Please use a PC Browser to access Register-Tadawul

Cipher Mining (CIFR) Is Up 15.4% After Google-Backed $3 Billion AI Hosting Deal at Barber Lake

Cipher Mining Inc. - Common Stock CIFR | 17.05 | -9.69% |

- In October 2025, Cipher Mining announced a landmark 10-year, Google-backed agreement with Fluidstack to provide 168 MW of high-performance computing hosting at its new Barber Lake data center, expected to generate US$3 billion in revenue over the decade, funded in part by a US$1.3 billion zero-coupon convertible note issuance.

- This move marks a significant expansion of Cipher Mining’s business beyond Bitcoin mining, as it leverages its infrastructure for artificial intelligence and cloud services, signaling a major shift in its growth strategy.

- We'll discuss how Cipher Mining's entry into AI and high-performance computing hosting redefines its long-term earnings outlook and diversification potential.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Cipher Mining Investment Narrative Recap

To become a Cipher Mining shareholder, you have to believe in both the enduring potential of Bitcoin and the company’s ambitious move to expand into high-performance computing (HPC) hosting, as seen with its Google-backed, decade-long Fluidstack agreement. While these newsworthy partnerships support short-term optimism and future diversification, Cipher remains materially exposed to swings in Bitcoin prices, which continue to be the company’s most important catalyst and core risk for earnings, this exposure remains unchanged after the recent news.

Of the recent updates, Cipher’s US$1.3 billion zero-coupon convertible note issuance stands out as directly relevant to its HPC hosting strategy, providing key funding for the Barber Lake data center buildout. This scale of capital deployment underscores the company’s higher risk profile, especially if anticipated data center demand falls short of expectations.

By contrast, shareholders should be aware of the challenges that could arise if the HPC pivot does not attract sufficient tenant demand, potentially leaving capital tied up in underutilized assets...

Cipher Mining's narrative projects $696.2 million revenue and $91.1 million earnings by 2028. This requires 63.6% yearly revenue growth and a $245.1 million earnings increase from current earnings of $-154.0 million.

Uncover how Cipher Mining's forecasts yield a $11.38 fair value, a 33% downside to its current price.

Exploring Other Perspectives

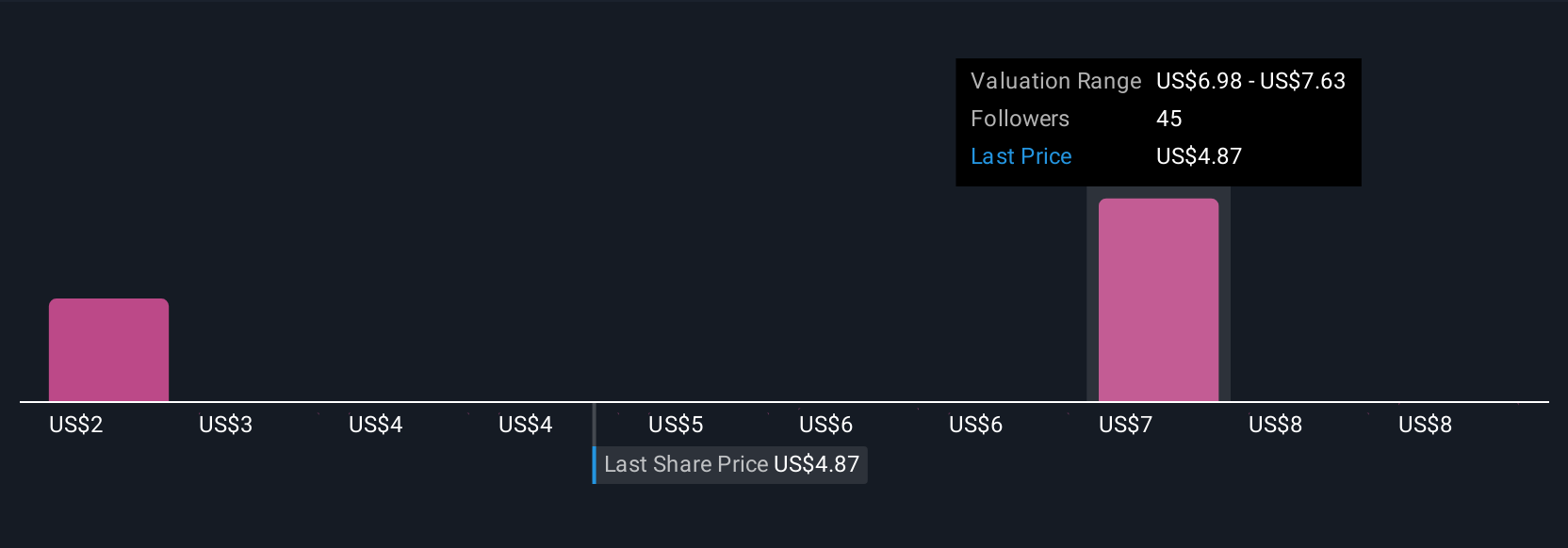

Seven members of the Simply Wall St Community have estimated fair value for Cipher Mining, ranging from US$6 to over US$30 per share. With ongoing questions around tenant demand for new data center capacity, these wide-ranging views show just how much opinions differ about the company’s long-term business mix.

Explore 7 other fair value estimates on Cipher Mining - why the stock might be worth less than half the current price!

Build Your Own Cipher Mining Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cipher Mining research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Cipher Mining research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cipher Mining's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.