Please use a PC Browser to access Register-Tadawul

Cirrus Logic (CRUS) Margin Strength In Q3 2026 Reinforces Bullish Profitability Narratives

Cirrus Logic, Inc. CRUS | 142.14 | +1.32% |

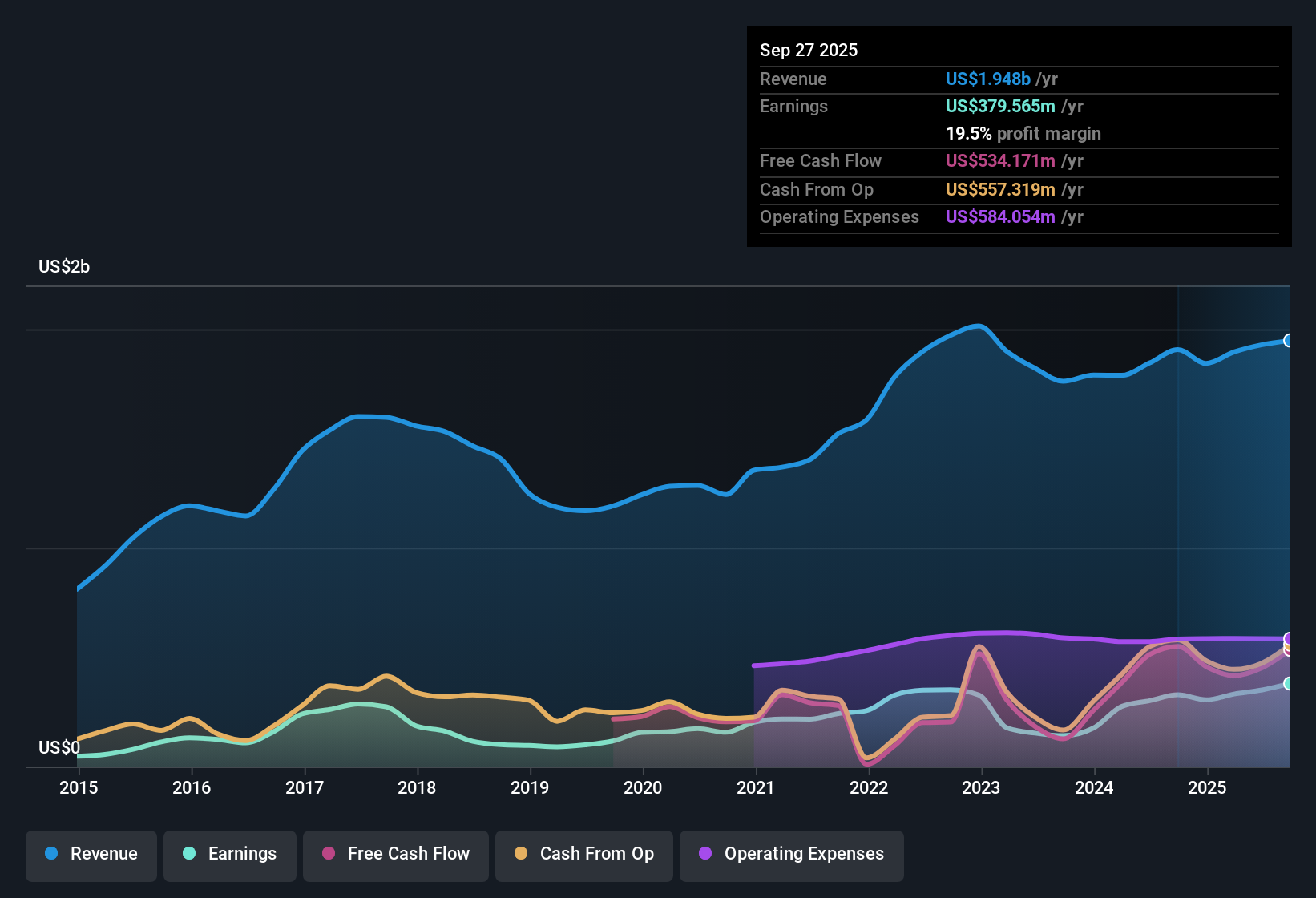

Cirrus Logic (CRUS) has reported another solid quarter, with Q3 2026 revenue of US$580.6 million and basic EPS of US$2.75 supported by net income of US$140.3 million, giving investors a clear snapshot of its recent profitability. The company’s quarterly revenue moved from US$555.7 million and EPS of US$2.19 in Q3 2025 to US$580.6 million and US$2.75 respectively in Q3 2026. Trailing 12 month EPS reached US$7.82 and net income was US$403.9 million, highlighting a margin profile that many investors are likely to watch closely.

See our full analysis for Cirrus Logic.With the headline numbers now available, the next step is to consider how this earnings profile aligns with the widely followed bullish and bearish narratives around Cirrus Logic, and to assess where the latest margin and growth trends support or challenge those views.

Margins Strengthen With 20.5% Net Income

- Over the last 12 months, Cirrus Logic generated US$403.9 million of net income on US$1.97b of revenue, which works out to a 20.5% net margin compared with 16.6% a year earlier.

- What stands out for bullish investors is that earnings grew 32.3% over the past year while revenue grew about 3%. Taken together:

- This combination of faster earnings growth and a higher net margin supports the bullish view that the business has recently been converting sales into profit more efficiently.

- At the same time, the relatively modest revenue growth rate gives bulls something to watch, because the stronger profit trend is leaning more on margins than on top line expansion.

TTM EPS Near US$7.82 With Consistent Quarterly Support

- Trailing 12 month basic EPS sits at US$7.82, backed by recent quarterly EPS of US$2.75, US$2.57 and US$1.17 in Q3, Q2 and Q1 2026 respectively.

- Bulls often focus on earnings durability, and this recent run of EPS figures:

- Lines up with the 32.3% year over year earnings growth in the trailing data, which supports the bullish idea that recent profit levels are not coming from a single one off event.

- Exists alongside five year EPS growth of 8.9% per year in the supplied data, which bulls may read as a longer history of earnings support behind the current 12 month performance.

P/E Of 17x Versus Sector At 42.2x

- The trailing P/E of 17x sits below the US Semiconductor industry average of 42.2x, the peer average of 26.3x, and the cited US market P/E of 19.3x.

- Bears point to the risk side of the story, and the numbers give them material talking points:

- Forecasts in the data show earnings expected to decline about 2.1% per year over the next three years, which contrasts with the strong trailing 32.3% earnings growth and can underpin a cautious stance.

- The current share price of US$134.91 is also above the US$93.50 DCF fair value cited, so even with a lower P/E than peers, skeptics can argue that the stock trades above this cash flow based estimate.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Cirrus Logic's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Cirrus Logic’s modest 3% revenue growth alongside forecasts of 2.1% yearly earnings decline and a share price above the cited DCF estimate may concern valuation focused investors.

If that gap between recent profit strength and a share price above the cash flow estimate feels uncomfortable, check out these 868 undervalued stocks based on cash flows to focus on companies where current pricing looks more aligned with their underlying cash generation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.