Please use a PC Browser to access Register-Tadawul

Chefs' Warehouse (CHEF) Is Up 5.7% After Raising Full-Year Guidance on Strong Q3 Results

Chefs' Warehouse, Inc. CHEF | 66.67 | +3.94% |

- The Chefs' Warehouse, Inc. recently reported third-quarter 2025 results, delivering US$1.02 billion in sales and US$19.15 million in net income, both higher than the same period last year, and raised its full-year earnings guidance to reflect stronger anticipated performance.

- In addition, Chief Financial Officer James Leddy sold 22,000 shares for estate planning reasons, while analyst commentary focused on the company's ongoing growth in organic case volume, unique customer additions, and improved operational metrics.

- We’ll now explore how Chefs’ Warehouse’s raised guidance and robust earnings growth affect its evolving investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Chefs' Warehouse Investment Narrative Recap

To be a Chefs’ Warehouse shareholder, you need to believe in a long-term shift toward premium foodservice, steady urban restaurant demand, and management’s ability to both grow through acquisitions and improve margins. The company’s raised 2025 guidance and strong third-quarter earnings strengthen the near-term growth catalyst of rising premium customer and case volumes, but do not erase the existing risk of structural cost inflation, especially ongoing labor pressures that could compress margins. The impact of this news on the biggest short-term risk, cost inflation, remains limited, so that remains an issue for investors to track.

The most relevant company announcement is the recent upward revision to full-year earnings guidance following robust Q3 results. This reflects management’s confidence that core organic growth in higher-value offerings and new customer gains are driving improved financials, reinforcing the growth catalyst of mix shift toward premium categories and digital-enabled efficiencies. Yet, for investors relying on guidance upgrades as a signal, it will be important to monitor whether these trends can continue in the face of margin challenges.

But while robust revenue trends look promising, investors should still keep a close eye on persistent labor cost inflation and...

Chefs' Warehouse's outlook anticipates $4.9 billion in revenue and $121.9 million in earnings by 2028. This is based on a projected annual revenue growth rate of 7.6% and represents a $52.3 million increase in earnings from the current $69.6 million.

Uncover how Chefs' Warehouse's forecasts yield a $76.62 fair value, a 23% upside to its current price.

Exploring Other Perspectives

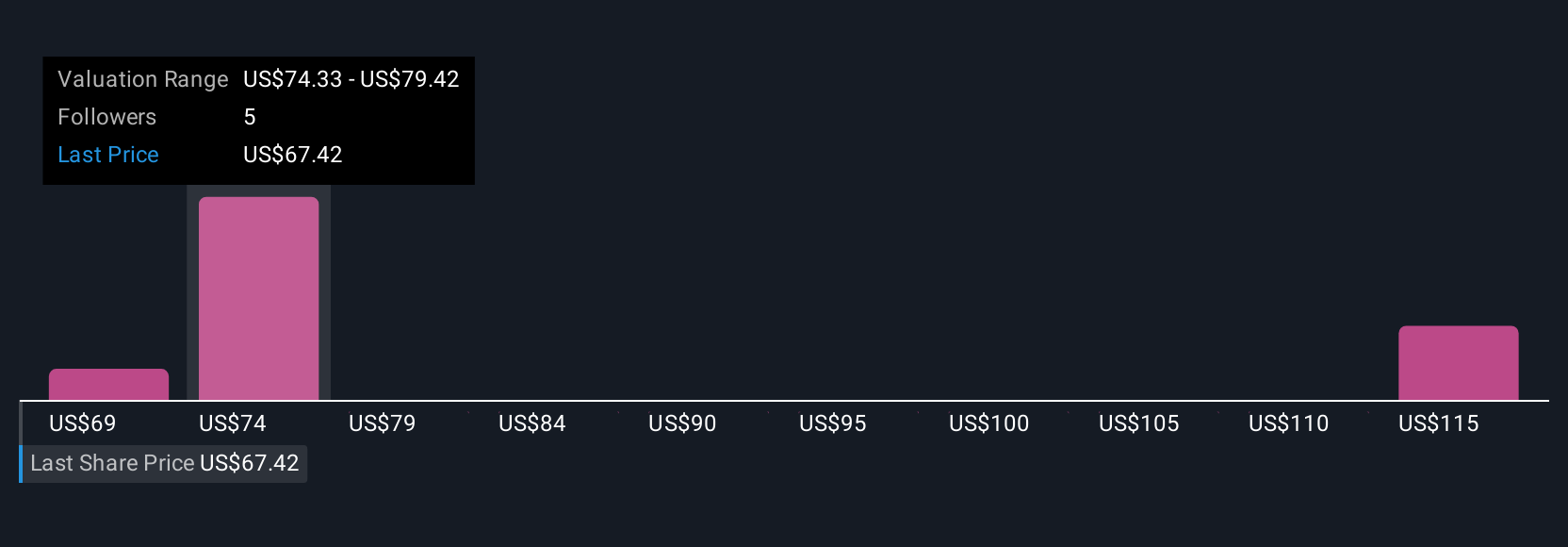

Five members of the Simply Wall St Community placed individual fair values for Chefs’ Warehouse between US$38.55 and US$90.50. While community perspectives vary widely, the continued risk of operating cost inflation could significantly affect future profitability, so make sure to consider several viewpoints before deciding how you understand the company’s potential.

Explore 5 other fair value estimates on Chefs' Warehouse - why the stock might be worth 38% less than the current price!

Build Your Own Chefs' Warehouse Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Chefs' Warehouse research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Chefs' Warehouse research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Chefs' Warehouse's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.