Please use a PC Browser to access Register-Tadawul

Check Point Software (CHKP) Margin Expansion Reinforces Bullish Narratives Despite Earnings Decline Forecast

Check Point Software Technologies Ltd. CHKP | 193.06 | -1.41% |

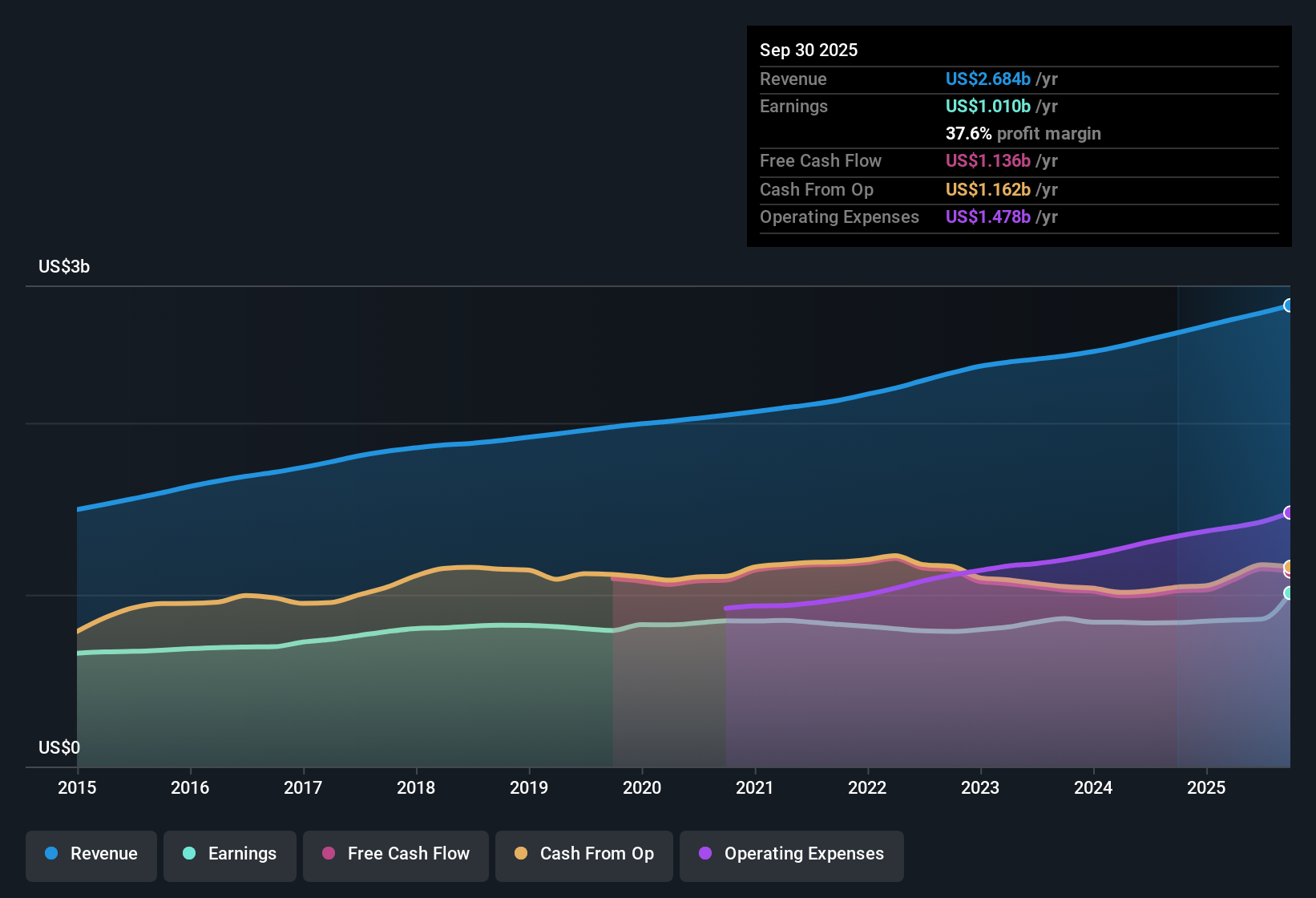

Check Point Software Technologies (CHKP) reported annual earnings growth of 1.5% over the past five years, but recently posted a sharp acceleration with earnings up 20.6% and net profit margins improving to 37.6% from 33.2% last year. However, compared to the broader US software sector, revenue is forecast to rise at a slower pace of 5.8% per year and earnings are expected to decline by 1.5% per year over the next three years. While the company trades at a relatively attractive 21 times Price-to-Earnings ratio compared to industry peers, the share price of $197.28 currently sits above the estimated fair value, creating a mixed picture for investors.

See our full analysis for Check Point Software Technologies.The next section puts these headline numbers up against the most widely discussed investor narratives, highlighting where expectations are confirmed and where the story takes a turn.

Profit Margin Expands Despite Competitor Pressures

- Net profit margin rose to 37.6% from 33.2% year-over-year, widening the gap over many peers and revealing operational leverage that extends beyond basic revenue growth.

- According to the analysts' consensus view, this margin surge strongly supports expectations for sustained profitability driven by robust adoption of Quantum Force appliances and the Infinity platform.

- The consensus narrative highlights that Infinity's double-digit revenue contribution and expanding customer base put Check Point in a stronger position to defend margins as it broadens cloud and AI-based security offerings.

- However, the analysts also point to emerging risks such as increased R&D spending needed to keep pace with SASE and AI competitors, which could put pressure on future net margins even if topline trends remain healthy.

Consensus signals provide a balanced perspective on these improvements and the strategic shifts ahead. Read the full Consensus Narrative for a rounded perspective. 📊 Read the full Check Point Software Technologies Consensus Narrative.

Analyst Target Implies 16.4% Upside from Share Price

- The current share price of $197.28 stands 16.4% below the sole permitted analyst price target of $229.51. Consensus forms this target from forecasts of $3.1 billion in revenue and $989 million in earnings by 2028.

