Please use a PC Browser to access Register-Tadawul

Columbia Sportswear (COLM): A Fresh Look at Valuation Following Analyst Skepticism Over Growth and Returns

Columbia Sportswear Company COLM | 56.85 | -0.57% |

Most Popular Narrative: 4.9% Undervalued

According to the prevailing analyst consensus, Columbia Sportswear's current valuation is seen as slightly undervalued compared to its calculated fair value, based on projected earnings and risk factors.

“Accelerating investment in omnichannel and digital transformation, including a fully redesigned website, enhanced mobile capabilities, modern social-first marketing, and effective e-commerce strategy (with notable success on Chinese platforms such as Tmall, JD, and TikTok), is positioning Columbia to capture secular shifts in consumer shopping behavior. This is likely supporting revenue and margin improvement.”

Curious about what’s fueling this subtle undervaluation call? The key drivers behind this price target are based on future profit potential and ambitious digital bets. Interested to see what powerful assumptions about profit, sales, and company focus are building this case? The full narrative breaks down the numbers and big ideas shaping Columbia Sportswear’s market value.

Result: Fair Value of $56.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, strong growth in international markets or successful brand innovation could quickly change the outlook and support a renewed shift in sentiment.

Find out about the key risks to this Columbia Sportswear narrative.Another View: Discounted Cash Flow Tells a Different Story

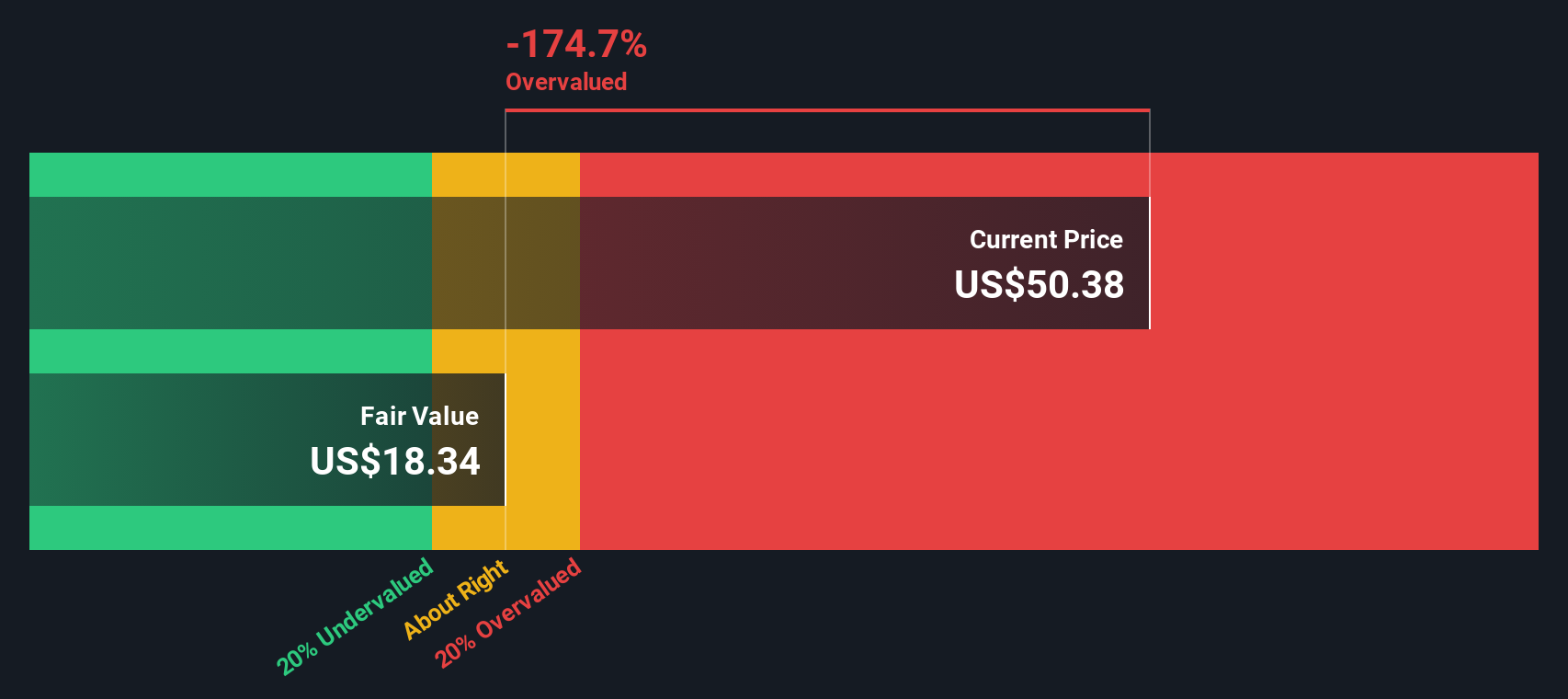

While analysts have called Columbia Sportswear undervalued based on future earnings potential, our SWS DCF model offers another perspective. This approach suggests the stock could actually be overvalued at the moment. Which method is more accurate?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Columbia Sportswear Narrative

If this view doesn’t quite match your own, or you want to dive deeper with your own research, it’s easy to craft your own take in just a few minutes. Do it your way

A great starting point for your Columbia Sportswear research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Angles?

Hundreds of potential winners are waiting beyond Columbia Sportswear. Use these handpicked shortcuts to spot companies making big moves in unique markets, powerful trends, and tomorrow’s hottest sectors.

- Boost your search for overlooked gems by zeroing in on undervalued stocks based on cash flows signaling strong return potential often missed by the crowd.

- Supercharge your portfolio with next-gen technology leaders by tapping into AI penny stocks shaping the future of artificial intelligence and automation.

- Catch the latest trends in digital assets and blockchain by starting with cryptocurrency and blockchain stocks before the rest of the market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.