Please use a PC Browser to access Register-Tadawul

Cloudflare (NET): Assessing Valuation After Recent Share Dip and Ongoing Growth Expectations

Cloudflare NET | 202.44 | -2.65% |

Cloudflare (NET) has caught the attention of investors once again, after its shares experienced a small dip of around 2.2% in the most recent session. While there is no specific event or headline driving this move, such shifts often serve as a reminder to step back and reconsider our assumptions about the company’s prospects. Is this just another blip, or could it be the subtle signal some investors are looking for as they assess the risk and potential reward going forward?

Looking beyond this latest session, Cloudflare’s stock has logged meaningful growth over the year, with the shares climbing over 161% since last year and an impressive gain of nearly 18% in the past 3 months. Momentum has generally favored the bulls, even as markets digest a mix of industry updates and macro headlines. As growth and profitability trends continue to play out, the underlying question is how much optimism is already reflected in the stock’s valuation.

Is the recent dip a window of opportunity for those on the sidelines, or is the market already pricing Cloudflare for everything it can deliver in the coming years?

Most Popular Narrative: 6.8% Overvalued

The most widely followed narrative concludes that Cloudflare is currently trading above its fair value, estimating the stock is about 6.8% overvalued when factoring in growth prospects and risk assumptions.

The accelerating adoption of AI, explosion in global web traffic, and proliferation of IoT devices are driving increased demand for fast, secure, and resilient cloud-native infrastructure. This is Cloudflare's core strength, as shown by strategic partnerships with major AI companies and record-breaking DDoS mitigation. These factors are positioning the company for sustained top-line revenue growth and strengthening customer retention.

Curious about what is really fueling Cloudflare’s massive expectations? The narrative promises bold, sustained growth, thanks to soaring demand and industry tailwinds. But what assumptions lie behind these high hopes? Unpack the calculations and see what hidden drivers make up the analysts’ surprisingly ambitious value for this stock.

Result: Fair Value of $209.01 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.Still, ongoing declines in gross margins and intensifying competition from larger cloud providers could quickly challenge even the most bullish assumptions for Cloudflare’s future.

Find out about the key risks to this Cloudflare narrative.Another View: The SWS DCF Model

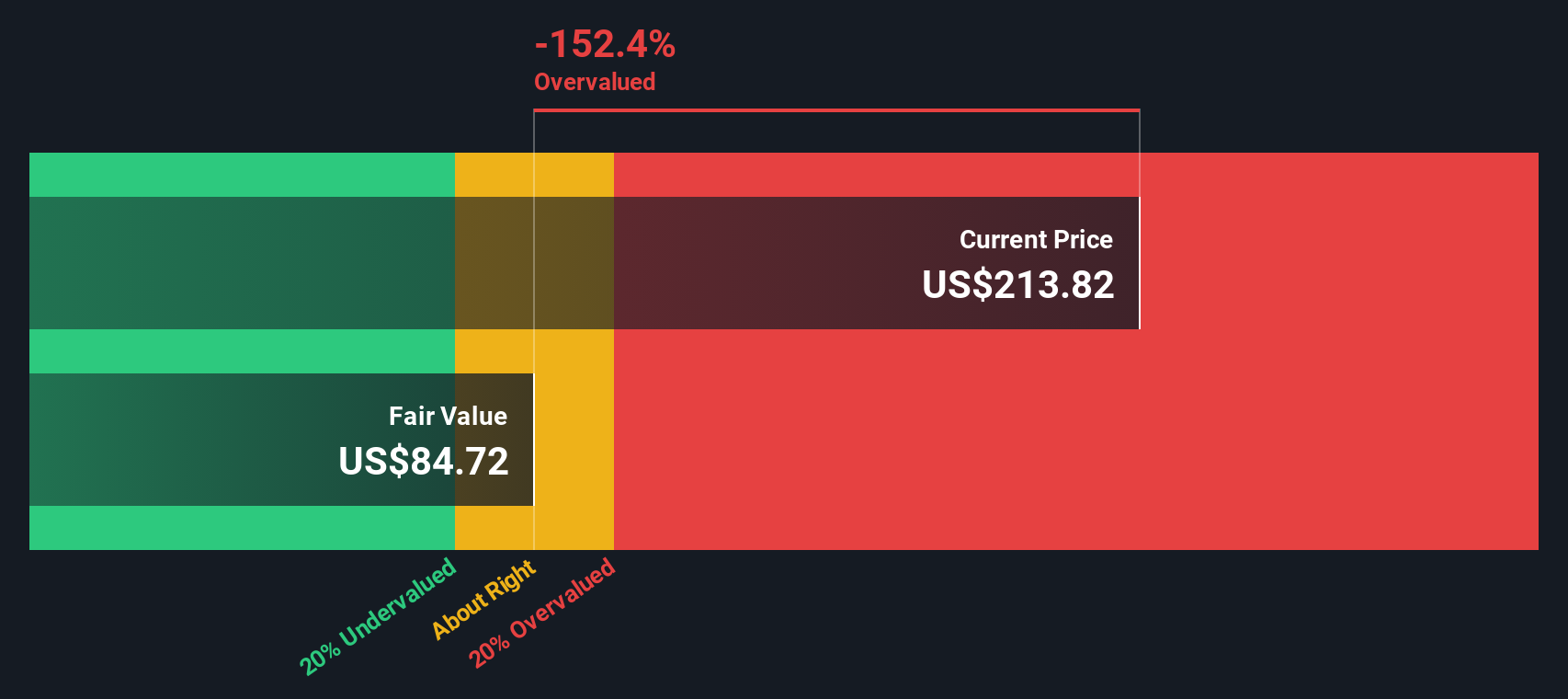

For a different perspective, the SWS DCF model takes a deep dive into Cloudflare’s future cash flows and fundamentals. This approach currently suggests the stock is priced well above its fair value. Could this more sober long-term outlook be signaling caution?

Build Your Own Cloudflare Narrative

If you find yourself with different assumptions, or want to run the numbers your own way, you can easily shape a narrative of your own in just a few minutes. Do it your way

A great starting point for your Cloudflare research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Set yourself up for smarter decisions by tapping into potential you might be missing. Find your next stock ahead of the crowd and stay one step ahead.

- Uncover overlooked opportunities with undervalued stocks based on cash flows to position your portfolio for value gains before others catch on.

- Explore the next evolution in computing by browsing quantum computing stocks, where breakthrough tech is reshaping what is possible in tomorrow's markets.

- Find potential growth from tomorrow’s healthcare leaders by scanning healthcare AI stocks, focused on AI-driven innovation transforming patient outcomes and medical research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.