Please use a PC Browser to access Register-Tadawul

Centrus Energy’s Nuclear Buildout Tests Valuation After Oak Ridge Expansion

Centrus Energy Corp. Class A LEU | 203.73 | -2.47% |

- Centrus Energy (NYSE:LEU) plans to invest more than US$560 million in expanding its Oak Ridge, Tennessee facility.

- The project is expected to create nearly 430 new jobs focused on advanced centrifuge production for U.S. uranium enrichment and national security uses.

- This move follows a recent US$900 million federal award tied to expanding Centrus' enrichment facility in Ohio.

- Together, the projects point to a larger build out of U.S. nuclear fuel and enrichment capabilities.

Centrus Energy, which focuses on uranium enrichment and nuclear fuel services, is becoming more closely linked with efforts to rebuild domestic nuclear supply chains. For investors following NYSE:LEU, these projects sit at the intersection of energy policy, defense priorities, and the push for low carbon power. The company now has large, long term commitments in both Tennessee and Ohio that connect directly to U.S. nuclear infrastructure.

Looking ahead, the scale of these investments may influence how investors think about Centrus' role in advanced nuclear fuel, national security work, and long duration contracts. The Oak Ridge expansion and federal backing in Ohio also add new context for anyone tracking how U.S. nuclear fuel capabilities are being rebuilt and where capital is flowing within the sector.

Stay updated on the most important news stories for Centrus Energy by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Centrus Energy.

Quick Assessment

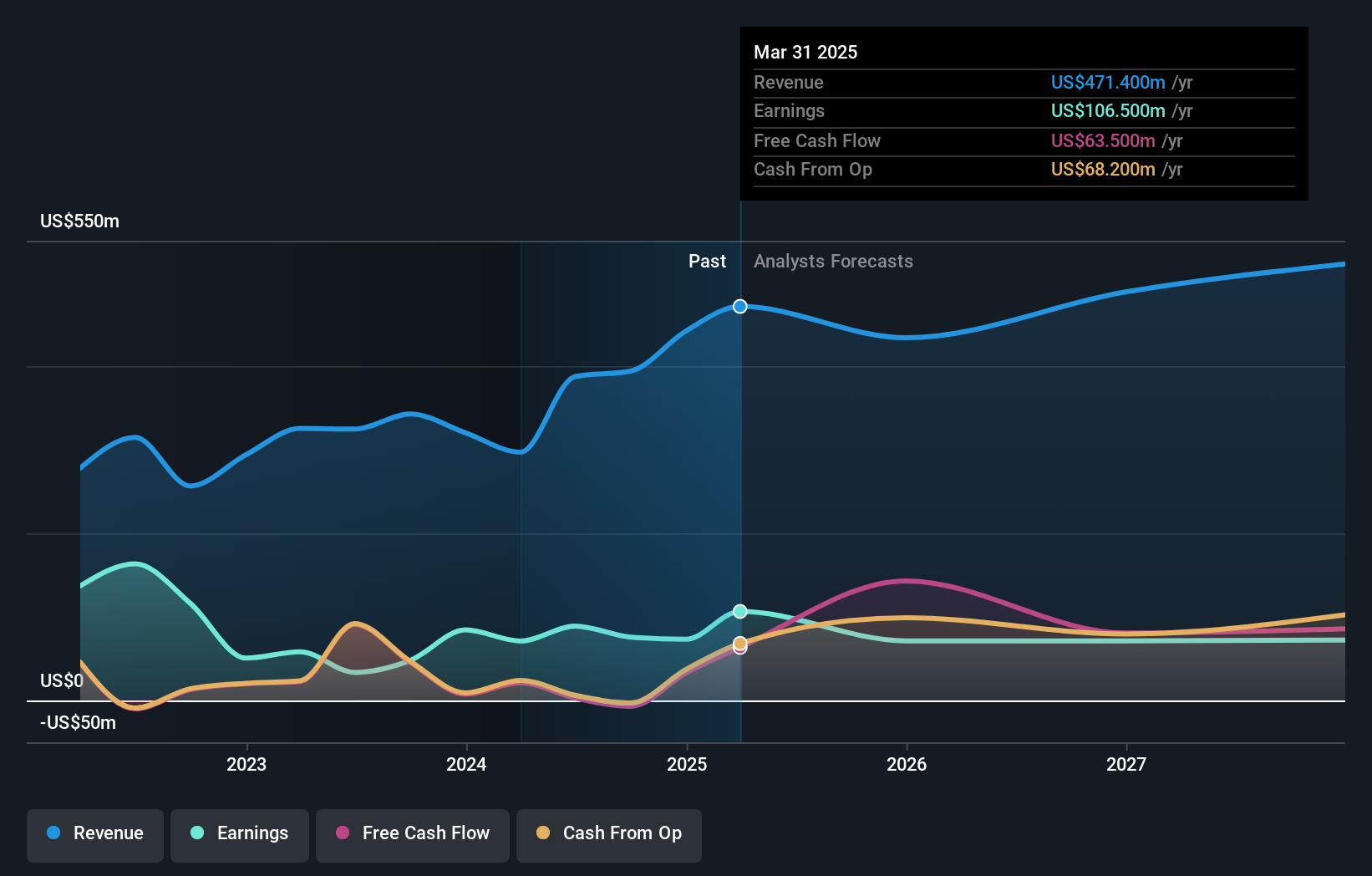

- ❌ Price vs Analyst Target: At US$296.19, the share price sits slightly above the US$294.11 analyst target.

- ❌ Simply Wall St Valuation: Shares are described as trading about 14.5% above estimated fair value.

- ✅ Recent Momentum: The 30 day return is roughly 13.8%, which is a solid short term gain.

Check out Simply Wall St's in depth valuation analysis for Centrus Energy.

Key Considerations

- 📊 The Tennessee and Ohio expansions tie Centrus more closely to U.S. nuclear infrastructure and long duration government related work.

- 📊 Watch the P/E of 47.4 versus the Oil and Gas industry average of about 13.6, plus any new contracts linked to enrichment and national security.

- ⚠️ The stock has a flag for a volatile share price over the past 3 months, which can amplify both news driven upside and downside.

Dig Deeper

For the full picture including more risks and rewards, check out the complete Centrus Energy analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.