Please use a PC Browser to access Register-Tadawul

Collegium Pharmaceutical (COLL): Valuation Check After Strong Revenue Beat and Upgraded Full-Year Performance

Collegium Pharmaceutical, Inc. COLL | 49.84 | +0.52% |

Collegium Pharmaceutical earnings spark renewed investor attention

Collegium Pharmaceutical (COLL) just turned heads with Q3 results, lifting revenue about 31% year on year and topping expectations by roughly 11%, while also beating its own full year revenue guidance.

The upbeat earnings seem to be feeding into a clear uptrend, with the share price at about $49.01 and a roughly 71% year to date share price return. This points to building momentum that reflects improving sentiment on Collegium’s growth and risk profile.

If this kind of move has you rethinking your healthcare exposure, it could be a good moment to scout other opportunities via healthcare stocks and compare how they stack up on growth and resilience.

Yet with shares now hovering around analyst targets after a powerful rerating, the real question becomes whether Collegium is still trading below its intrinsic value or if the market is already baking in the next leg of growth.

Most Popular Narrative: 4.7% Overvalued

With Collegium Pharmaceutical last closing at $49.01 against a narrative fair value of about $46.80, the story leans modestly rich and hinges on future execution.

The company's differentiated pain portfolio, notably with products featuring proprietary abuse deterrent and extended release technologies (e.g., Xtampza ER's DETERx platform), is supported by industry and regulatory trends that increasingly favor safer opioid options, likely enhancing market share, pricing power, and sustaining net margins as regulatory emphasis on abuse deterrence grows.

Want to see why flat headline revenue assumptions still support a premium value? The narrative quietly leans on expanding margins and a surprisingly low future earnings multiple. Curious how that math stretches today’s price beyond consensus targets?

Result: Fair Value of $46.80 (OVERVALUED)

However, that narrative could wobble if patent cliffs accelerate generic pressure on core pain brands or if regulatory shifts further dampen opioid prescribing volumes.

Another View: Multiples Tell a Hotter Story

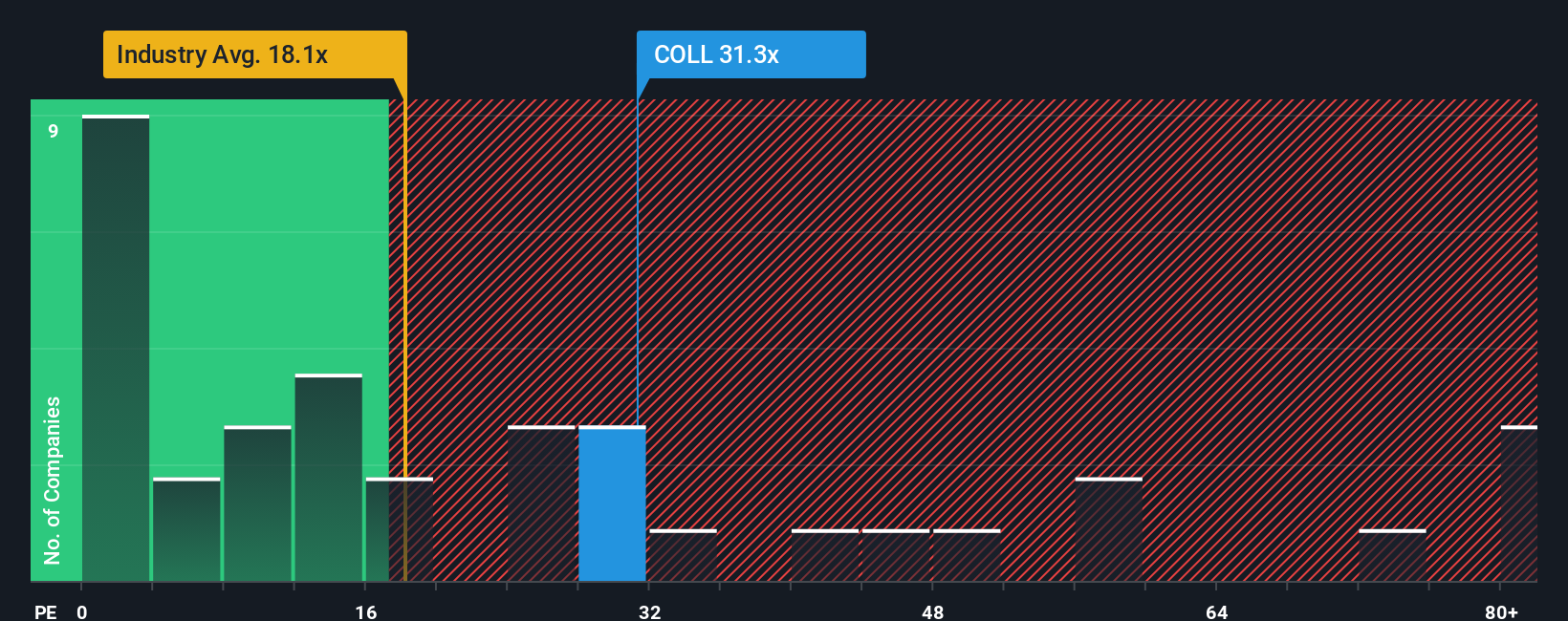

Step away from narratives and the numbers look punchy. On a price to earnings basis, Collegium trades around 26.5 times, versus a 23 times fair ratio and roughly 19.7 times for the US pharma group and 24 times for peers, pointing to richer sentiment than fundamentals alone.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Collegium Pharmaceutical for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Collegium Pharmaceutical Narrative

If you see the story differently or want to dive into the numbers yourself, you can build a personalized take in minutes: Do it your way.

A great starting point for your Collegium Pharmaceutical research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before the next move in Collegium's story, lock in fresh opportunities using the Simply Wall St Screener so you do not miss the market's next leaders.

- Capture mispriced potential by targeting companies that look cheap on future cash flows through these 908 undervalued stocks based on cash flows and position yourself ahead of any possible re rating.

- Focus on innovation heavy names powered by these 26 AI penny stocks, where rapid adoption may translate into higher returns.

- Strengthen your income stream with cash generators via these 13 dividend stocks with yields > 3%, aiming for yields above 3 percent while maintaining a focus on quality fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.