Please use a PC Browser to access Register-Tadawul

Clear Secure (YOU) Jumps 7.0% After Biometric Partnership With Fidelity National—Is Real Estate the Next Growth Driver?

Clear Secure, Inc. YOU | 38.99 | +0.31% |

- Fidelity National Financial recently announced a collaboration with Clear Secure to integrate CLEAR's biometric identity platform into real estate transactions via the inHere digital platform, aiming to tackle increasing impersonation and wire fraud threats in property sales.

- This partnership marks a move for CLEAR into the real estate sector, potentially positioning biometric authentication as a new standard for transaction security beyond its established footprint in travel and venue access.

- We'll explore how Clear Secure's entry into the real estate market with biometric verification could influence its long-term investment outlook.

Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

Clear Secure Investment Narrative Recap

To have confidence as a Clear Secure shareholder, an investor needs to believe in the company’s potential to set industry standards for digital identity verification and expand beyond travel into sectors like real estate and healthcare. The recent Fidelity National Financial partnership aligns with this vision but does not generate an immediate catalyst for rapid growth in quarterly revenues or mitigate the present execution risk associated with new management transitions.

The August 20 announcement, where CLEAR1 was integrated with Snappt to verify property management applicants, is closely tied to the new real estate move with Fidelity. Both developments illustrate Clear Secure’s focus on applying its biometric authentication technology to counter fraud in major real-world settings, establishing new business lines, but not alleviating near-term volatility linked to financial and operational shifts.

Yet, while these expansions have the potential to increase stability for Clear Secure, investors should also consider the impact of quick leadership changes on...

Clear Secure's narrative projects $1.1 billion revenue and $149.9 million earnings by 2028. This requires 9.7% yearly revenue growth and a $27 million decrease in earnings from $176.9 million currently.

Uncover how Clear Secure's forecasts yield a $34.00 fair value, a 9% downside to its current price.

Exploring Other Perspectives

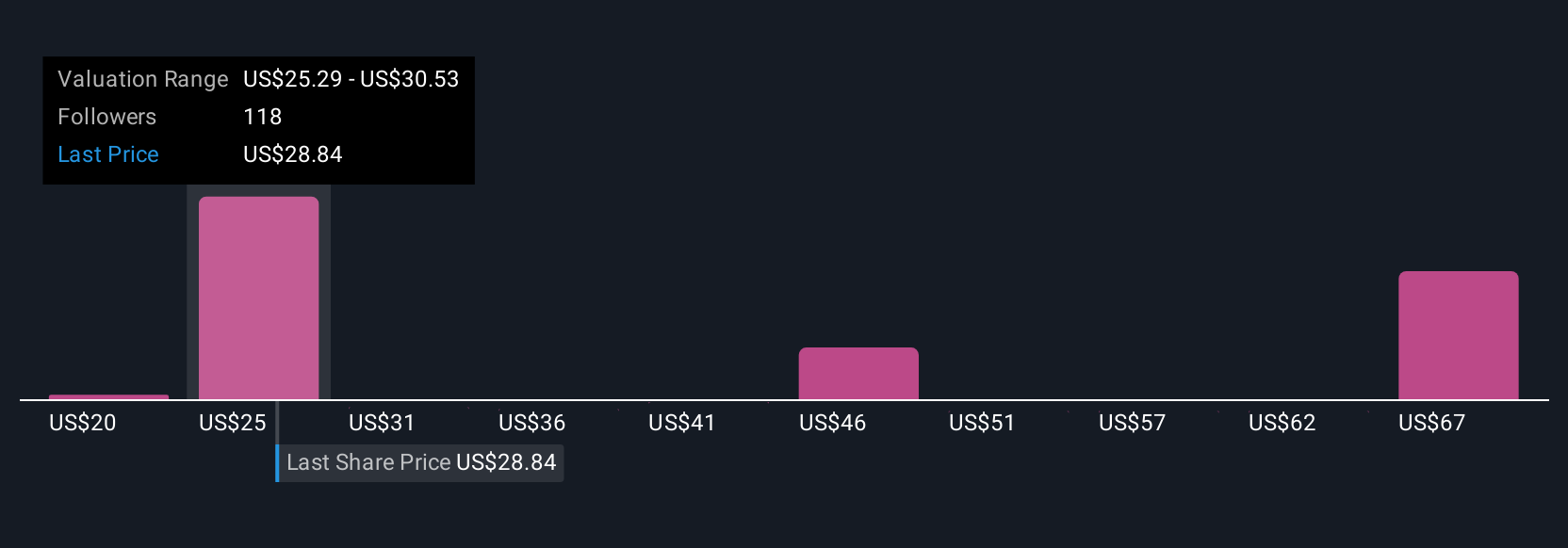

Thirteen Simply Wall St Community fair value estimates for Clear Secure range widely, from US$20.05 to US$69.70 per share. As you weigh this broad spectrum of investor opinions, remember ongoing leadership changes could influence the consistency of future financial performance, compare several viewpoints to see how others factor this into their outlook.

Explore 13 other fair value estimates on Clear Secure - why the stock might be worth 46% less than the current price!

Build Your Own Clear Secure Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Clear Secure research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Clear Secure research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Clear Secure's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.