Please use a PC Browser to access Register-Tadawul

Commerce Bancshares (CBSH) Valuation After Record Q4 Results And FineMark Acquisition Completion

Commerce Bancshares, Inc. CBSH | 54.03 | +0.65% |

Commerce Bancshares (CBSH) stock action is being shaped by fresh fourth quarter results, including record revenues, solid earnings and share repurchases, as well as the completed FineMark acquisition that expands its wealth management and private banking reach.

Those record fourth quarter numbers and the FineMark deal come after a mixed stretch for investors, with a 90 day share price return of 5.26% and a 1 year total shareholder return decline of 13.78%, suggesting short term momentum has picked up while longer term returns have been much softer.

If this kind of bank earnings story has your attention, it could be a good moment to widen your search and check out fast growing stocks with high insider ownership.

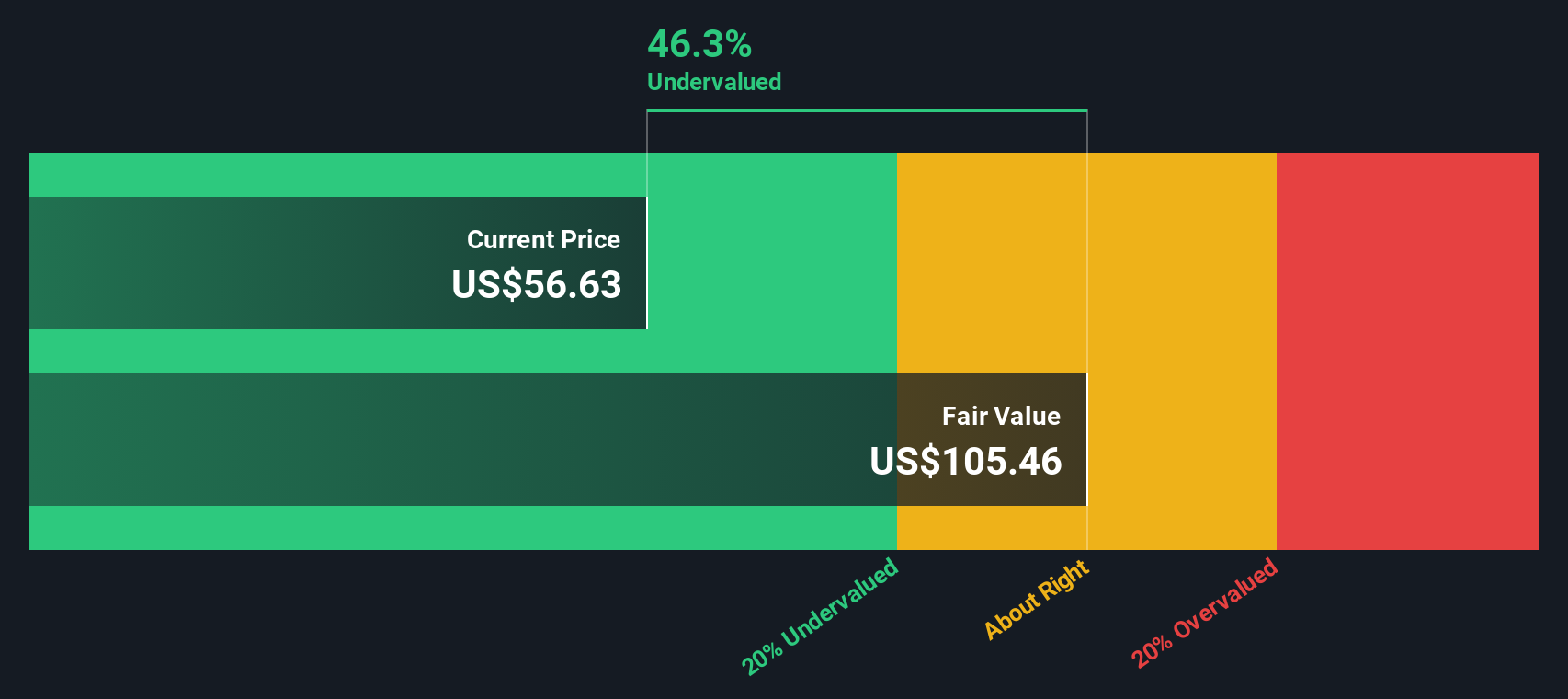

With shares down on a 1 year view but trading at a reported 47% discount to one intrinsic value estimate and below the average analyst target, you have to ask: is there a genuine opportunity here, or is the market already factoring in future growth?

Preferred P/E of 13.8x: Is it justified?

Commerce Bancshares currently trades on a P/E of 13.8x, which prices the stock above the wider US banks industry average of 11.8x but roughly in line with the 14x peer group average.

The P/E ratio links the current share price to earnings. A higher multiple usually means the market is asking you to pay more today for each dollar of profit. For a bank like CBSH, that often reflects views on the quality and durability of earnings rather than rapid growth expectations.

Here, the picture is mixed. On one hand, earnings have grown 3.6% per year over the past 5 years, with a stronger 8.6% earnings growth figure over the last year and current net profit margins of 33.1% compared to 32% a year ago. On the other hand, CBSH's Return on Equity is 15%, which is classed as low against a 20% benchmark. In addition, earnings are forecast to grow 6.7% per year, slower than both the broader US market and the US banks industry.

Compared with the US banks industry average P/E of 11.8x and an estimated fair P/E of 12.4x, CBSH's 13.8x multiple sits at a premium level. The market could potentially move toward aligning with that fair ratio over time. This suggests investors are currently paying more than both the industry and the modelled fair level for each dollar of earnings, despite growth forecasts that are not especially high.

Result: Price-to-Earnings of 13.8x (OVERVALUED)

However, the recent 1 year total shareholder return decline of 13.78% and a value score of 3 hint that sentiment and valuation risks could easily resurface.

Another view: DCF says the stock looks cheap

While the 13.8x P/E suggests Commerce Bancshares trades at a premium, our DCF model presents a different picture. With the shares at $53.21 versus an estimated future cash flow value of $100.24, the model indicates a significant discount and a potential mismatch in expectations.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Commerce Bancshares for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 871 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Commerce Bancshares Narrative

If you look at the numbers and reach a different conclusion, or just want to test your own assumptions against the data, you can build a custom view and shape your own thesis in minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Commerce Bancshares.

Looking for more investment ideas?

If you stop here, you risk missing companies that better fit your style. Use the screeners below to pressure test your thinking and widen your watchlist.

- Target reliable cash flows and growing income streams by scanning these 13 dividend stocks with yields > 3% that could complement or contrast with a bank like Commerce Bancshares.

- Spot potential mispricings by running through these 871 undervalued stocks based on cash flows that might offer a different balance between price, quality and outlook.

- Get ahead of fast moving themes by checking these 18 cryptocurrency and blockchain stocks that are tied to blockchain, digital assets and the infrastructure around them.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.