Please use a PC Browser to access Register-Tadawul

Centrus Energy Expansion And HALEU Award Reshape Nuclear Fuel Outlook

Centrus Energy Corp. Class A LEU | 203.73 | -2.47% |

- Centrus Energy (NYSE:LEU) is expanding its Oak Ridge, Tennessee facility to increase manufacturing capacity and support additional jobs.

- The company has been selected by the U.S. Department of Energy for a potential US$900 million award tied to High Assay Low Enriched Uranium, or HALEU, production.

Centrus Energy focuses on nuclear fuel and related services, and the Oak Ridge expansion highlights how its operations link directly to the U.S. nuclear supply chain. The potential US$900 million HALEU award from the Department of Energy also connects Centrus to policy goals around domestic fuel availability for next generation reactors.

For investors, these updates go beyond typical quarterly headlines and relate to how Centrus is positioning its assets and expertise. The size of the potential federal award and the scale of the facility expansion may be relevant when considering the company’s contract visibility, capital needs, and exposure to long term nuclear trends.

Stay updated on the most important news stories for Centrus Energy by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Centrus Energy.

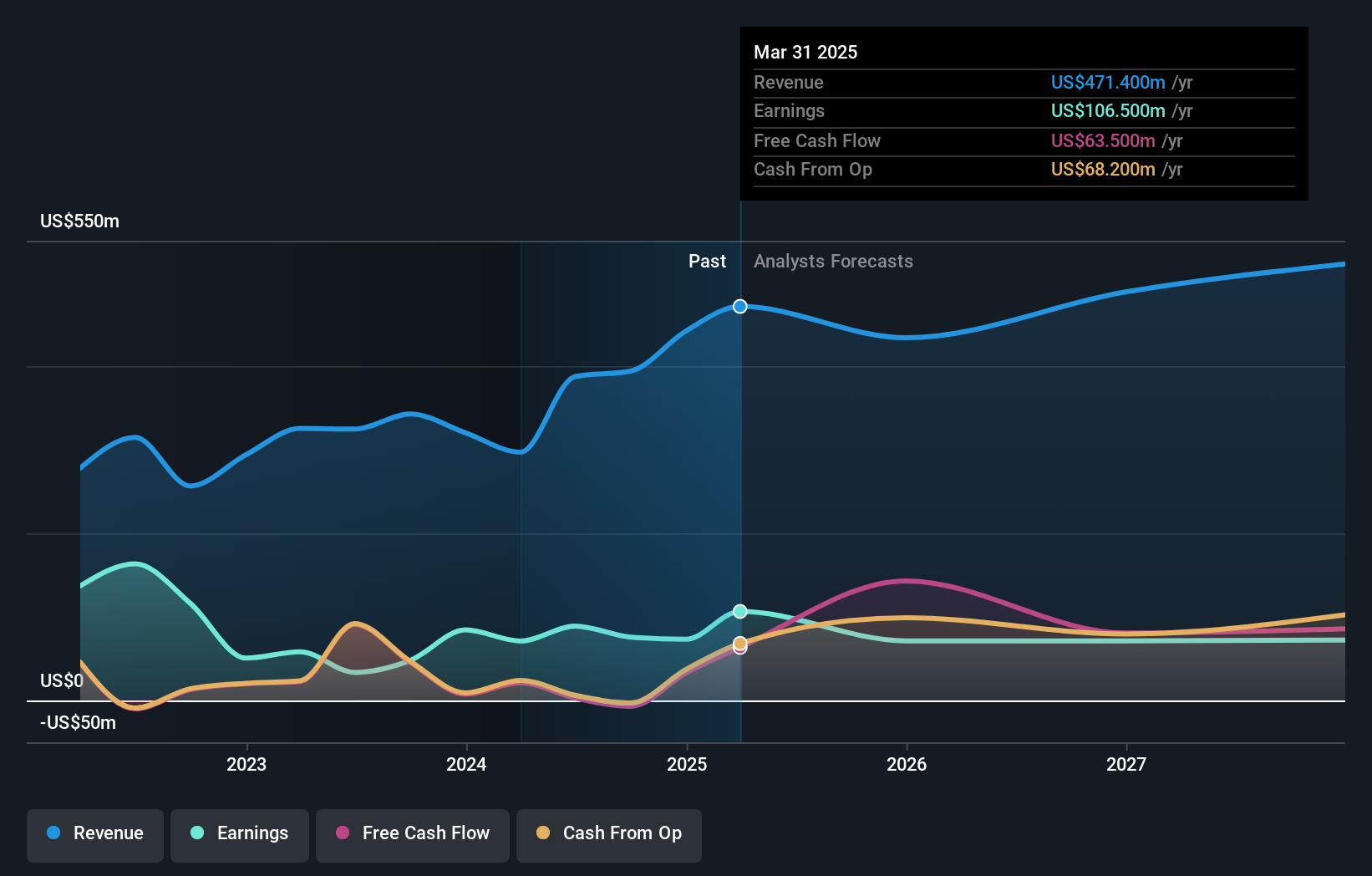

The Oak Ridge expansion and the potential US$900 million HALEU award sit alongside a business that is already producing material revenue and earnings. Centrus reported full year 2025 revenue of US$448.7 million and net income of US$77.8 million, with earnings per share from continuing operations slightly lower than the prior year on both a basic and diluted basis. Management is guiding 2026 revenue to a range of US$425 million to US$475 million, so this expansion speaks more to capacity and contract visibility over the longer term than to an immediate reset of the near term numbers. For you as an investor, the key link is between this new manufacturing footprint, the existing US$2.3b commercial low enriched uranium backlog and the company’s plan to target 12 metric tons of HALEU production per year sometime after 2030.

How This Fits Into The Centrus Energy Narrative

- The Oak Ridge build out and HALEU award selection align with the narrative that Centrus is positioning around federal support for nuclear fuel and a larger addressable market for both low enriched uranium and HALEU.

