Please use a PC Browser to access Register-Tadawul

Coda Octopus Group, Inc.'s (NASDAQ:CODA) 32% Jump Shows Its Popularity With Investors

Coda Octopus Group, Inc. CODA | 14.00 | +3.24% |

Coda Octopus Group, Inc. (NASDAQ:CODA) shareholders would be excited to see that the share price has had a great month, posting a 32% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 41% in the last year.

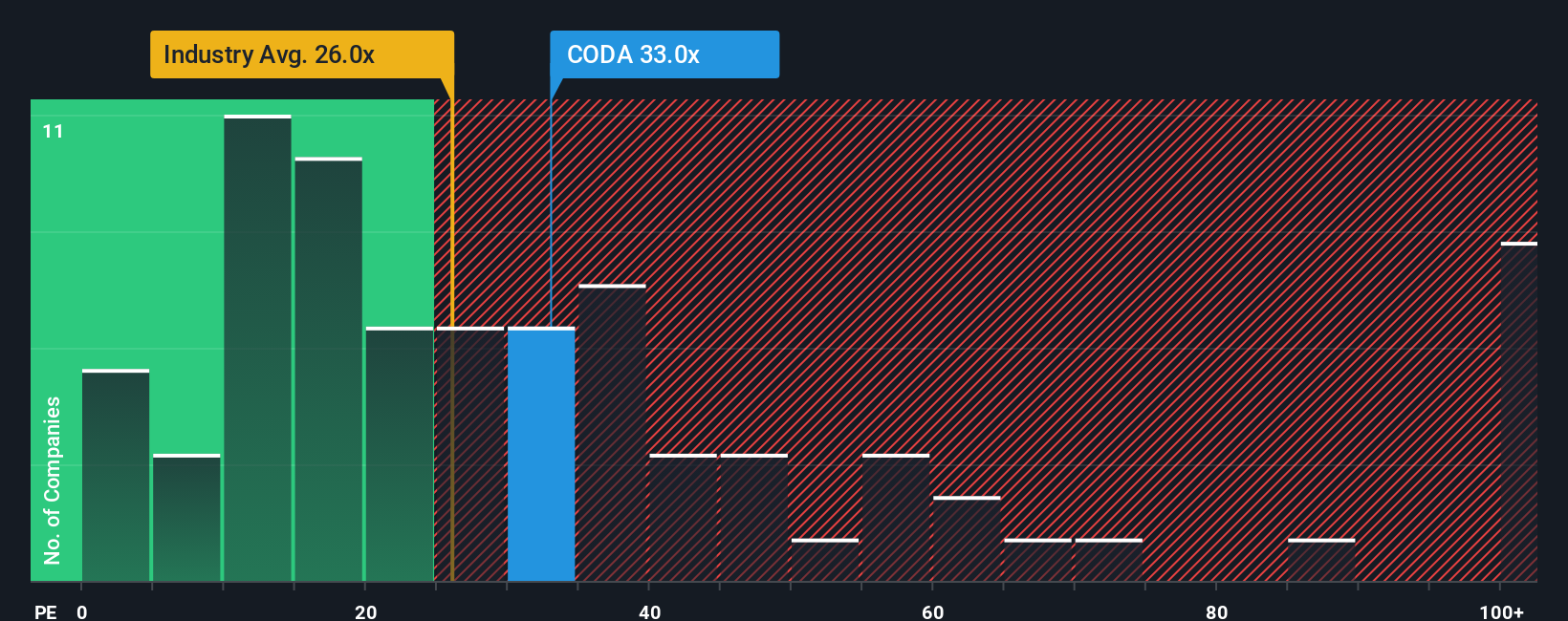

Since its price has surged higher, Coda Octopus Group may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 39.3x, since almost half of all companies in the United States have P/E ratios under 19x and even P/E's lower than 11x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's superior to most other companies of late, Coda Octopus Group has been doing relatively well. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. If not, then existing shareholders might be a little nervous about the viability of the share price.

Is There Enough Growth For Coda Octopus Group?

In order to justify its P/E ratio, Coda Octopus Group would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings growth, the company posted a worthy increase of 14%. Still, lamentably EPS has fallen 10% in aggregate from three years ago, which is disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 43% during the coming year according to the sole analyst following the company. Meanwhile, the rest of the market is forecast to only expand by 16%, which is noticeably less attractive.

With this information, we can see why Coda Octopus Group is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Coda Octopus Group's P/E

Coda Octopus Group's P/E is flying high just like its stock has during the last month. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Coda Octopus Group's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Coda Octopus Group with six simple checks will allow you to discover any risks that could be an issue.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.