Please use a PC Browser to access Register-Tadawul

Compass Therapeutics And 2 Other Promising Penny Stocks To Watch

Acumen Pharmaceuticals, Inc. ABOS | 2.10 2.10 | +1.94% 0.00% Pre |

The market has stayed flat over the past week, but it's up 11% over the past year, with earnings forecasted to grow by 15% annually. Penny stocks may be a throwback term, but they represent opportunities that are far from outdated. With strong balance sheets and solid fundamentals, these smaller or newer companies can offer growth potential at lower price points, making them intriguing options for investors seeking hidden gems in today's market.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Waterdrop (WDH) | $1.46 | $509.94M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.9662 | $169.86M | ✅ 4 ⚠️ 1 View Analysis > |

| Perfect (PERF) | $2.28 | $228.14M | ✅ 3 ⚠️ 0 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $100.41M | ✅ 3 ⚠️ 1 View Analysis > |

| Safe Bulkers (SB) | $4.08 | $420.49M | ✅ 2 ⚠️ 3 View Analysis > |

| Cardno (COLD.F) | $0.1701 | $6.64M | ✅ 2 ⚠️ 4 View Analysis > |

| BAB (BABB) | $0.83 | $6.16M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.68 | $109.38M | ✅ 3 ⚠️ 2 View Analysis > |

| North European Oil Royalty Trust (NRT) | $4.83 | $44.48M | ✅ 2 ⚠️ 2 View Analysis > |

| Tandy Leather Factory (TLF) | $3.33 | $28.06M | ✅ 2 ⚠️ 2 View Analysis > |

Let's dive into some prime choices out of the screener.

Compass Therapeutics (CMPX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Compass Therapeutics, Inc. is a clinical-stage biopharmaceutical company in the United States that develops antibody-based therapeutics for oncology, with a market cap of $373.36 million.

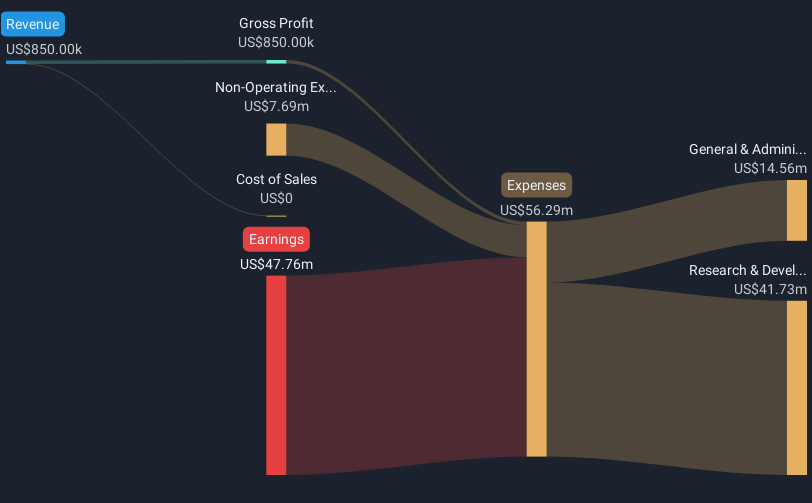

Operations: Compass Therapeutics, Inc. currently does not report any revenue segments.

Market Cap: $373.36M

Compass Therapeutics, Inc., with a market cap of US$373.36 million, is a pre-revenue biopharmaceutical company focused on oncology therapeutics. Recently added to multiple Russell Growth Indexes, it has gained visibility in the investment community. Despite being unprofitable and experiencing increased losses over the past five years, Compass remains debt-free with sufficient cash runway for over a year based on current free cash flow trends. The company’s revenue is forecasted to grow significantly at 62.21% per year, although profitability is not expected in the near term. Its management team has limited experience but benefits from an experienced board of directors.

Acumen Pharmaceuticals (ABOS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Acumen Pharmaceuticals, Inc. is a clinical-stage biopharmaceutical company focused on developing targeted therapies for Alzheimer's disease, with a market cap of $84.80 million.

Operations: Acumen Pharmaceuticals currently does not report any revenue segments.

