Please use a PC Browser to access Register-Tadawul

Cognex Returns To Profitable Growth As AI Products Reshape Business

Cognex Corporation CGNX | 56.03 | +0.16% |

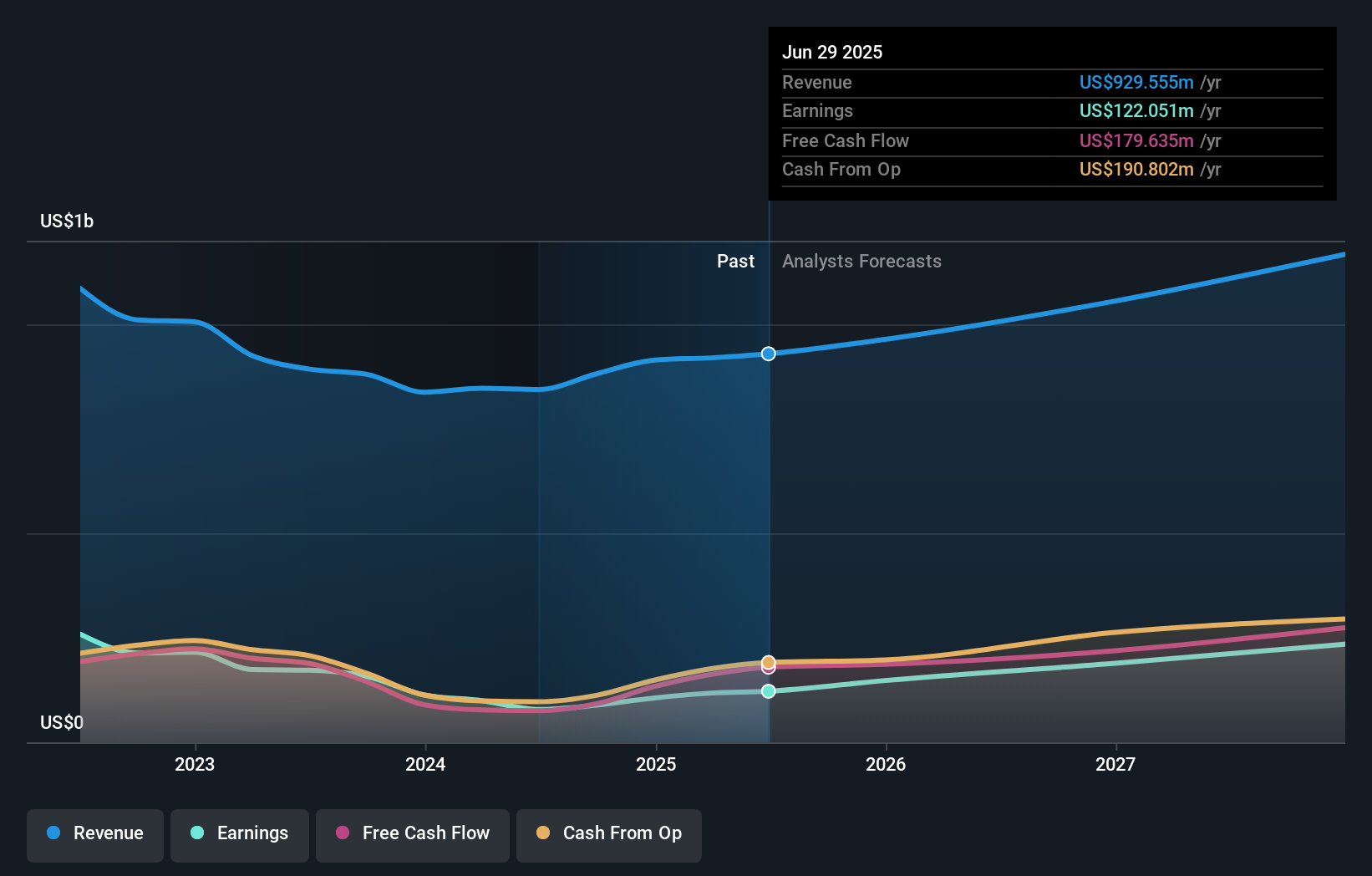

- Cognex (NasdaqGS:CGNX) reported Q4 2025 results that marked a return to profitable growth.

- Management highlighted an operational turnaround helped by portfolio optimization and cost actions.

- The quarter included launches of new AI-powered machine vision products and strong new customer intake.

Cognex, trading at $58.79, is back in focus after Q4 2025 results showed a shift to profitable growth supported by operational changes. The stock has been strong recently, up 34.5% over the past week, 43.7% over the past month, and 59.2% year to date, with a 78.7% return over the past year. For investors watching machine vision and industrial automation, this mix of earnings progress and share price momentum is drawing attention.

The company ties its improved performance to divesting noncore lines, consolidating its salesforce, and focusing on AI-driven products that appear to be resonating with customers. With efforts to expand margins and attract new customers now feeding into reported results, a central consideration for investors is how durable this profit profile could be if Cognex continues to execute on its current strategy.

Stay updated on the most important news stories for Cognex by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Cognex.

Cognex’s Q4 2025 update is not just about higher sales and earnings, it is about how the business is being reshaped. Revenue of US$252.34 million and net income of US$32.66 million for the quarter, alongside full year sales of US$994.36 million, sit alongside actions like exiting noncore lines, rolling out AI-powered vision products and overhauling the salesforce. That mix is important for you as an investor because it points to a business model that is trying to lean more on higher value software rich systems and a broader customer base in logistics, consumer electronics and packaging, where automation demand has been robust.

How This Fits Into The Cognex Narrative

- The return to profitable growth in 2025, supported by AI-powered products and an overhauled salesforce, aligns with the narrative that cost discipline and automation demand can support margins and share repurchases.

- The focus on AI and cloud enabled software could be tested by competition from peers such as Keyence, Teledyne and Rockwell Automation, which also target machine vision and factory automation and may pressure pricing or win deals where software transitions are slower.

- The completed US$500 million buyback and new authorization are material capital allocation moves that are not fully reflected in the narrative’s emphasis on operational catalysts, and they may influence how future earnings per share trends compare to headline profit growth.

Knowing what a company is worth starts with understanding its story. Check out one of the top narratives in the Simply Wall St Community for Cognex to help decide what it's worth to you.

The Risks and Rewards Investors Should Consider

- ⚠️ Cognex operates in a competitive machine vision market, with hardware pricing pressure and lower cost providers that could weigh on margins if AI and software adoption is slower than planned.

- ⚠️ The share price has been volatile over the past 3 months compared to the US market, so short term swings may be significant around news or guidance updates.

- 🎁 Management is targeting ongoing efficiency gains, and analysts expect earnings to grow over time, which, if achieved, could support Cognex’s effort to sustain a higher quality profit mix.

- 🎁 The combination of AI powered product launches, a revamped sales approach and completed share repurchases suggests management is actively shaping the business and capital structure rather than simply relying on end market cycles.

What To Watch Going Forward

From here, it is worth tracking whether Cognex can keep adding new customers at the 2025 pace, while holding or improving margins as AI powered offerings roll out more broadly. Watch how Q1 2026 revenue and profitability land versus the company’s guidance range, and how quickly any newly authorized buyback is used. Competitive responses from other industrial automation and machine vision players will also matter for pricing and win rates in logistics and electronics projects.

To ensure you're always in the loop on how the latest news impacts the investment narrative for Cognex, head to the community page for Cognex to never miss an update on the top community narratives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.