Please use a PC Browser to access Register-Tadawul

CG Oncology (CGON) Is Up 10.7% After Positive Phase 3 Results and Insider Buying – What's Changed

CG Oncology Inc. CGON | 40.57 | -0.90% |

- Recent updates from CG Oncology highlighted positive results from its Phase 3 BOND-003 Cohort C study, with a 41.8% complete response rate at 24 months for its bladder cancer treatment, cretostimogene.

- A significant insider purchase by Director Brian Guan-Chyun Liu added further momentum, signaling internal confidence as analysts noted the therapy’s durable outcomes.

- We’ll explore how the strong Phase 3 results for cretostimogene reinforce CG Oncology’s investment narrative in cancer therapeutics.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

What Is CG Oncology's Investment Narrative?

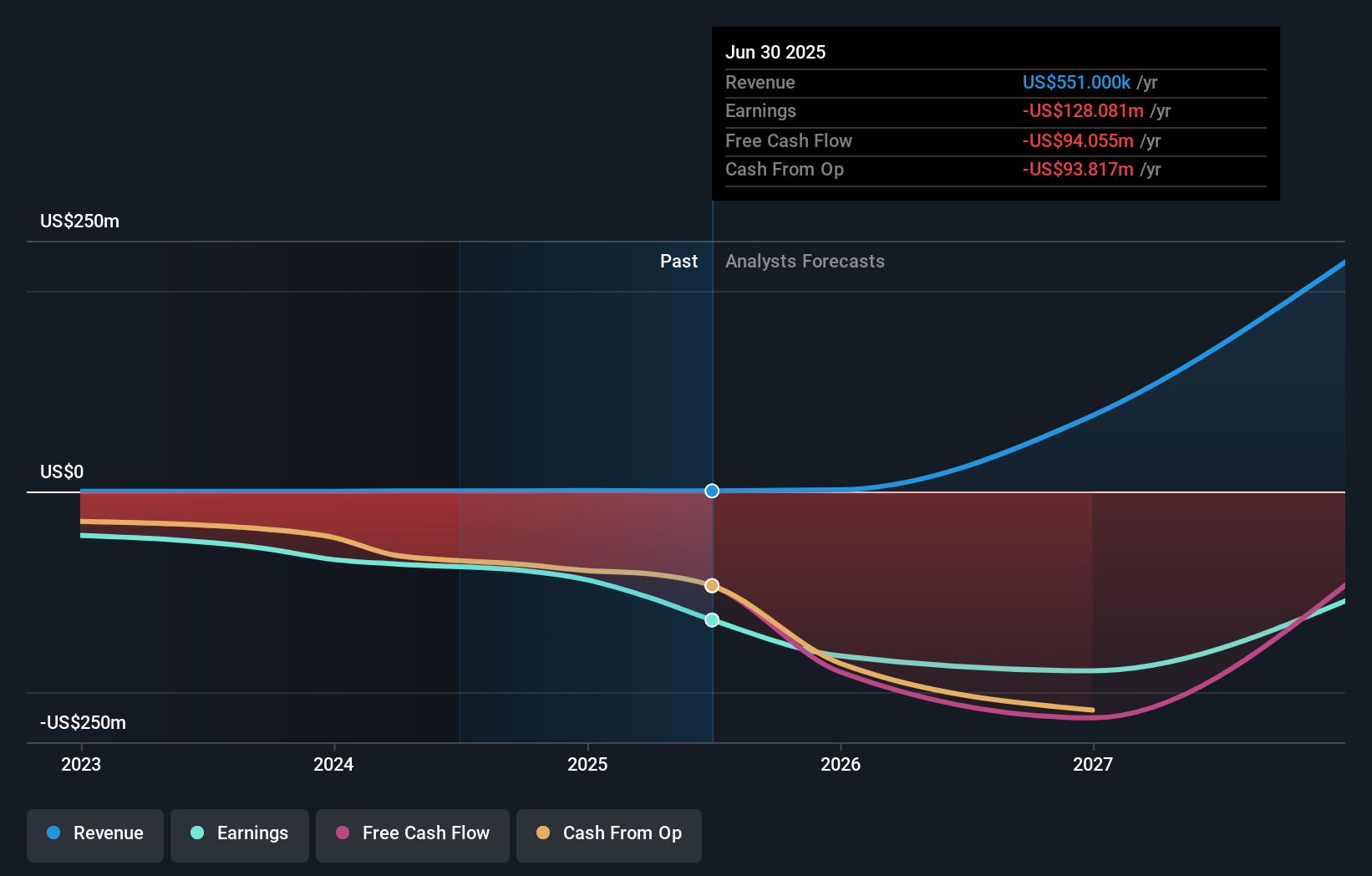

For CG Oncology, the investment narrative hinges on whether cretostimogene can become a differentiated standard-of-care for bladder cancer and catalyze wider acceptance of the company’s pipeline. The latest Phase 3 results for cretostimogene, with a 41.8% complete response at 24 months and very few adverse events, improve visibility for regulatory and commercial milestones, a key short-term catalyst investors have waited for. Recent enthusiastic insider buying and sharp price gains signal renewed confidence, which could bolster market sentiment and position CG Oncology for stronger negotiation with partners or payors. At the same time, this momentum does not erase core risks: CG Oncology remains unprofitable with persistent losses, higher cash outflow, and ambitious growth projections that are not expected to translate into profitability soon. The improved clinical profile makes regulatory setbacks less likely in the short term, but execution risks, including cash burn, are still top of mind for many shareholders. On the flip side, investors should not overlook the pressure from mounting losses and questions around when profitability might be reached.

CG Oncology's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore another fair value estimate on CG Oncology - why the stock might be a potential multi-bagger!

Build Your Own CG Oncology Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CG Oncology research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free CG Oncology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CG Oncology's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 30 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.