Please use a PC Browser to access Register-Tadawul

Centrus Energy Weighs Project Vault Tailwinds Against Volatile Growth Path

Centrus Energy Corp. Class A LEU | 203.73 | -2.47% |

- The U.S. government has launched Project Vault, which includes building a strategic uranium reserve and new federal spending on critical minerals.

- Centrus Energy (NYSE:LEU), a supplier of enriched uranium and producer of HALEU, is positioned to participate in these initiatives.

- Project Vault is expected to influence demand patterns across the nuclear fuel supply chain as policies are implemented.

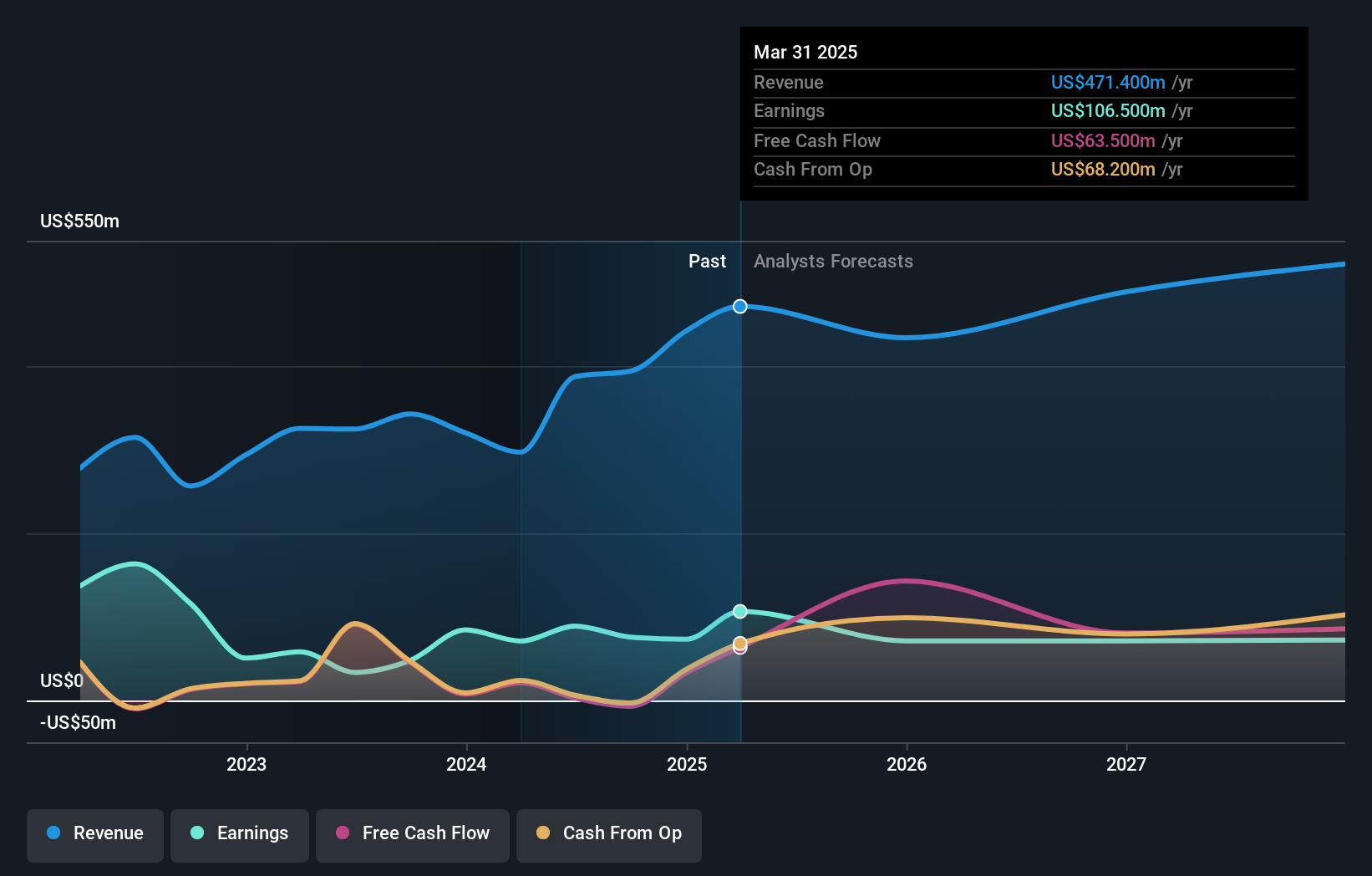

Centrus Energy, trading at $242.09, has seen its share price move sharply over the past year, with a 195.9% return in that period and a very large gain over five years. That said, the stock has also experienced a 19.7% decline over the past week and a 22.4% decline over the past 30 days, which highlights how reactive NYSE:LEU can be to policy headlines and sentiment around nuclear fuel.

For investors following the nuclear fuel story, Project Vault ties directly to Centrus's role as a leading supplier of enriched uranium and the only public U.S. company producing HALEU for advanced reactors. As the policy details and funding timelines become clearer, the key questions will center on how much volume, contract visibility, and capital support could flow to Centrus from the uranium reserve and the broader critical minerals push.

Stay updated on the most important news stories for Centrus Energy by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Centrus Energy.

Project Vault aligns with Centrus Energy's plan to turn its Oak Ridge site into a high-rate centrifuge plant and expand enrichment in Ohio. Policy support for a uranium reserve and critical minerals could help keep that manufacturing pipeline busy if contracts materialize. For you, the link to value creation runs through how effectively Centrus converts this policy backdrop and its more than US$560 million Tennessee investment into long-term, contracted volumes for low-enriched uranium and HALEU, compared with peers like Cameco and Urenco.

Centrus Energy narrative, policy tailwinds and execution reality

The existing narratives around NYSE:LEU already highlight expectations for growth tied to government funding and reshoring of enrichment, and Project Vault fits into that story by potentially expanding the role of domestic suppliers in the fuel cycle. At the same time, those narratives also indicate that timelines for adding new cascades are long and heavily dependent on Department of Energy decisions, so this news mainly sharpens the focus on execution and contract timing rather than changing the core thesis.

Risks and rewards you should keep in mind

- Policy support through Project Vault and Tennessee's Nuclear Energy Fund could support demand for centrifuges and enrichment services if federal and state spending flows through to Centrus contracts.

- Centrus is one of the few U.S. enrichment players, with HALEU exposure, which could influence its position versus larger fuel suppliers such as Cameco and Orano if domestic content becomes more important.

- Analysts and narratives already incorporate strong growth and government support, so slower contracting, delays in the Ohio expansion, or tighter funding could leave expectations looking stretched.

- The share price has been volatile over short periods, and funding plans that include equity issuance and debt raise the risk of dilution or return volatility even if the long-term project build-out continues.

What to watch next

From here, it is worth watching how quickly Centrus converts Project Vault and Department of Energy support into signed, multi-year contracts, how the Oak Ridge and Piketon build-outs progress against cost and timing, and how its positioning evolves versus other fuel suppliers. If you want a broader view of how other investors are thinking about these trade-offs, have a look at the community narratives on Centrus through this discussion hub for NYSE:LEU.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.