Please use a PC Browser to access Register-Tadawul

Cipher Mining (CIFR) Is Up 10.5% After Google-Backed $3B AI Project and Hosting Pact Announcement

Cipher Mining Inc. - Common Stock CIFR | 17.05 | -9.69% |

- Earlier this month, Fluidstack, backed by Google, announced a 10-year AI hosting agreement with Cipher Mining, alongside a US$3 billion investment for building an artificial intelligence project in Texas that is set to generate US$300 million in annual revenue for Cipher.

- This shift marks Cipher Mining’s expansion from a pure Bitcoin mining firm into a broader technology infrastructure provider, capitalizing on growing demand for AI training and high-performance computing services.

- We'll examine how Google’s long-term investment to support Cipher Mining’s AI infrastructure ambitions could reshape its investment outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Cipher Mining Investment Narrative Recap

Cipher Mining’s shift from pure Bitcoin mining to AI-driven infrastructure through its US$3 billion agreement with Google-backed Fluidstack marks a fundamental change in its investment thesis. For shareholders, the big picture now centers on Cipher’s ability to diversify and stabilize revenues via high-performance computing, but the most important short-term catalyst, ramp-up of AI hosting, will take time to scale, while the biggest risk remains execution on untested HPC demand and significant capital deployment. The full impact of these changes on near-term results appears limited for now, keeping attention on operational delivery and contract ramp-up as key watchpoints.

Of the company’s recent announcements, the proposal to double authorized common shares to 1 billion is especially relevant. This move hints at the need for additional financial flexibility to fund growth initiatives like the AI infrastructure buildout, though it also raises the risk of future shareholder dilution if new shares are issued, something closely tied to how quickly new revenue streams can cover large-scale investments and ongoing operating losses.

In contrast, while expanded growth prospects are exciting, investors should stay alert to the risk that capital-intensive expansion may require further share issuance if...

Cipher Mining's narrative projects $696.2 million in revenue and $91.1 million in earnings by 2028. This requires 63.6% yearly revenue growth and a $245.1 million increase in earnings from -$154.0 million today.

Uncover how Cipher Mining's forecasts yield a $16.88 fair value, a 10% downside to its current price.

Exploring Other Perspectives

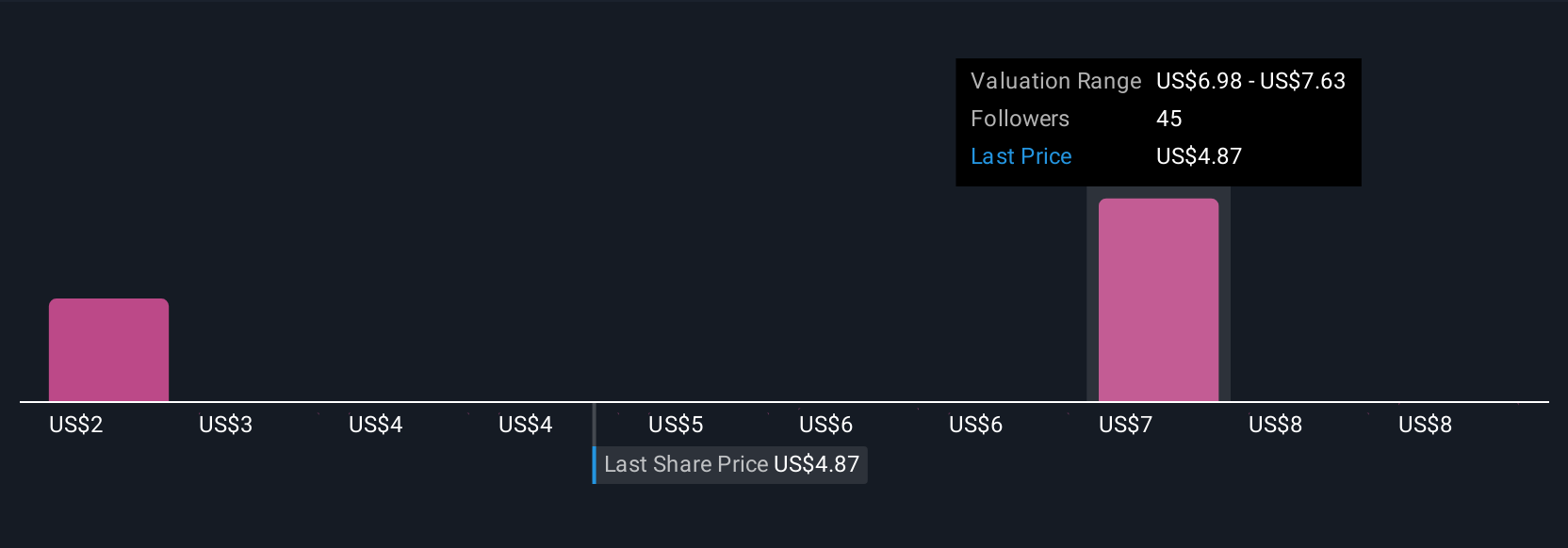

Seven fair value estimates from the Simply Wall St Community span US$6 to nearly US$31 per share, reflecting a broad range of future expectations. With Cipher’s revenue diversification still early, views differ sharply on how quickly AI infrastructure can support growth and offset core crypto risks.

Explore 7 other fair value estimates on Cipher Mining - why the stock might be worth as much as 65% more than the current price!

Build Your Own Cipher Mining Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cipher Mining research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Cipher Mining research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cipher Mining's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.