Please use a PC Browser to access Register-Tadawul

Cleveland Cliffs (CLF) Valuation In Focus As Steel Demand And Margin Actions Support Sector Optimism

Cleveland-Cliffs Inc CLF | 14.02 | -7.09% |

Recent sector commentary has put steel demand in the spotlight, and Cleveland-Cliffs (CLF) is right in the middle of that discussion. The stock has also attracted attention after recent margin focused operational changes.

The recent optimism around steel demand and Cleveland-Cliffs’ margin actions has coincided with a 7 day share price return of 5.16% and a 90 day share price return of 8.08%, while the 1 year total shareholder return of 39.25% contrasts with weaker 3 and 5 year total shareholder returns.

If you are looking beyond steel for other ideas, this could be a good moment to compare sector stories using our screen of auto manufacturers.

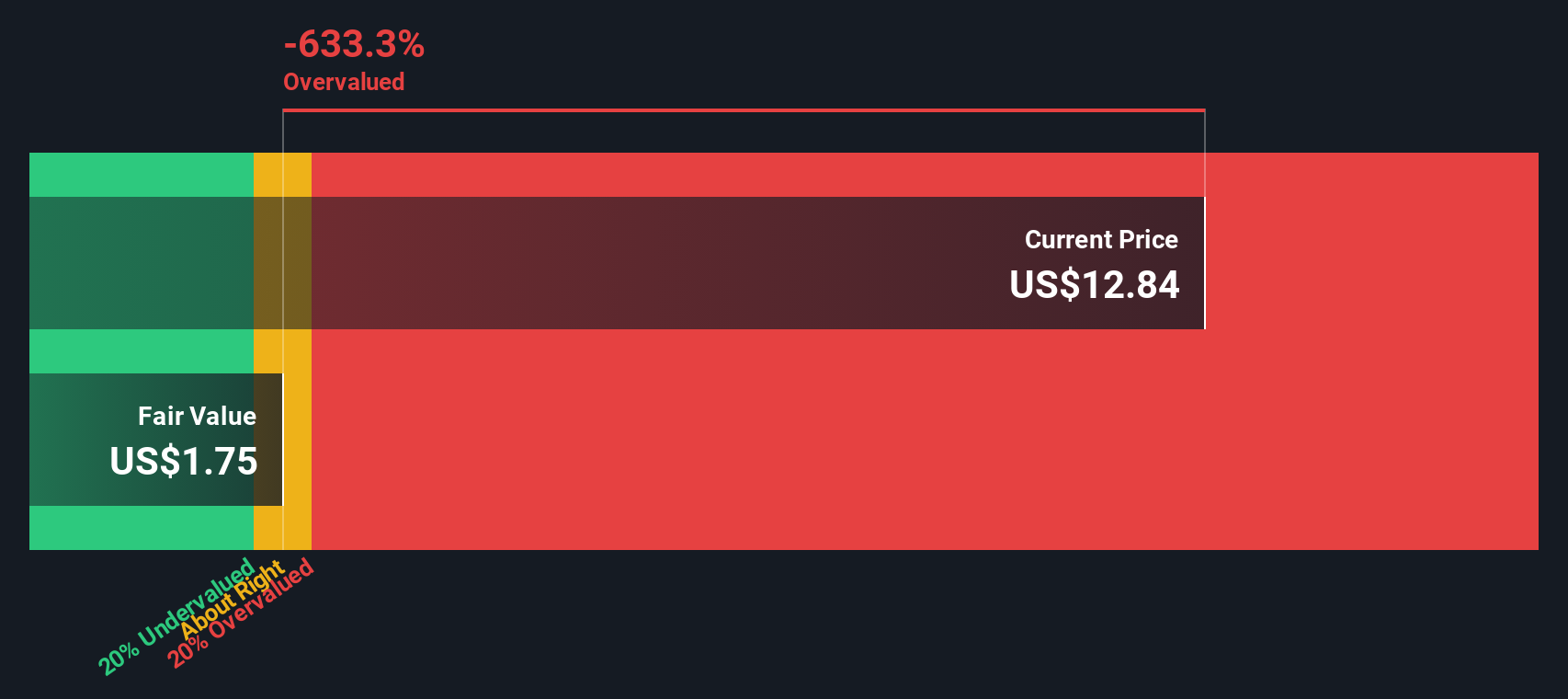

So with Cleveland-Cliffs trading at US$14.05, an intrinsic discount estimate of 34.80% and a recent sector-driven run, should you view current levels as an attractive entry point, or has the market already reflected the future growth potential in the price?

Price-to-Sales of 0.5x: Is it justified?

Cleveland-Cliffs is trading on a P/S of 0.5x at a last close of US$14.05, a level our checks flag as cheap versus both peers and the wider Metals and Mining industry.

The P/S ratio compares the company’s market value to its revenue, so it is especially useful when a business, like Cleveland-Cliffs, is currently loss making but still generating sizeable sales. At 0.5x sales, the market is pricing each US$1 of revenue at a clear discount to many comparable names, despite revenue of US$18,622.0m and annual revenue growth of 6.52%.

Against that backdrop, the gap is stark. The company’s 0.5x P/S sits well below the peer average of 1.8x and far under the US Metals and Mining industry average of 3.3x. Our fair P/S estimate of 0.6x also stands above the current level, indicating room for the valuation multiple to move closer to what the broader data set implies.

Result: Price-to-Sales of 0.5x (UNDERVALUED)

However, the recent loss of US$1,673.0m and weaker 3 and 5 year total returns suggest that earnings execution and investor confidence could still challenge the current discount story.

Another View: What Does The DCF Say?

While the low 0.5x P/S points to a cheap revenue multiple, our DCF model tells a similar story using cash flows instead of sales. It points to a future cash flow value of US$21.55 per share versus the current US$14.05, which also suggests Cleveland-Cliffs is undervalued. If both sales and cash flow views are pointing in the same direction, the key question is what could close that gap, or keep it open.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cleveland-Cliffs for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 872 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cleveland-Cliffs Narrative

If you see the figures differently or prefer to work from your own assumptions, you can rebuild the story yourself in just a few minutes, starting with Do it your way.

A great starting point for your Cleveland-Cliffs research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop with just one stock, you could miss out on opportunities that fit you better, so consider widening your search before you make your next move.

- Spot potential value candidates early by scanning these 872 undervalued stocks based on cash flows that line up with solid cash flow profiles and attractive pricing signals.

- Tap into the AI trend by checking out these 24 AI penny stocks that are building real businesses around artificial intelligence rather than hype alone.

- Add a different source of growth potential by reviewing these 19 cryptocurrency and blockchain stocks that connect equity markets with the broader digital asset theme.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.