Please use a PC Browser to access Register-Tadawul

Citizens Financial Group (CFG): Exploring Valuation After Sector Loan Quality Concerns Offset Strong Company Results

Citizens Financial Group, Inc. CFG | 65.29 | +1.08% |

Recent commentary from regional banks about worsening loan quality sparked a cautious mood among investors, pressuring stocks across the sector. Citizens Financial Group (CFG) was not immune, even though it posted upbeat results and company updates.

It has been a busy stretch for Citizens Financial Group, with new executive appointments, a bigger dividend, fresh product launches and an upbeat outlook all announced recently. Yet, despite steady results and plenty of progress, the share price slipped nearly 8% across the past month, reflecting industry-wide jitters around loan quality. However, with a year-to-date share price return of over 13% and a robust 1-year total shareholder return of nearly 25%, the bank’s long-term momentum is clearly still intact.

If you’re keeping an eye on how financial stocks are responding to sector trends, this is a perfect time to broaden your perspective and uncover fast growing stocks with high insider ownership

So with Citizens Financial Group’s shares trading well below analyst targets and strong performance on key metrics, is the recent dip a compelling entry point for long-term investors, or are markets already factoring in the next phase of growth?

Most Popular Narrative: 19.8% Undervalued

With Citizens Financial Group’s last close at $49.31 and the widely-followed narrative suggesting a fair value near $61.48, the gap hints at substantial upside potential if narrative assumptions materialize.

The company's "Reimagining the Bank" initiative, focused on deploying advanced technologies such as AI and automation across customer service, operations, and risk management, is expected to unlock significant cost efficiencies and improve customer experience. These efforts are likely to drive down operating expenses, improve the efficiency ratio, and enhance net margins in the long term.

What bold changes and ambitious digital bets drive this valuation target? Under the surface: higher margins, revenue shocks, and a total earnings revamp. Curious how the new tech vision, capital strategy, and aggressive profit forecasts actually stack up? The full narrative breaks it down. See the surprising details behind this premium fair value call.

Result: Fair Value of $61.48 (UNDERVALUED)

However, heavy exposure to commercial real estate and the challenges of keeping pace with larger digital competitors could still threaten Citizens Financial Group’s growth story.

Another View: What Do Market Ratios Say?

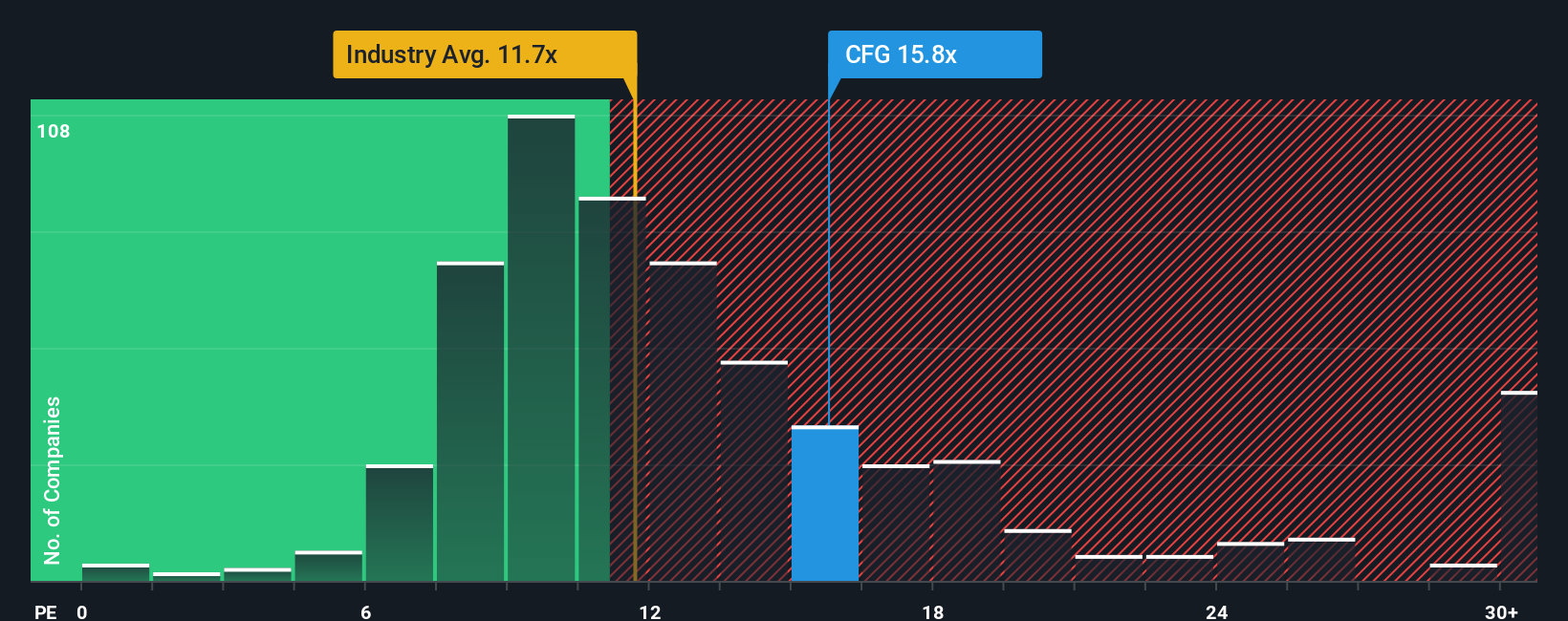

Although the fair value estimate implies that Citizens Financial Group is notably undervalued, a look at one key market ratio paints a more cautious picture. The company trades at a price-to-earnings ratio of 13.6, which is higher than both the US Banks industry average (11.2) and the peer group average (10.7). However, it is still below the fair ratio suggested by regression analysis (16.9). This gap means markets might be assigning a valuation risk premium, or there could be unrecognized upside that may lead to a re-rating.

Build Your Own Citizens Financial Group Narrative

If you want to check the numbers for yourself or have a different take on the story, dive in and build your view in just minutes. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Citizens Financial Group.

Looking for more investment ideas?

Leave the sidelines behind and seize your next opportunity by tapping into stocks with real momentum, future-focused tech, or proven income generation. The Simply Wall Street Screener equips you with actionable shortcuts to the market’s most exciting trends. See what you could be missing:

- Jumpstart your search for steady cash flow by checking out these 100+ dividend stocks with yields > 3%, which offers high yields that could boost your portfolio’s income potential.

- Unearth tomorrow’s innovation leaders when you check out these 24 AI penny stocks, positioned at the frontiers of artificial intelligence and automation breakthroughs.

- Cement your investing edge by targeting value opportunities among these 877 undervalued stocks based on cash flows, trading below their intrinsic worth right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.