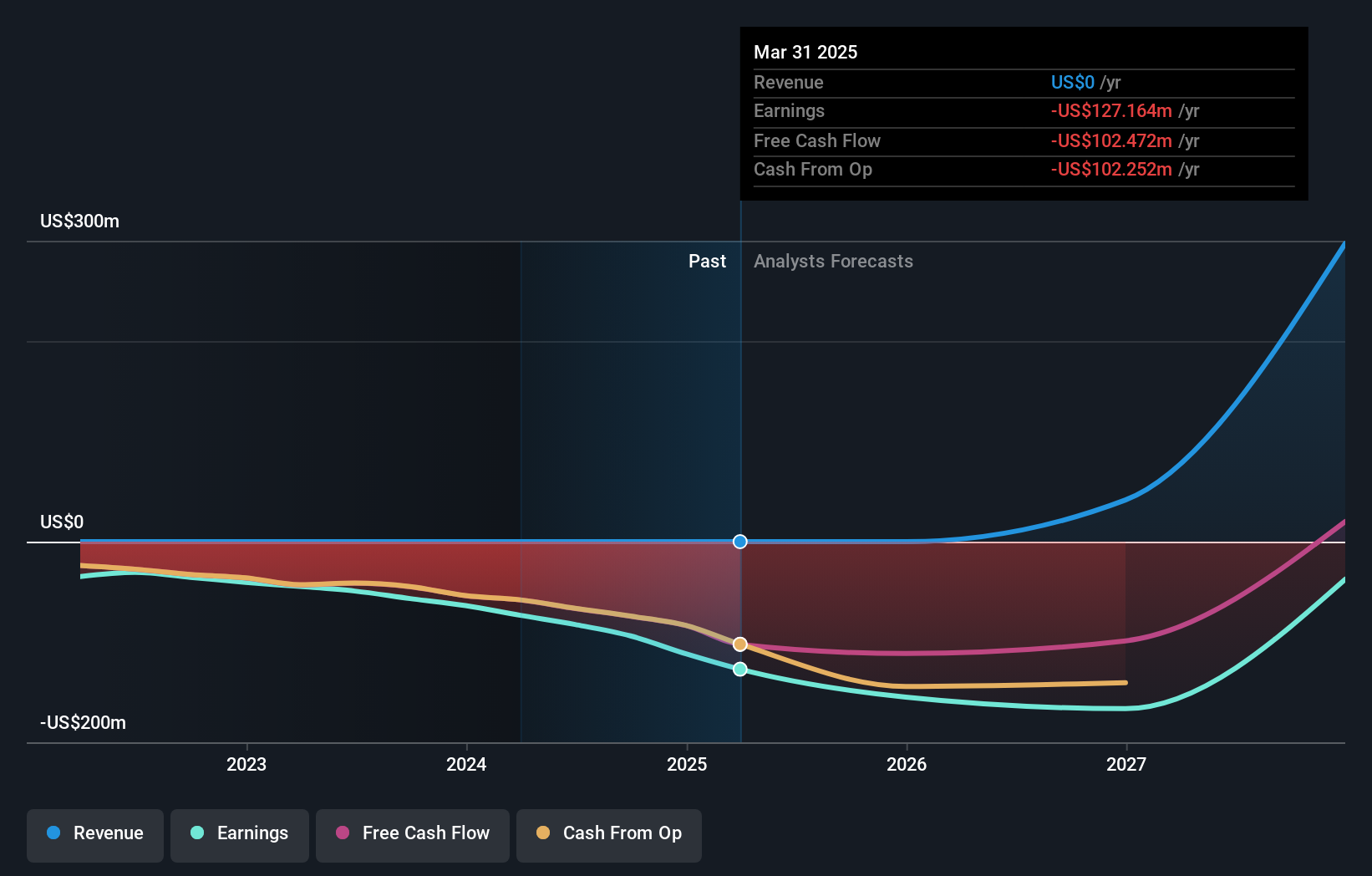

The investment case with Celcuity now hinges even more on the clinical and commercial opportunity for gedatolisib, following the high-profile Phase 3 VIKTORIA-1 trial results. For shareholders, the big-picture belief is that Celcuity could transform the standard of care in HR+/HER2- advanced breast cancer, if regulatory approval and future adoption play out. The headline trial data, showing a 76% reduction in disease progression risk and a median progression-free survival benefit, significantly shifts near-term catalysts: regulatory filing with the FDA in late 2025 is the next clear milestone, with rich optionality around broader adoption and label expansion. On the flip side, the sharp rally in share price and recent capital raises now focus attention even more keenly on execution risks. Dilutive financings, ongoing high cash burn, and the company’s lack of current revenue or profits remain front-and-center risks, as does the formidable challenge of transitioning from clinical-stage to commercial-stage biotech. The latest news event amplifies both excitement and scrutiny, moving Celcuity much closer to a potential inflection point, but not eliminating the underlying risks, just raising the stakes. Yet, with this kind of momentum, it's easy to overlook how capital raises can impact shareholders.

Celcuity's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore another fair value estimate on Celcuity - why the stock might be worth just $394.22!

Build Your Own Celcuity Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Celcuity research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Celcuity research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Celcuity's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.