Please use a PC Browser to access Register-Tadawul

Cinemark Holdings (CNK) Valuation Check After Mixed Recent Share Price Performance

Cinemark Holdings, Inc. CNK | 26.49 | +0.49% |

Recent performance snapshot

Cinemark Holdings (CNK) has seen mixed share performance, with a roughly 9.2% gain over the past month, a 13.1% decline over the past 3 months, and a 17.4% negative 1 year total return.

With the share price at US$26.04, recent momentum has picked up, with a positive 7 day and 30 day share price return, while the 1 year total shareholder return remains negative despite a strong 3 year gain.

If Cinemark’s mixed track record has you thinking about diversification, this could be a good moment to scan a wider field of opportunities through our 22 top founder-led companies.

So, with Cinemark shares at about US$26.04, positive recent momentum, an 8.7% intrinsic discount and trading around 21% below analyst targets, is there still a buying opportunity here, or is the market already pricing in future growth?

Price-to-Earnings of 19.7x: Is it justified?

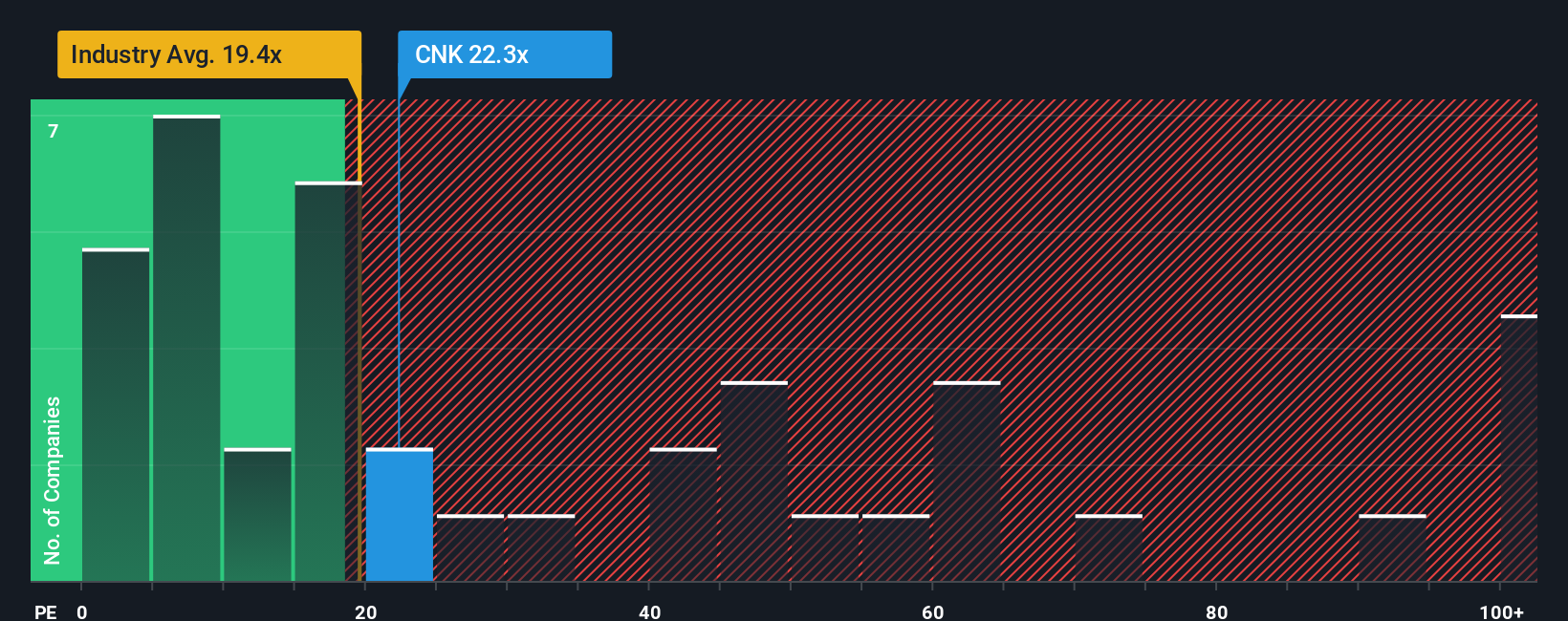

Cinemark Holdings currently trades on a P/E of 19.7x, which screens as good value relative to both its peers and the wider US Entertainment industry.

The P/E ratio compares the share price with earnings per share and is a common way investors weigh what they are paying for each dollar of profit. For a cinema operator with positive net income of $153.6m, this measure puts the focus squarely on how the market is valuing current profitability.

Our data indicates the stock is trading at good value compared to peers and industry, with its 19.7x P/E sitting well below the peer average of 58x and under the estimated fair P/E of 22.4x. That gap suggests the market is valuing Cinemark’s earnings at a discount to where our fair ratio model estimates they could settle if sentiment and fundamentals lined up more closely.

On top of that, the company’s earnings are forecast to grow 20.8% per year, while revenue is expected to grow 5.5% per year and return on equity is projected at 39.4% in three years, according to the data provided. Against that backdrop, a P/E below both peers and the fair P/E level may indicate the current price is not fully reflecting the growth profile that analysts are expecting.

Result: Price-to-Earnings of 19.7x (UNDERVALUED)

However, you should still keep an eye on the recent 13.1% three-month share price decline and the 17.4% negative one-year total return as possible sentiment overhangs.

Another view on value

So far you have seen the P/E story, with Cinemark trading at 19.7x compared with a fair ratio of 22.4x and peer levels around 58x. That looks appealing, but it also raises a question: is the market correctly pricing the risk that comes with high debt and softer recent profit margins?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cinemark Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 51 high quality undervalued stocks. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cinemark Holdings Narrative

If you see the numbers differently or simply prefer to test your own assumptions, you can build a custom view of Cinemark in just a few minutes by starting with Do it your way.

A great starting point for your Cinemark Holdings research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Cinemark has sparked your interest, do not stop here. Cast a wider net and let fresh ideas challenge and refine how you build your portfolio.

- Spot potential bargains early by scanning companies on our 51 high quality undervalued stocks and compare how their prices stack up against underlying fundamentals.

- Prioritise resilience by checking out stocks in the 85 resilient stocks with low risk scores where business quality and risk scores sit at the centre of the filter.

- Hunt for under followed opportunities with the screener containing 24 high quality undiscovered gems and see which quieter names match the fundamental traits you care about most.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.