Please use a PC Browser to access Register-Tadawul

CNA Financial (CNA): A Fresh Look at Valuation Following Recent Share Price Uptick

CNA Financial Corporation CNA | 47.13 | -0.34% |

While there haven’t been major headlines for CNA Financial this week, its momentum hasn’t gone unnoticed. The 1-year total shareholder return of just over 7% reflects a steady, if unspectacular, longer-term climb. Recent share price movements suggest some renewed interest as investors weigh valuation and income potential.

If you’re open to finding new ideas beyond the insurance sector, now’s a great moment to broaden your scope and discover fast growing stocks with high insider ownership

With CNA Financial’s solid long-term gains and relatively stable valuation, the key question for potential investors now is whether the current price holds hidden value or if the market has already factored in future growth prospects.

Price-to-Earnings of 14.3x: Is it justified?

CNA Financial's stock is trading at a Price-to-Earnings (P/E) ratio of 14.3x, with the most recent closing price at $46.39. This multiple suggests the market is valuing CNA's earnings moderately, positioning it near the average for its industry peers.

The P/E ratio represents how much investors are willing to pay per dollar of current earnings. It offers a direct comparison of valuation across similar insurance companies. For CNA, this figure is particularly relevant as it reflects the company’s earnings profile and growth expectations relative to its peers.

The current P/E of 14.3x is just above the US Insurance industry average of 14.2x. This indicates that the market is pricing CNA on the higher end compared to similar companies. However, it's important to note that CNA's P/E is well below its estimated fair P/E of 20.7x. This could suggest the market is undervaluing CNA’s future profit potential if the company achieves expected growth. The fair ratio offers a useful benchmark for where valuations could trend if underlying fundamentals improve.

Result: Price-to-Earnings of 14.3x (UNDERVALUED)

However, weaker long-term share price trends or unexpected earnings volatility could quickly shift investor sentiment away from CNA Financial's current valuation story.

Another View: What Does the SWS DCF Model Say?

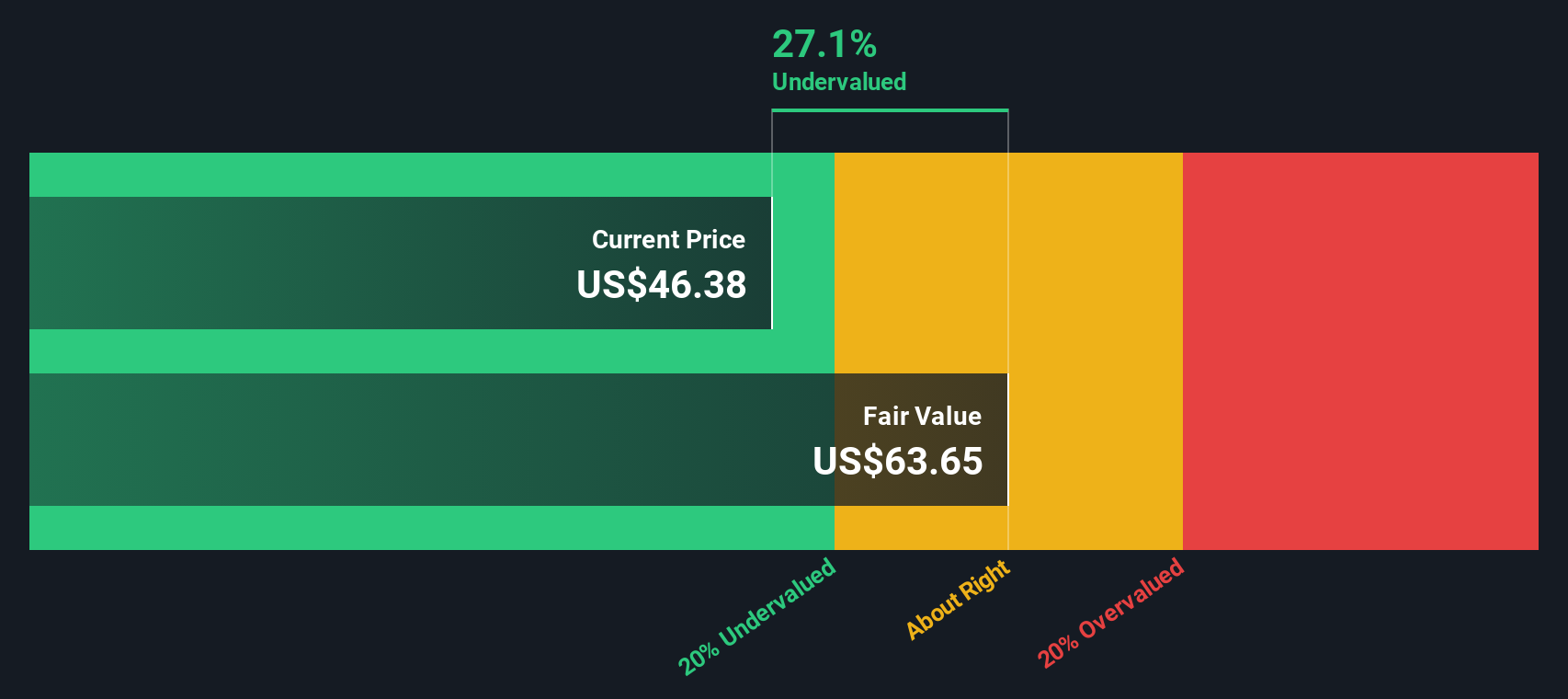

Looking at CNA Financial through the lens of our DCF model offers a different take. The current price of $46.39 is almost 30% below our DCF estimate of fair value at $65.97. This approach suggests the stock could be undervalued, which may indicate a disconnect with recent market sentiment. Does this alternative perspective point to opportunity or a need for caution?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CNA Financial for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CNA Financial Narrative

If you have a different perspective on CNA Financial or want to explore the numbers firsthand, it’s easy to build your own view in just a few minutes with Do it your way.

A great starting point for your CNA Financial research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let fresh opportunities pass you by. Use the Simply Wall Street Screener to spot the next big winners across industries right now.

- Accelerate your search for double-digit returns by checking out these 885 undervalued stocks based on cash flows, which is packed with stocks the market might be overlooking.

- Tap into future-defining breakthroughs by reviewing these 24 AI penny stocks, featuring companies driving advances in artificial intelligence and machine learning.

- Secure reliable passive income by exploring these 19 dividend stocks with yields > 3%, showcasing businesses with exceptional yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.