Please use a PC Browser to access Register-Tadawul

Cohen And Steers ETF Shift Tests Valuation Premium And Dividend Support

Cohen & Steers, Inc. CNS | 67.12 | +0.42% |

- Cohen & Steers plans to convert its Future of Energy Fund into an ETF.

- The shift aligns the firm with a broader move by traditional asset managers toward ETF structures.

- The conversion responds to changing investor preferences around access, fees, and trading flexibility.

Cohen & Steers, listed as NYSE:CNS, is moving its Future of Energy Fund into an ETF format at a time when investors are paying close attention to listed asset managers and their product line ups. The shares most recently closed at $64.83, with a mixed return profile that includes a 19.9% decline over the past year and a 15.5% gain over five years. For investors evaluating NYSE:CNS, this step into ETFs sits alongside that track record and may factor into how the company’s responsiveness to client demand is viewed.

The conversion also places Cohen & Steers more directly in the competitive ETF arena, where factors such as costs, liquidity, and index or theme design are important to many investors. For those following NYSE:CNS, it may be useful to watch how the Future of Energy ETF is structured, how assets develop once the conversion is complete, and what this move may indicate about any future product changes.

Stay updated on the most important news stories for Cohen & Steers by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Cohen & Steers.

Quick Assessment

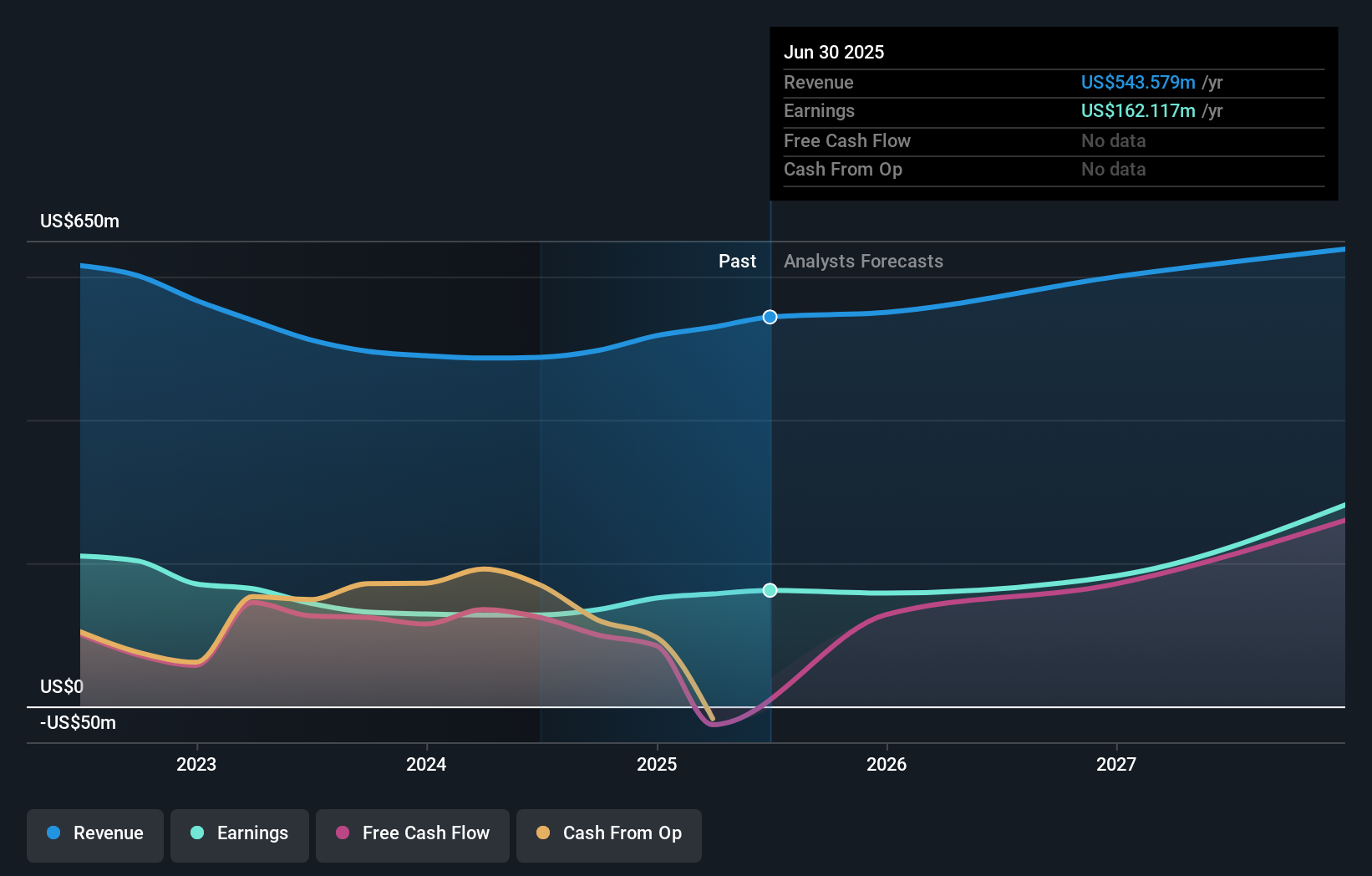

- ⚖️ Price vs Analyst Target: At US$64.83 versus a US$72.00 consensus target, Cohen & Steers trades about 10% below where analysts expect it to be.

- ❌ Simply Wall St Valuation: Shares are trading at roughly 24.6% above the estimated fair value, flagging a premium to intrinsic valuation.

- ❌ Recent Momentum: The 30 day return of about 5.1% decline shows recent weakness even as the ETF news lands.

There is only one way to know the right time to buy, sell or hold Cohen & Steers. Head to Simply Wall St's company report for the latest analysis of Cohen & Steers's fair value.

Key Considerations

- 📊 The ETF conversion could broaden distribution for the Future of Energy strategy, which may influence fee mix and asset stickiness over time.

- 📊 Watch how ETF assets, net flows and pricing evolve, alongside the current P/E of 21.6x versus the Capital Markets industry average of 22.9x.

- ⚠️ The flagged risk is dividend coverage, as the 3.83% yield is not well covered by free cash flow, which may matter if ETF build out requires investment.

Dig Deeper

For the full picture including more risks and rewards, check out the complete Cohen & Steers analysis. Alternatively, you can visit the community page for Cohen & Steers to see how other investors believe this latest news will impact the company's narrative.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.