Market Cap: $84.8M

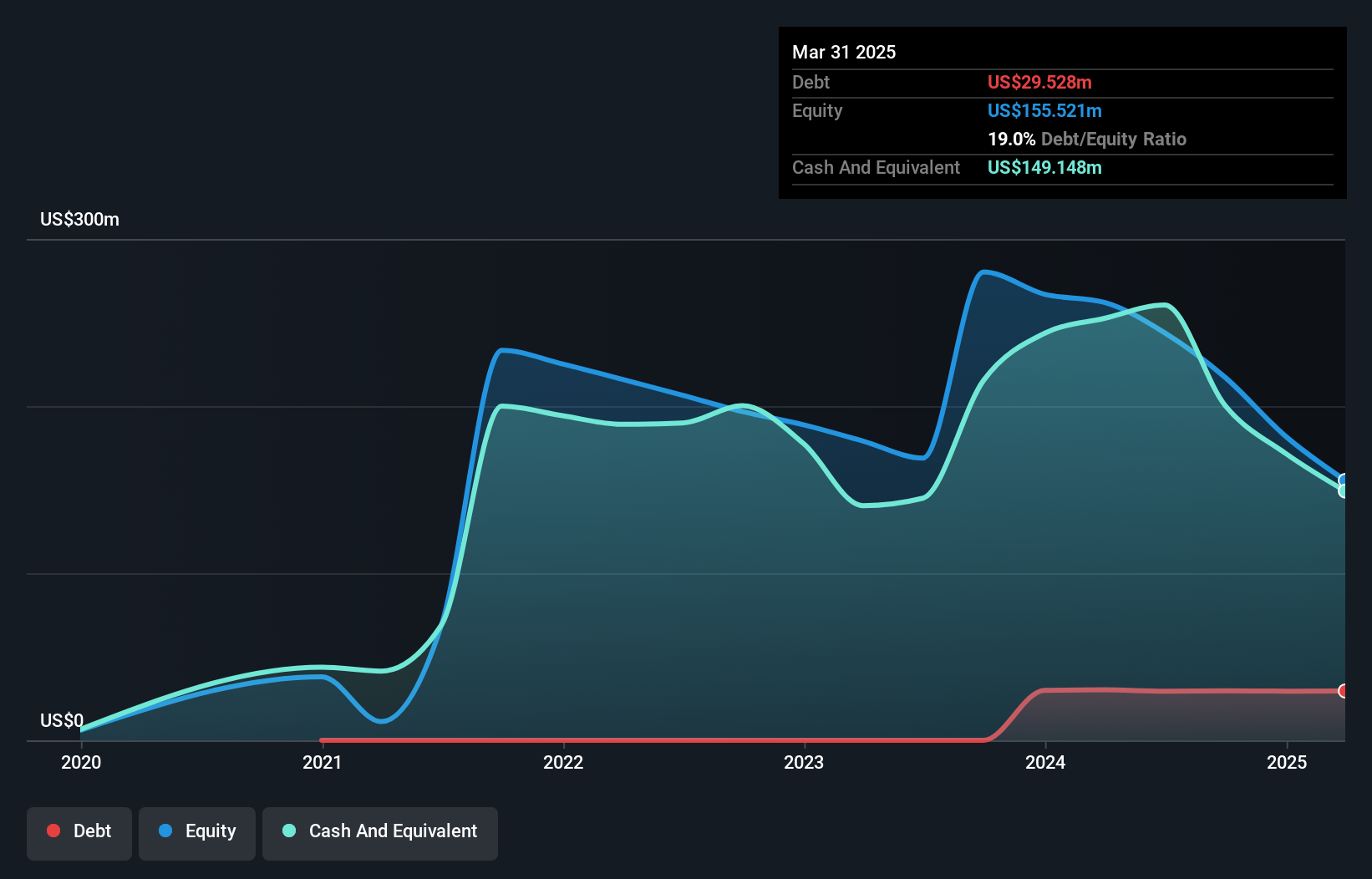

Acumen Pharmaceuticals, with a market cap of US$84.80 million, is a pre-revenue biopharmaceutical company focused on Alzheimer's therapies. Despite its unprofitability and increasing losses, the company maintains more cash than debt and has a cash runway exceeding one year. The management team and board are experienced, with average tenures of 3.7 and 6.8 years respectively. Recent challenges include being dropped from several Russell Indexes in June 2025, reflecting potential investor concerns about its financial performance or market positioning amidst ongoing high share price volatility over recent months.

Safe Bulkers (SB)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Safe Bulkers, Inc., along with its subsidiaries, offers international marine drybulk transportation services and has a market cap of $420.49 million.

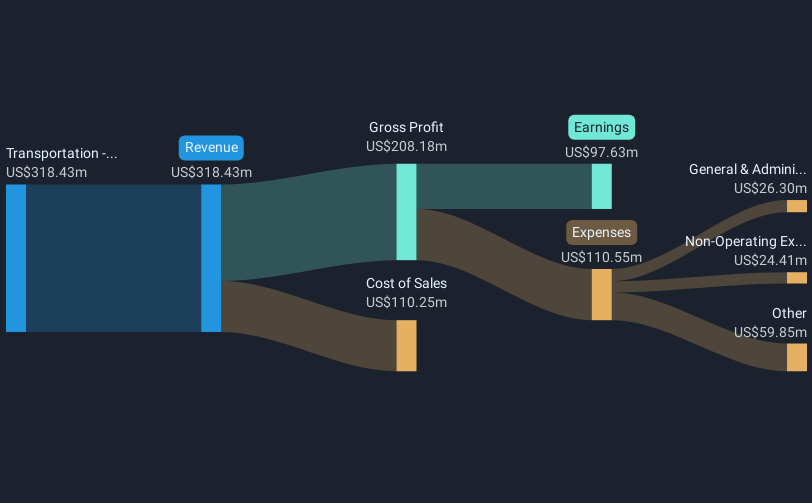

Operations: The company generates revenue of $290.31 million from its international marine drybulk transportation services.

Market Cap: $420.49M

Safe Bulkers, Inc., with a market cap of US$420.49 million, navigates the penny stock landscape by balancing strengths and challenges. The company has seen its debt to equity ratio improve significantly over five years, though it still carries high net debt levels. Its earnings growth has been negative recently, but forecasts suggest potential improvement. Despite lower current net profit margins compared to last year and a low return on equity of 9.6%, Safe Bulkers maintains stable weekly volatility and seasoned leadership. Recent strategic moves include share buybacks and dividends on preferred shares, indicating active capital management efforts amidst fluctuating revenues.

Where To Now?

- Click through to start exploring the rest of the 417 US Penny Stocks now.

- Curious About Other Options? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.