- According to analysts' consensus, achieving the target requires earnings to outpace sector dilution concerns through continued share repurchases and improved margins.

- This scenario requires that by 2028, Check Point maintains a projected PE ratio of 29.6x, even though the software sector average remains higher at 36.2x.

- This outlook relies on a projected decrease in shares outstanding (down 3.08% per year), which is important for delivering the necessary increase in per-share earnings that supports the price target premium over the current market price.

Trading Below Peer Multiples but Above DCF Fair Value

- With a PE ratio of 21x, Check Point trades significantly below the US software industry average (34.8x) and the peer mean (40.3x), yet still carries a 20.8% premium to its DCF fair value of $163.31 at the current price.

- The analysts' consensus narrative frames this as a valuation paradox: while the stock appears to offer relative value compared to most peers, the gap to its intrinsic value reflects market confidence that recent profitability gains can withstand growing macroeconomic and competitive risks.

- Consensus specifically notes the risk that long-term revenue and earnings are forecast to decline, which could influence sentiment and prevent valuations from closing the gap with higher-growth competitors.

- The ongoing contrast between headline operational strength and cautious forward guidance maintains debate around whether Check Point should sustain a premium to DCF fair value, even within a sector known for high innovation premiums.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Check Point Software Technologies on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Curious about a different interpretation of the data? Take just a few minutes to shape your own perspective and share your unique view. Do it your way

A great starting point for your Check Point Software Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Explore Alternatives

Despite recent profit margin gains, Check Point faces slowing long-term revenue and earnings forecasts, which puts its premium valuation at risk compared to faster-growing competitors.

If you want exposure to companies where the numbers are pointing up year after year, use stable growth stocks screener (2122 results) to focus on steady performers with more reliable growth outlooks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.