- The size and timing of government awards were already highlighted as a risk, and the fact that the US$900 million HALEU award is still subject to negotiation keeps that execution question in focus.

- The ramp up of high rate centrifuge manufacturing in Tennessee and planned deployment in Ohio after 2029 adds operational detail that may not be fully captured in earlier views of how and when new cascades come online.

Knowing what a company is worth starts with understanding its story. Check out one of the top narratives in the Simply Wall St Community for Centrus Energy to help decide what it's worth to you.

The Risks and Rewards Investors Should Consider

- ⚠️ The HALEU award is described as subject to negotiation, so there is a risk that terms, timing or funding flows differ from expectations, which could affect project economics and capacity rollout.

- ⚠️ Scaling manufacturing and enrichment capacity at Oak Ridge and Piketon requires hiring and execution over multiple years, so delays or cost pressure could weigh on margins, especially with earnings per share already slightly lower year on year.

- 🎁 Being selected for a potential US$900 million HALEU award reinforces Centrus’ role in a part of the fuel cycle where there are relatively few Western suppliers, which may matter when utilities compare options with peers such as Urenco or Cameco.

- 🎁 The combination of a US$2.3b commercial backlog, expansion at two sites and federal attention on domestic fuel supply gives Centrus multiple levers that could support contract visibility and long term demand for its services.

What To Watch Going Forward

From here, it is worth tracking how quickly Centrus finalizes terms on the US$900 million HALEU award and how those terms align with its planned capacity build out in Tennessee and Ohio. You can also watch whether revenue in the 2026 guidance range lines up with the timing of new orders tied to the US nuclear supply chain, and how hiring at Oak Ridge and Piketon progresses against expectations. Finally, pay attention to how competitors such as Cameco and Urenco position themselves in enrichment and advanced fuels, since contract wins or technology choices across the sector could influence how attractive Centrus looks to utilities over the long run.

To ensure you're always in the loop on how the latest news impacts the investment narrative for Centrus Energy, head to the community page for Centrus Energy to never miss an update on the top community narratives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.