Please use a PC Browser to access Register-Tadawul

Cohen & Steers (CNS) Valuation Check After New Private Real Estate Leadership Appointment

Cohen & Steers, Inc. CNS | 70.42 | +1.13% |

Cohen & Steers (CNS) has drawn investor attention after appointing Diana Shieh as Chief Operating Officer and Head of Asset Management for its Private Real Estate Group, placing leadership change at the center of the stock’s latest story.

The recent appointment of Diana Shieh comes as Cohen & Steers’ share price sits at $68.04, with a 30 day share price return of 8.79% and a 1 year total shareholder return decline of 16.99%. This suggests improving short term momentum alongside a softer longer term record.

If this kind of leadership shift has caught your eye, it could be a good moment to widen your search and check out fast growing stocks with high insider ownership.

With Cohen & Steers trading at $68.04, showing a 30 day gain of 8.79% but a 1 year total return decline of 16.99%, is the recent bounce a reset opportunity, or is the market already pricing in future growth?

Most Popular Narrative: 5.1% Undervalued

With Cohen & Steers last closing at $68.04 against a narrative fair value of about $71.67, the current price sits slightly below that reference point.

Strategic expansion into active ETFs and broader product diversification (including the launch of integrated listed/private real estate strategies) is expected to attract new investor segments and improve client retention, supporting future AUM growth and revenue stability.

Curious what kind of revenue path, margin profile, and earnings multiple this narrative is banking on? The full story ties all three into one valuation view.

Result: Fair Value of $71.67 (UNDERVALUED)

However, it is worth keeping in mind that ongoing client outflows and higher expenses linked to global expansion and new products could pressure margins and unsettle this upbeat earnings path.

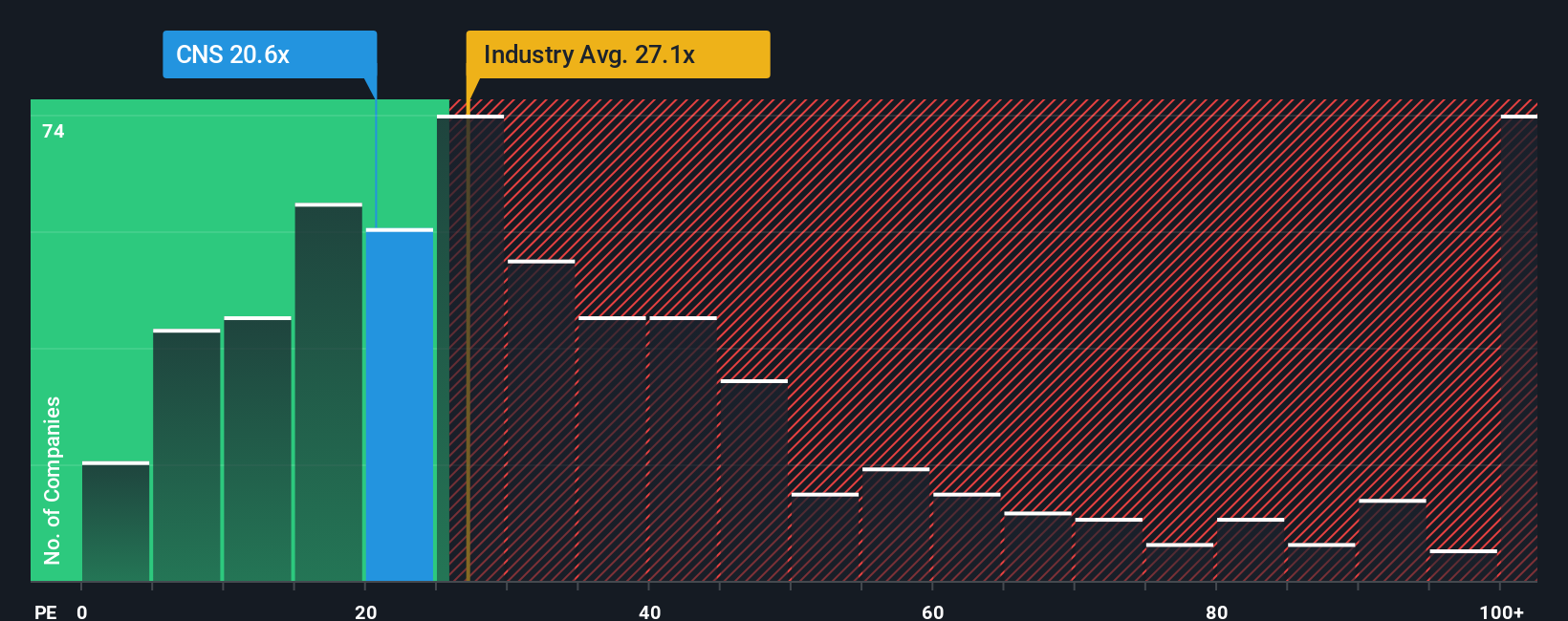

Another View: What The P/E Ratio Is Saying

Analysts see a fair value of about $71.67 for Cohen & Steers, yet the current P/E of 21.1x sits below the US Capital Markets average of 25.6x and above an estimated fair ratio of 15x. That gap points to both downside risk and upside potential. Which side do you think is more likely to close first?

Build Your Own Cohen & Steers Narrative

If this story does not quite fit your view, or you would rather test the numbers yourself, you can build a fresh thesis in minutes: Do it your way.

A great starting point for your Cohen & Steers research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

If Cohen & Steers has your attention, do not stop here. The next step is lining up a few more high quality ideas to compare side by side.

- Spot potential value opportunities early by scanning these 885 undervalued stocks based on cash flows that the market might be overlooking on their current cash flow profiles.

- Ride structural shifts in technology by checking out these 26 AI penny stocks that are tied to artificial intelligence themes across different sectors.

- Strengthen your income watchlist by reviewing these 12 dividend stocks with yields > 3% that offer yields above 3% and may complement your existing holdings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.