Please use a PC Browser to access Register-Tadawul

Chefs' Warehouse (CHEF) Valuation Check After Fresh 2026 Sales And Earnings Guidance

Chefs' Warehouse, Inc. CHEF | 70.02 | +0.81% |

Guidance-driven move in Chefs' Warehouse stock

Chefs' Warehouse (CHEF) recently issued preliminary unaudited guidance for fiscal 2026, indicating expected net sales between US$4.35 billion and US$4.45 billion and net income in the US$88.0 million to US$92.0 million range, giving investors a fresh reference point.

The guidance lands at a time when Chefs' Warehouse shares have a 90 day share price return of 9.53%, while the 1 year total shareholder return is 18.98%. This points to momentum that has been building rather than fading.

If this update has you thinking about other food and consumer names, it could be a good moment to broaden your search with fast growing stocks with high insider ownership.

With Chefs' Warehouse trading at US$63.89 and sitting at an estimated 29% discount to one intrinsic value measure, the question now is whether this is a genuine opening or if the market already anticipates that growth.

Most Popular Narrative: 16.1% Undervalued

Chefs' Warehouse's most followed narrative pegs fair value at about $76.13, above the latest close at $63.89, which sets up a clear valuation gap for investors to assess.

Operational improvements such as investments in procurement, digital ordering (now ~60% of specialty sales), predictive demand forecasting, and inventory optimization technology are already contributing to margin efficiency and scalability, laying the groundwork for further net margin and earnings expansion as these initiatives mature.

Curious what kind of revenue growth, margin lift, and future earnings multiple are baked into that fair value around $76? The narrative leans on a detailed set of long term forecasts and a specific discount rate to bridge today’s price and those expectations.

Result: Fair Value of $76.13 (UNDERVALUED)

However, this story can change quickly if cost inflation continues to pressure margins or if acquisition integration issues weigh on earnings more than analysts currently expect.

Another Angle On Valuation

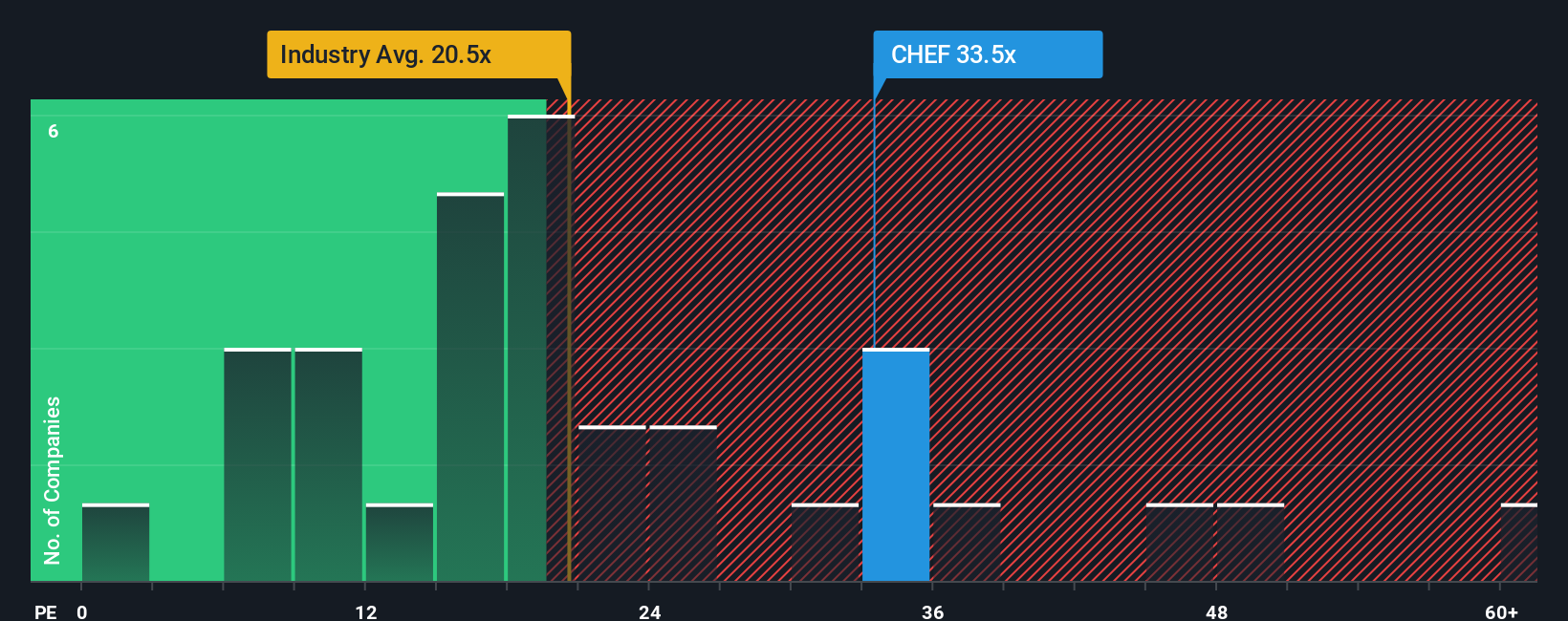

There is a twist when you look at Chefs' Warehouse through its P/E. The shares trade at 34.8x earnings, compared with a 22.2x industry average, 29.6x for peers, and a fair ratio of 17.7x. That kind of premium can signal confidence, but it can also raise the bar if expectations slip. Which side of that tradeoff do you think matters more?

Build Your Own Chefs' Warehouse Narrative

If you read this and come to a different conclusion, or simply want to test your own assumptions against the data, you can build a personalized view in just a few minutes with Do it your way.

A great starting point for your Chefs' Warehouse research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Chefs' Warehouse has sparked fresh thinking, do not stop here. Use the screeners below to spot other opportunities before they move without you.

- Target reliable income streams by checking out these 13 dividend stocks with yields > 3% that focus on companies offering yields above 3%.

- Position yourself early in potential growth stories with these 23 AI penny stocks that are tied to artificial intelligence themes.

- Hunt for mispriced opportunities through these 872 undervalued stocks based on cash flows that highlight companies trading below estimated cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.