Please use a PC Browser to access Register-Tadawul

Citigroup (C) Announces US$4 Billion Q2 Income With Increased US$0.60 Dividend

Citigroup Inc. C | 112.61 | +1.20% |

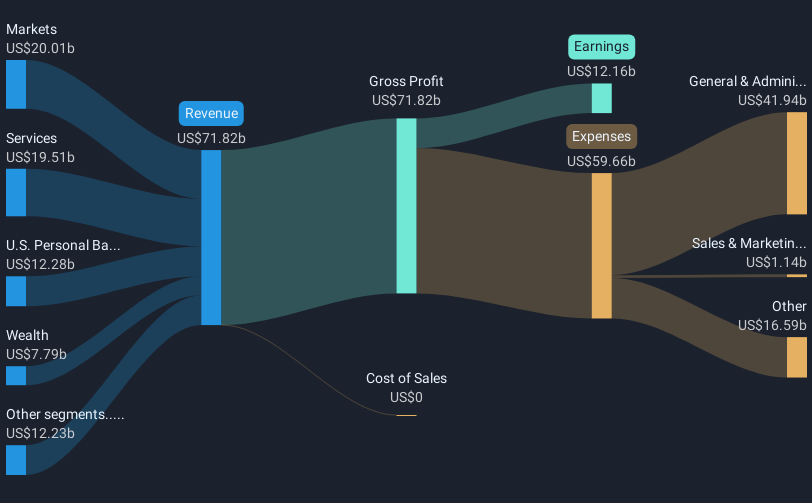

Citigroup (C) recently announced a quarterly dividend increase to $0.60 per share alongside strong earnings results with a net income of $4 billion for Q2 2025, up from $3.2 billion in the previous year. These events may have added weight to Citigroup's substantial 36% share price rise in the last quarter. The broader market impact, with banking stocks generally sliding, contrasted with Citigroup’s gain, suggesting that the company's earnings and dividend declarations provided solid support in a mixed market influenced by inflation concerns and tech rallies.

Citigroup's recent announcement of increased dividends alongside robust earnings results highlights the company's trajectory toward shareholder value creation. Over the past five years, the company achieved a substantial total return of 110.70%, reflecting a strong capacity to generate value over time. Despite broader market challenges, Citigroup outperformed the US Banks industry over the past year, suggesting resilience and effective strategic direction.

The positive news could bolster revenue and earnings forecasts by emphasizing Citigroup's potential for sustained profitability and expanded market share. Investments in AI and wealth management, highlighted in the narrative, are likely to further enhance operational efficiency and client acquisition, aligning with the company’s growth-focused initiatives. While the current share price of US$87.50 remains below the consensus price target of US$94.40, recent developments could bridge this gap, potentially uplifting the valuation closer to optimistic forecasts. Investors may view Citigroup's initiatives and robust financial health as factors supporting future appreciation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.