Please use a PC Browser to access Register-Tadawul

Ciena (CIEN): Evaluating Valuation Following Comcast Fiber Expansion and Growing AI Network Momentum

Ciena Corporation CIEN | 218.44 | -9.87% |

Ciena (CIEN) has caught investor attention following news that Comcast is deploying its 5131 Coherent Access Platform to expand fiber connectivity. This partnership aligns with broader efforts to enhance digital access in rural and underserved areas.

After the Comcast partnership announcement, Ciena has seen momentum build both operationally and in investor sentiment. Recent upgrades and commentary around its expansion in AI-powered networks and data centers have coincided with a steady climb, delivering a 1.3% total shareholder return over the past year. The company’s stock performance suggests investors are beginning to price in growth potential tied to these new opportunities.

If Ciena’s recent moves have sparked your curiosity, why not see what else is possible and explore fast growing stocks with high insider ownership

With the stock hovering near its 52-week high and analysts signaling optimism, the big question for investors remains: Is Ciena undervalued given its new momentum, or has the market already factored in this growth potential?

Most Popular Narrative: 20% Overvalued

Compared to Ciena’s most popular narrative fair value of $127.22, the last close price of $152.66 sits noticeably higher. This places expectations on future growth and margins front and center.

Major cloud providers and a new wave of neo-scalers are aggressively investing in high-capacity, low-latency optical networking infrastructure to support AI workloads. This is driving multiyear, global network buildouts that should significantly expand Ciena's addressable market and underpin sustained, above-trend revenue growth. Ciena's industry-leading solutions (WaveLogic 6, RLS platform, pluggables, DCOM) are rapidly becoming de facto standards for AI network infrastructure, resulting in sizable multi-hundred-million-dollar orders, a record order book, and strong visibility into 2026 growth. This suggests consensus revenue estimates may be too conservative.

Curious what’s behind these bold valuation calls? The narrative leans on projections that demand for AI and cloud infrastructure will skyrocket Ciena’s future growth and margins. Uncover which big financial assumptions power this fair value target.

Result: Fair Value of $127.22 (OVERVALUED)

However, heavy reliance on a few major customers and rapid technological shifts could quickly challenge Ciena’s bullish outlook if industry dynamics change.

Another View: Multiple-Based Valuation Raises Questions

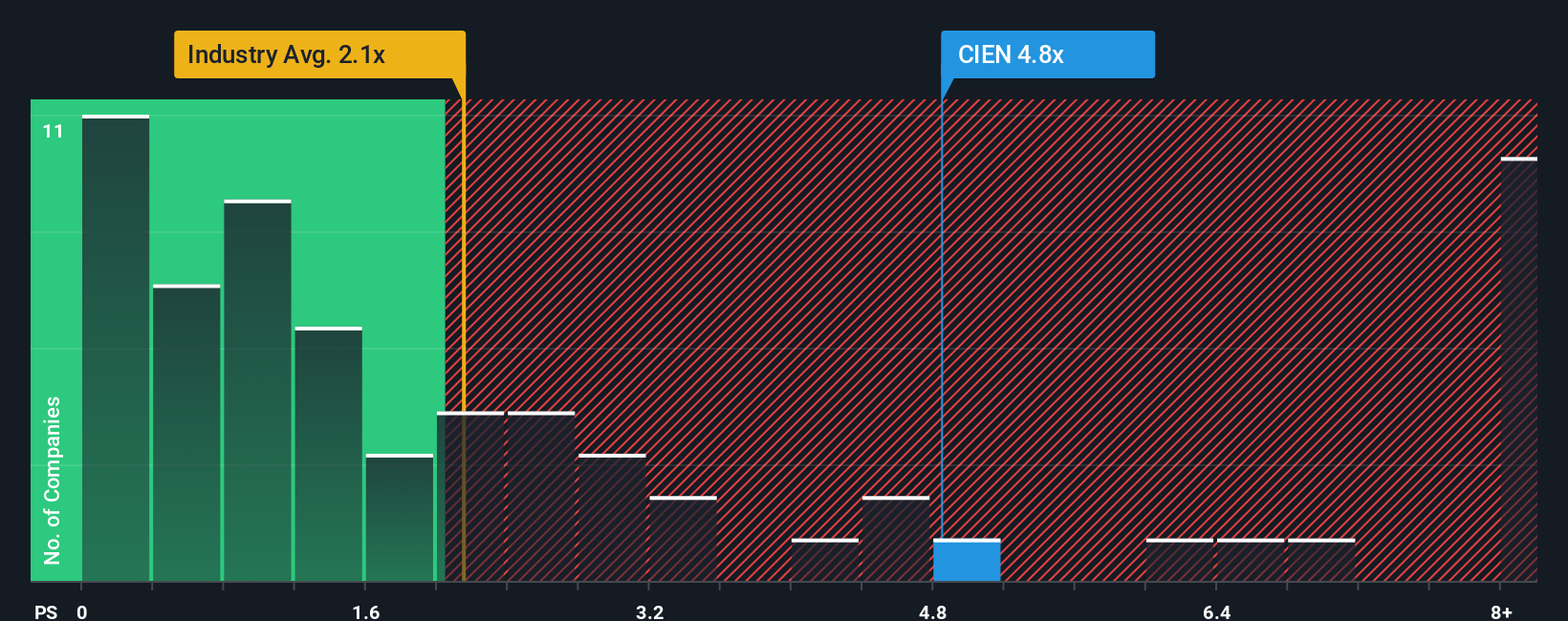

Looking at how Ciena is priced compared to its sales reveals a different perspective. Its current ratio of 4.7x is well above both the industry average of 2.3x and the fair ratio of 4.2x that analysts believe the market could eventually move toward. This premium suggests investors are paying up for future growth, but at what risk?

Build Your Own Ciena Narrative

If you want to take a different angle or dig deeper into the numbers on your own, you can easily put together a personalized view in just a few minutes, so why not Do it your way

A great starting point for your Ciena research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let a great opportunity slip by. Tap into unique stock picks and bold trends using exclusive SWS screeners designed to match your investing ambitions.

- Capture growth with potential market disruptors as you review these 26 quantum computing stocks, which is driving breakthroughs at the forefront of computing innovation.

- Strengthen your portfolio’s long-term cash flow by targeting companies featured in these 19 dividend stocks with yields > 3% for robust yields above 3%.

- Ride the digital revolution by following these 78 cryptocurrency and blockchain stocks, a key resource at the heart of blockchain innovation and next-generation finance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.