Please use a PC Browser to access Register-Tadawul

Cinemark (CNK): Assessing Valuation Following Annual Net Income and Revenue Growth

Cinemark Holdings, Inc. CNK | 25.72 | -0.19% |

After a bumpy start to the year, Cinemark’s share price has rebounded with a 12% gain over the past month. However, its year-to-date share price return remains negative and its one-year total return sits at -8.8%. Despite this mixed momentum, the three- and five-year total shareholder returns of 115% and 77% highlight the company’s longer-term recovery story and its ongoing appeal for patient investors.

If you're watching the recent bounce and thinking about new opportunities, it might be the perfect moment to discover fast growing stocks with high insider ownership.

But with shares still trading below analyst targets, the debate is whether Cinemark stock remains a value play or if the recent momentum has already incorporated expectations for future growth. Investors are considering if there is a buying opportunity, or if the market is already pricing in all the upside.

Most Popular Narrative: 13% Undervalued

With Cinemark’s fair value estimated at $33.91 and the last close at $29.49, investors are looking at a healthy gap. This potential upside sets the stage for the most widely followed narrative explaining how these numbers stack up.

Expansion of premium cinematic offerings, such as PLF formats (XD, D-BOX, ScreenX), recliner seating, and enhanced concession merchandising, enables Cinemark to drive higher average ticket prices and increase per-visit spend. These factors directly impact both revenue and net margin improvement in the long run. Sustained market share gains in both the U.S. and Latin America, combined with continued population growth in key geographies, set the stage for above-industry attendance growth and favorable operating leverage, positively influencing topline revenue and adjusted EBITDA.

Curious about the math behind that bold valuation? The narrative banks on explosive growth in revenue per guest, margin expansion from strategic upgrades, and a profit trajectory sized to rival sector leaders. Want the inside story? The real numbers, and the risks, await.

Result: Fair Value of $33.91 (UNDERVALUED)

However, factors such as film pipeline disruptions and rising operating costs could quickly reverse recent gains and challenge Cinemark's current recovery narrative.

Another View: What Do the Earnings Multiples Say?

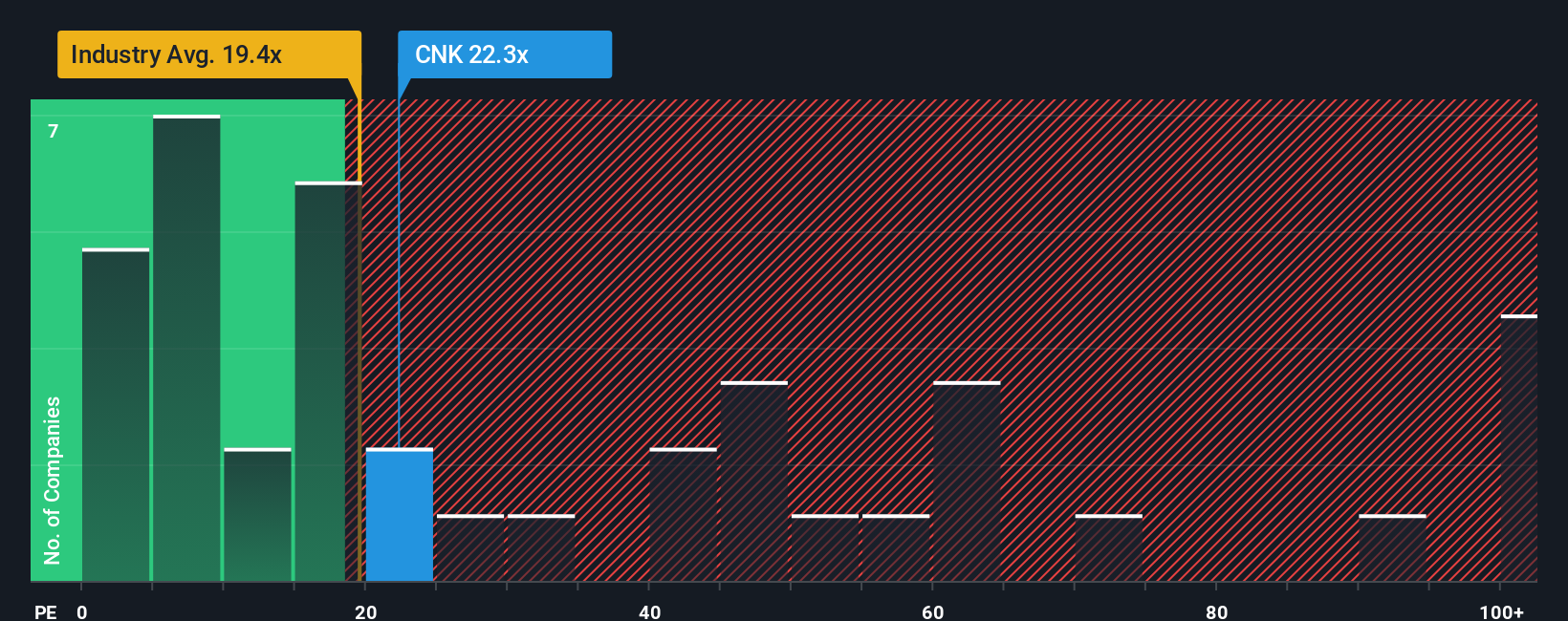

Looking at the numbers a different way, Cinemark’s price-to-earnings ratio is currently 22.3x, which is higher than both the US Entertainment industry average of 19.5x and the estimated fair ratio of 20.4x. This suggests the stock may be priced a bit above what fundamentals alone justify, compared to peers and market expectations. The real question is whether the premium is a sign of stronger future growth or if it could expose investors to a pullback if results disappoint.

Build Your Own Cinemark Holdings Narrative

If you see things differently or want to try your own spin on the numbers, it only takes a few minutes to build your own perspective. Do it your way.

A great starting point for your Cinemark Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. There’s more to the market than just one stock. Cast a wider net and set yourself up for your next smart move.

- Tap into reliable income streams by checking out these 17 dividend stocks with yields > 3%, featuring companies with strong yields and consistent payouts.

- Catch the AI revolution early by following these 25 AI penny stocks, where innovators with long-term growth potential are making their mark.

- Capitalize on shifting valuations as you explore these 918 undervalued stocks based on cash flows, highlighting companies trading below their real worth based on fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.