Please use a PC Browser to access Register-Tadawul

Cipher Mining (CIFR) Is Up 28.2% After Google-Backed AI Data Center Deal With Fluidstack

Cipher Mining Inc. - Common Stock CIFR | 17.05 | -9.69% |

- Fluidstack recently announced a 10-year high-performance computing colocation agreement with Cipher Mining, under which Cipher will provide 168 MW of IT load at its Barber Lake site, supported by a US$1.4 billion lease backstop from Google and warrants for approximately a 5.4% stake in Cipher Mining.

- This collaboration positions Cipher Mining to accelerate its pivot from bitcoin mining into AI-focused data center infrastructure, leveraging both significant outside capital and a large-scale client commitment.

- We'll examine how Google's substantial investment and lease support could reshape Cipher Mining's investment narrative and growth profile.

Find companies with promising cash flow potential yet trading below their fair value.

Cipher Mining Investment Narrative Recap

To be a shareholder in Cipher Mining today, you must believe in its ability to transition from a bitcoin mining pure play to a diversified AI and data center powerhouse. The recently announced Google-backed Fluidstack deal could act as a meaningful short-term catalyst for the stock by providing significant new revenue visibility and capital access, but the biggest risk remains execution on these next-generation HPC projects and ensuring actual tenant demand materializes; otherwise, anticipated upside from the pivot could prove elusive.

Of Cipher’s recent announcements, the US$1.3 billion convertible notes offering stands out in direct relation to funding these infrastructure ambitions. This financing gives the company more runway to build out its Barber Lake site and other HPC developments, crucial for delivering on the promises embedded in new contracts such as the Fluidstack agreement.

By contrast, investors should also be aware that slow tenant ramp-up or underutilized AI infrastructure could …

Cipher Mining's narrative projects $696.2 million in revenue and $91.1 million in earnings by 2028. This requires a 63.6% yearly revenue growth and a $245.1 million increase in earnings from the current -$154.0 million.

Uncover how Cipher Mining's forecasts yield a $11.38 fair value, a 23% downside to its current price.

Exploring Other Perspectives

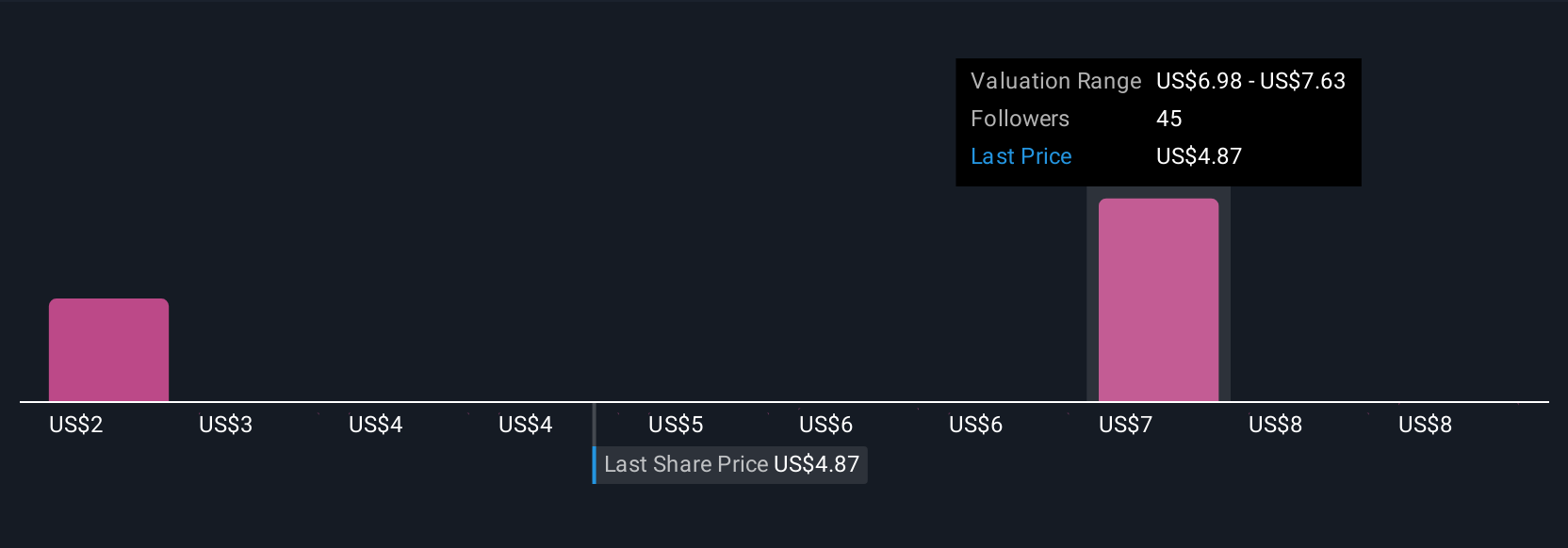

Simply Wall St Community estimates show fair values for Cipher Mining ranging from US$6 to over US$30 per share, based on 7 independent perspectives. Against this diversity in opinion, the need for real revenue from AI data center tenants is a common thread that could determine whether optimism or caution wins out.

Explore 7 other fair value estimates on Cipher Mining - why the stock might be worth over 2x more than the current price!

Build Your Own Cipher Mining Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cipher Mining research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Cipher Mining research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cipher Mining's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.