Please use a PC Browser to access Register-Tadawul

CNA Financial (CNA) Valuation Check After Robust Earnings And Special Dividend Announcement

CNA Financial Corporation CNA | 49.97 | +1.67% |

Earnings, special dividend and higher regular payout put CNA Financial in focus

CNA Financial (CNA) is back on investor radar after reporting fourth quarter and full year 2025 earnings, while also announcing a US$2.00 per share special dividend and a higher regular quarterly dividend.

At a share price of US$48.69, CNA’s recent 30 day share price return of 4.98% and 90 day share price return of 6.33% sit alongside a 1 year total shareholder return of 8.46%. This suggests that the dividend announcements and earnings update are feeding into steady, rather than runaway, momentum.

If CNA’s mix of income and steady compounding appeals to you, it might be a good time to broaden your search and check out our 23 top founder-led companies as another source of ideas.

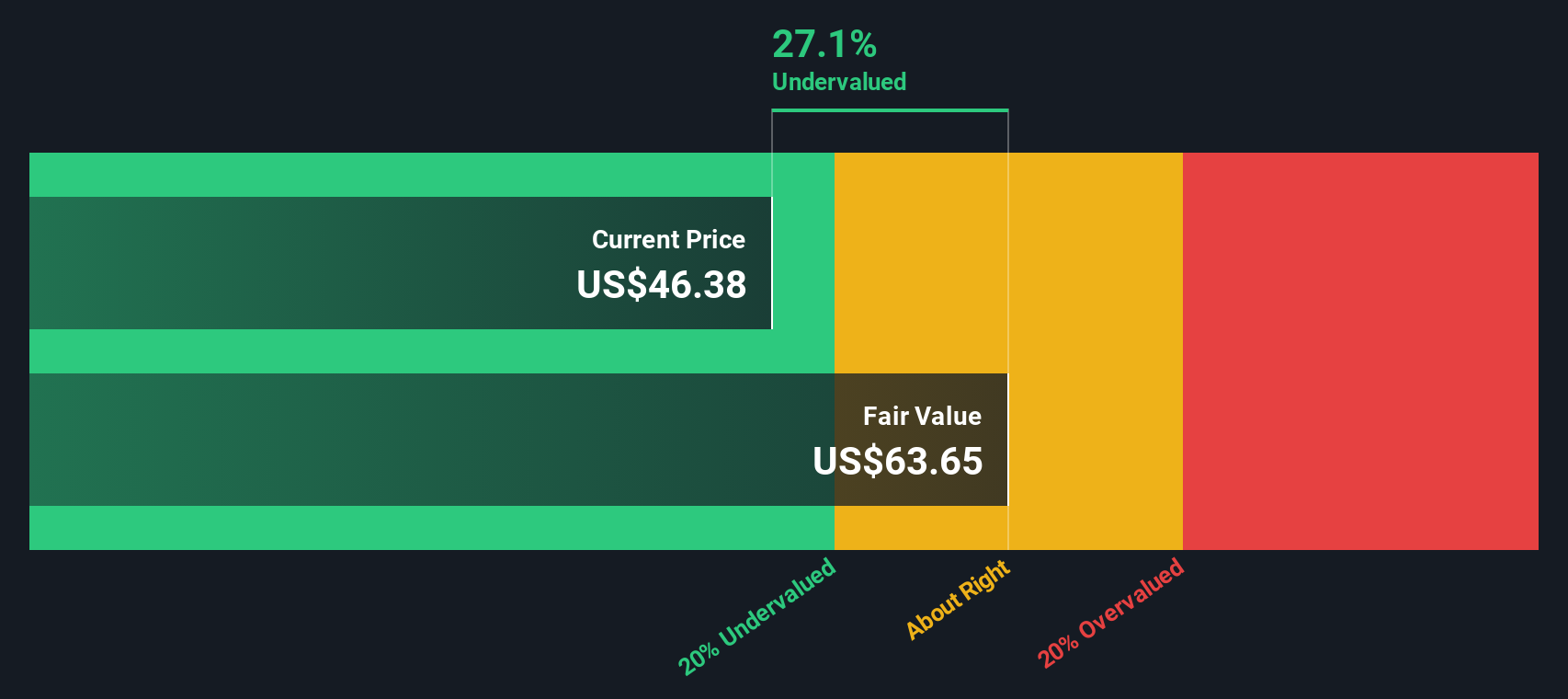

With a share price near US$48.69, a value score of 4 and an estimated intrinsic discount of about 29%, the key question is whether CNA is still on sale or if the market is already pricing in future growth.

Most Popular Narrative: 1% Overvalued

CNA Financial’s most followed narrative pegs fair value at about $48.37, which sits slightly below the last close of $48.69 and frames a very tight valuation gap.

Record levels of core income and underlying underwriting gains indicate operational efficiency and strong underwriting performance, likely boosting future earnings.

Investment income is projected to continue growing, with a 2% increase in 2025 driven by favorable reinvestment rates in fixed income portfolios, which is anticipated to strengthen total earnings.

Want to see what sits behind that near one for one link between earnings power and fair value, and how revenue growth, margin shifts and future earnings all connect to that tight valuation band? The narrative walks through a full earnings build, ties it to long run profitability, then backs into a market multiple that has to make the math work. If you are curious which assumptions move the model most, the full story lays them out clearly.

Result: Fair Value of $48.37 (ABOUT RIGHT)

However, it is still important to monitor elevated catastrophe losses and pressure in areas such as commercial auto and liability that could affect earnings.

Another View: Cash Flows Tell a Different Story

While the consensus narrative sees CNA Financial as roughly fairly priced around $48.37, our DCF model points in a different direction. On this view, the shares trade at about a 29% discount to an estimated fair value of $68.25, which frames today’s price as more cautious than the cash flow math suggests. Which set of assumptions do you find more convincing?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CNA Financial for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 53 high quality undervalued stocks. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CNA Financial Narrative

If you see the numbers differently or simply want to test your own assumptions against the data, you can create a personalized CNA view in just a few minutes and Do it your way.

A great starting point for your CNA Financial research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

If CNA has your attention, do not stop here, widen your watchlist and compare it against fresh ideas that could fit your goals just as well.

- Target steadier compounding by reviewing companies in our 84 resilient stocks with low risk scores where resilience scores and fundamentals work together to reduce unwanted surprises.

- Hunt for potential value by scanning the 53 high quality undervalued stocks built to highlight companies with solid cash flows that the market may be overlooking.

- Power up your income watchlist by checking out the 12 dividend fortresses focused on higher yielding businesses with an emphasis on stability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.