Please use a PC Browser to access Register-Tadawul

Centrus Energy Repositions On HALEU As Market Weighs New Task Order

Centrus Energy Corp. Class A LEU | 203.73 | -2.47% |

- Centrus Energy secured a $900 million US government task order to expand uranium enrichment capabilities.

- The company is shifting toward domestic production of high assay low enriched uranium, or HALEU, for advanced reactors.

- Centrus entered a new partnership with Fluor to scale operations at its enrichment facility in Ohio.

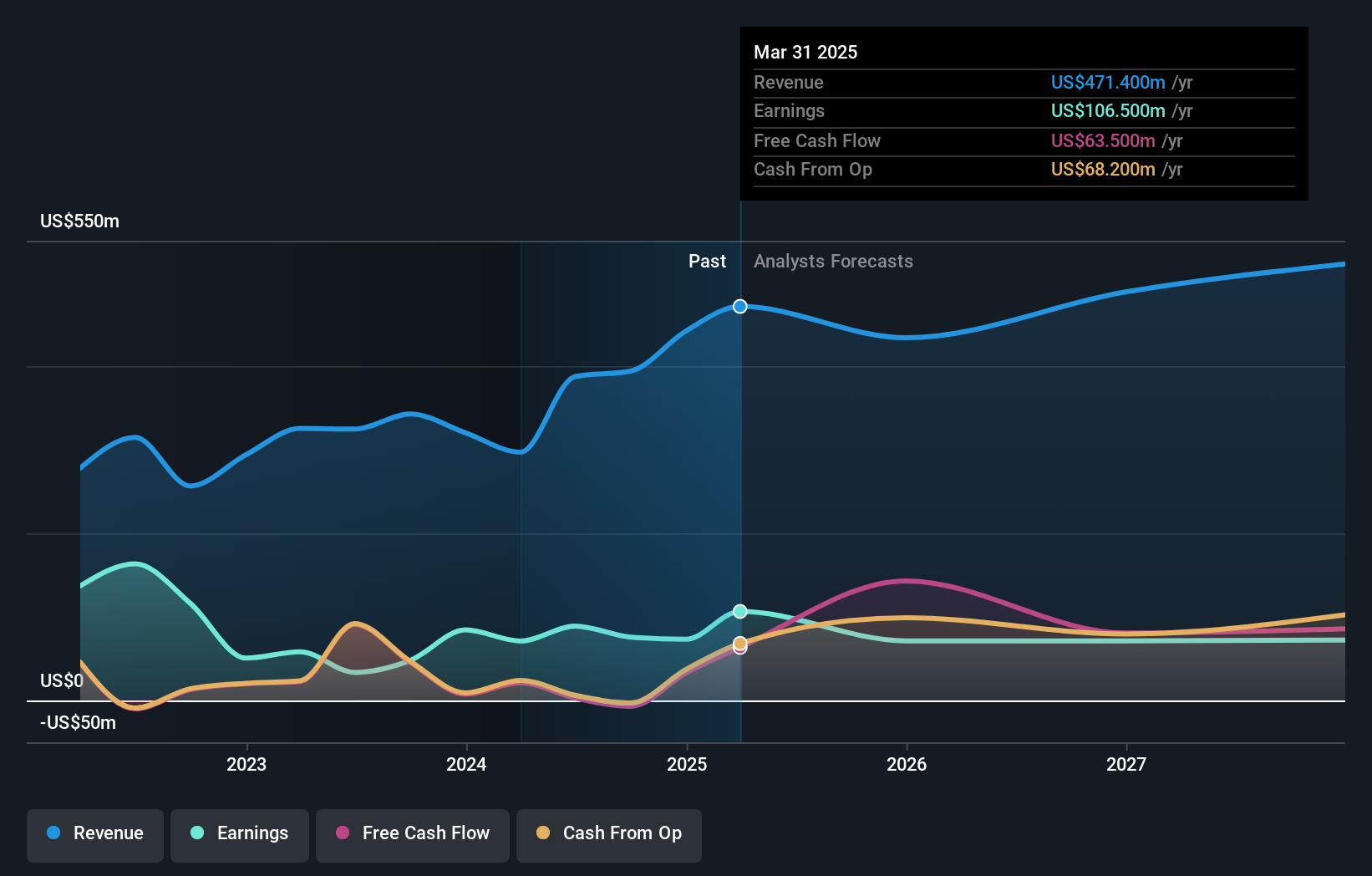

Centrus Energy (NYSE: LEU) sits at the center of a renewed push to build out a domestic nuclear fuel supply, with a current share price of $199.19. The stock has seen sharp swings, with a 27.9% decline over the past week and a 39.8% decline over the past month, yet it remains up 74.7% over the past year and has delivered very large multi‑year gains. That mix of recent pullback and longer‑term strength reflects shifting expectations around nuclear fuel demand and US policy support.

The new government task order and Fluor partnership indicate how Centrus is repositioning itself from a reseller to a producer of both standard enrichment and HALEU inside the US. For investors watching NYSE: LEU, the key questions now center on execution at the Ohio facility, contract visibility, and how domestic enrichment capacity might fit into longer‑term plans for next‑generation nuclear reactors.

Stay updated on the most important news stories for Centrus Energy by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Centrus Energy.

Quick Assessment

- ⚖️ Price vs Analyst Target: At US$199.19 vs a consensus target of about US$289.85, the price sits roughly 31% below analyst expectations.

- ⚖️ Simply Wall St Valuation: Shares are described as trading close to estimated fair value, with the model indicating they are around 7.2% below fair value.

- ❌ Recent Momentum: The stock has had a rough month, with a 30 day return of about 39.8% decline.

There is only one way to know the right time to buy, sell or hold Centrus Energy. Head to Simply Wall St's company report for the latest analysis of Centrus Energy's fair value.

Key Considerations

- 📊 The US$900m task order and HALEU focus tie Centrus more closely to US nuclear policy and fuel security, which this news highlights.

- 📊 Watch execution milestones at the Ohio enrichment facility, progress with the Fluor partnership, and any updates on contract terms or future task orders.

- ⚠️ Recent shareholder dilution and a P/E of about 50 vs an industry average of roughly 14.5 point to risk if expectations around future earnings or contracts change.

Dig Deeper

For the full picture, including more risks and rewards, check out the complete Centrus Energy analysis. Alternatively, you can visit the community page for Centrus Energy to see how other investors believe this latest news will impact the company's narrative.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.