Please use a PC Browser to access Register-Tadawul

Century Communities (CCS) Valuation In Focus After Citizens Rating And New Texas And North Carolina Projects

Century Communities, Inc. CCS | 71.85 | +0.27% |

Century Communities (CCS) is back on investors’ radar after Citizens issued a positive research rating and the homebuilder highlighted new communities in Texas and North Carolina, pairing analyst attention with visible project-level activity.

The recent stream of Grand Opening events in Texas and North Carolina has arrived alongside mixed market performance, with a 30 day share price return of 10.09% but a 1 year total shareholder return decline of 13.80%, suggesting shorter term momentum has picked up even as longer term investors have seen more modest progress.

If Century Communities has you thinking about where else housing demand could show up, it might be worth taking a look at auto manufacturers as a different angle on consumer linked spending.

With Citizens seeing upside to a US$72.67 price target and the stock recently at US$64.94, along with mixed short and long term returns, should you view CCS as undervalued today or assume markets are already pricing in future growth?

Most Popular Narrative: 10.6% Undervalued

Century Communities' most followed narrative sets a fair value of $72.67 against the last close at $64.94, framing the current debate around modest undervaluation.

Analysts expect earnings to reach $114.5 million (and earnings per share of $4.01) by about September 2028, down from $260.0 million today. The analysts are largely in agreement about this estimate.

Want to understand why a lower earnings path still supports a higher fair value? The heart of this narrative is how margins, revenue mix, and a richer future earnings multiple fit together. Curious which assumption carries the most weight in that $72.67 figure? The full narrative lays out the math behind that call.

Result: Fair Value of $72.67 (UNDERVALUED)

However, it is worth noting that weaker homebuyer demand, higher input costs, and reliance on entry level buyers could all challenge the view that the stock is undervalued.

Another View: Earnings Multiple Sends A Different Signal

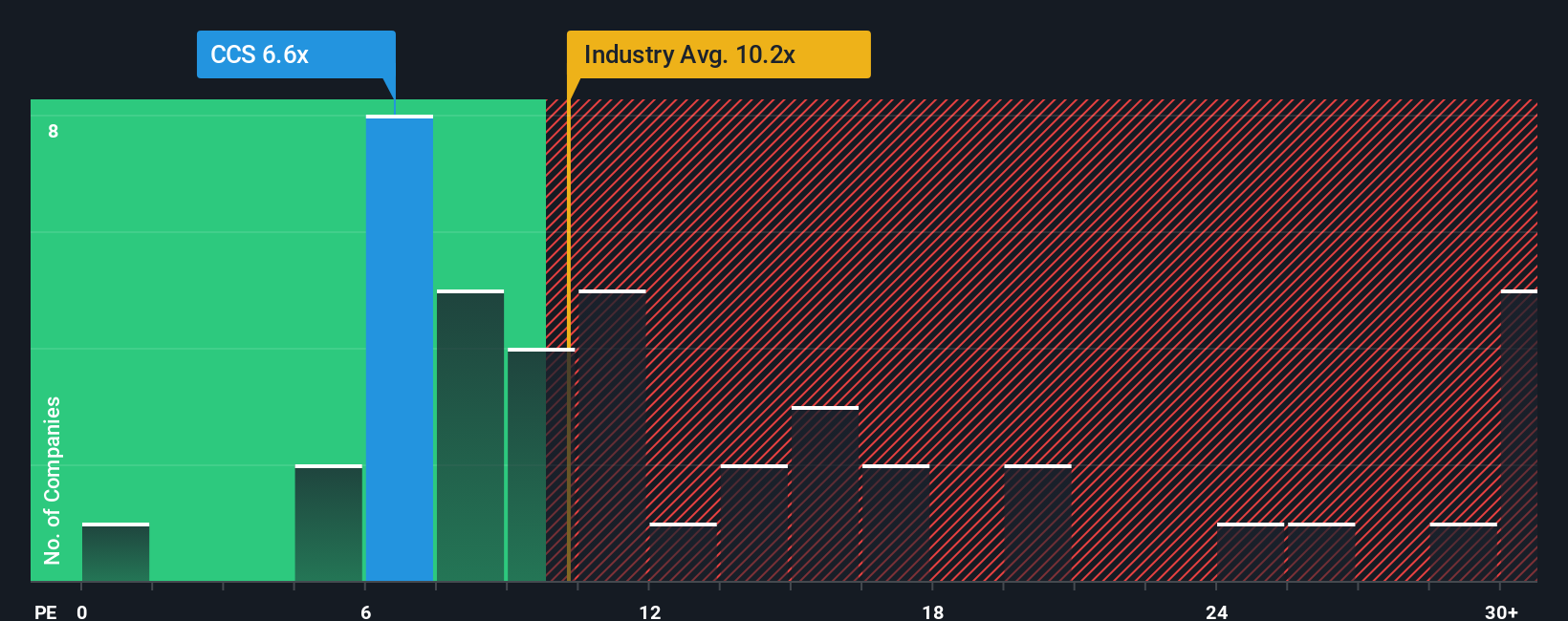

That $72.67 fair value narrative suggests modest upside, but the current 8.9x P/E tells a more cautious story. Century Communities trades slightly above peers at 8.1x, yet below an 11x fair ratio that our model suggests the market could move toward. This leaves you weighing limited discount against the possibility of a rerating.

Build Your Own Century Communities Narrative

If you see the numbers differently or prefer to test your own assumptions, you can create a custom Century Communities narrative in just a few minutes, starting with Do it your way.

A great starting point for your Century Communities research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Century Communities has sparked your interest, do not stop here. Use curated screeners to spot other opportunities that fit the kind of portfolio you want to build.

- Target future growth by checking out these 23 AI penny stocks that tie real businesses to advances in artificial intelligence.

- Strengthen your income stream with these 13 dividend stocks with yields > 3% that focus on cash returns above 3%.

- Add a different return profile through these 18 cryptocurrency and blockchain stocks that tap into companies linked to digital assets and blockchain themes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.