Please use a PC Browser to access Register-Tadawul

CG Oncology (CGON): Assessing Valuation After New Clinical Milestones and Regulatory Pipeline Updates

CG Oncology Inc. CGON | 40.94 40.94 | -1.61% 0.00% Pre |

CG Oncology (CGON) just dropped a string of updates that will make investors pause and take notice. The company announced encouraging results from the BOND-003 Cohort C trial, kicked off a new clinical study (CORE-008 Cohort CX), and set timelines for wrapping up enrollment in its pivotal Phase 3 PIVOT-006 trial. Management also flagged an upcoming Biologics License Application submission for cretostimogene by the end of the year. All these signals point to a packed regulatory calendar and strong momentum in its bladder cancer pipeline.

These developments come as the share price has seen gains in recent months, up 44% over the past three months after some volatility earlier in the year. The uptick follows a year of challenging returns, with the stock still roughly flat compared to last September. Despite the short-term surge, investors may be weighing whether CG Oncology’s progress is just the beginning or if the market is already factoring in future success. Recent annual revenue growth and an improving net income trend suggest the fundamentals are shifting, but the path ahead still relies on regulatory outcomes and clinical milestones.

So, after this latest run higher, is CG Oncology offering a genuine entry point, or is the market already baking in those next big wins?

Price-to-Book of 4.2x: Is It Justified?

Based on its current price-to-book (PB) ratio, CG Oncology is trading at 4.2x book value, which is substantially higher than the US Biotechs industry average of 2.2x. This means that, relative to the sector, the market is assigning a premium valuation to CG Oncology on this metric.

The price-to-book multiple compares a company's market capitalization to its net asset value. In biotechs, where profitability is often a distant milestone, PB is a common way for investors to value early-stage or pre-profit companies based on assets rather than earnings.

This higher-than-average PB ratio suggests investors are likely pricing in rapid future growth or potential breakthrough products. This may reflect more optimism than is seen for peers. Whether this premium is warranted depends on the success of CG Oncology's clinical and regulatory pipeline.

Result: Fair Value of $37.04 (OVERVALUED)

See our latest analysis for CG Oncology.However, weak profitability and ongoing net losses could weigh heavily on sentiment if clinical results or regulatory approvals experience a setback.

Find out about the key risks to this CG Oncology narrative.Another View: Our DCF Model Paints a Different Picture

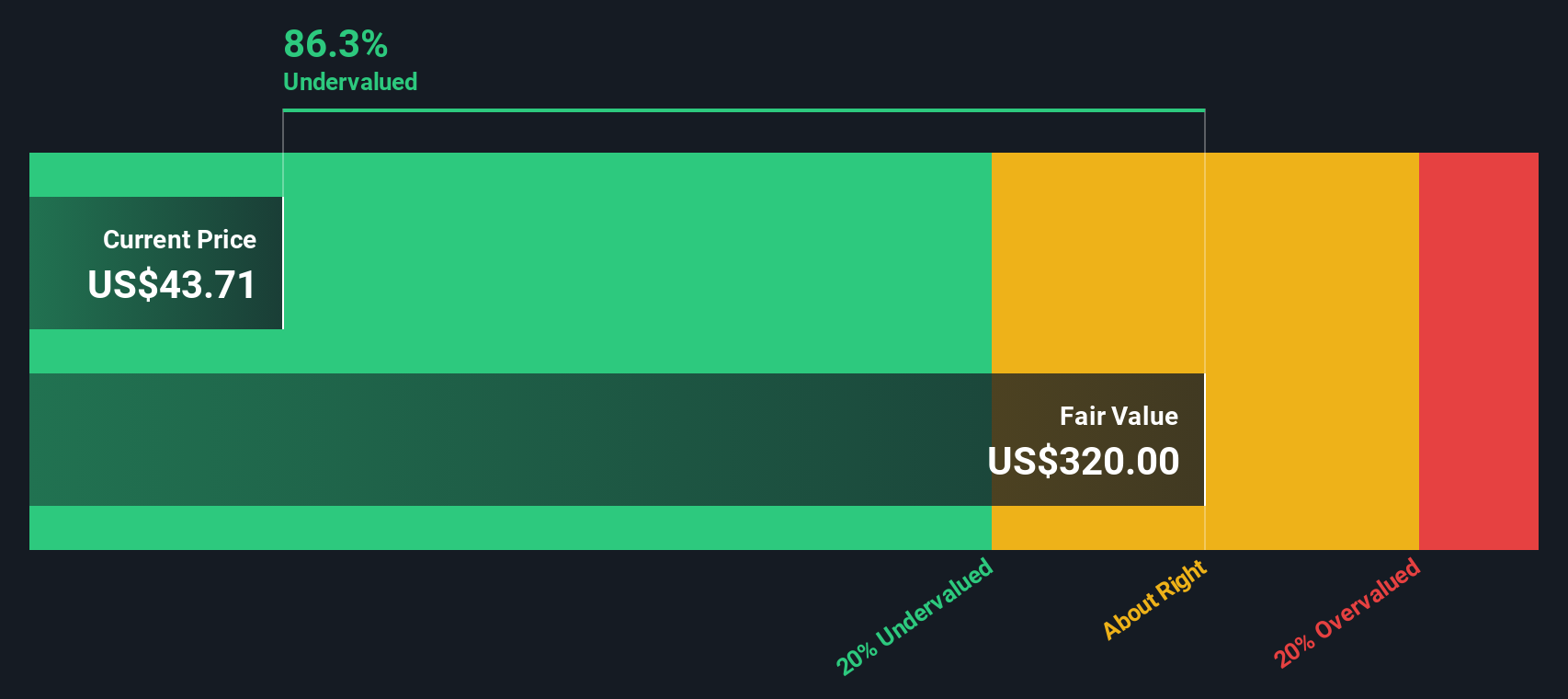

While the current price looks expensive compared to book value, our DCF model takes a longer-term outlook and suggests the shares are actually trading well below estimated fair value. Is the market missing something, or is caution still warranted?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own CG Oncology Narrative

If you see things differently or want to dive deeper into the numbers yourself, it takes just a few minutes to build your own perspective. Do it your way.

A great starting point for your CG Oncology research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Expand your opportunities today with targeted stock lists that could give your portfolio an edge. Don’t let the next winning trend pass you by.

- Spot high-potential growth early by scanning for emerging companies with penny stocks with strong financials. These companies may be setting the pace for tomorrow’s markets.

- Tap into tomorrow’s breakthroughs by tracking innovators at the forefront of medicine and tech through our healthcare AI stocks.

- Capture steady income and stability by filtering out companies offering reliable payouts using our powerful dividend stocks with yields > 3% tool.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.