Please use a PC Browser to access Register-Tadawul

Comstock Resources, Inc.'s (NYSE:CRK) Popularity With Investors Is Clear

Comstock Resources, Inc. CRK | 19.97 | +0.60% |

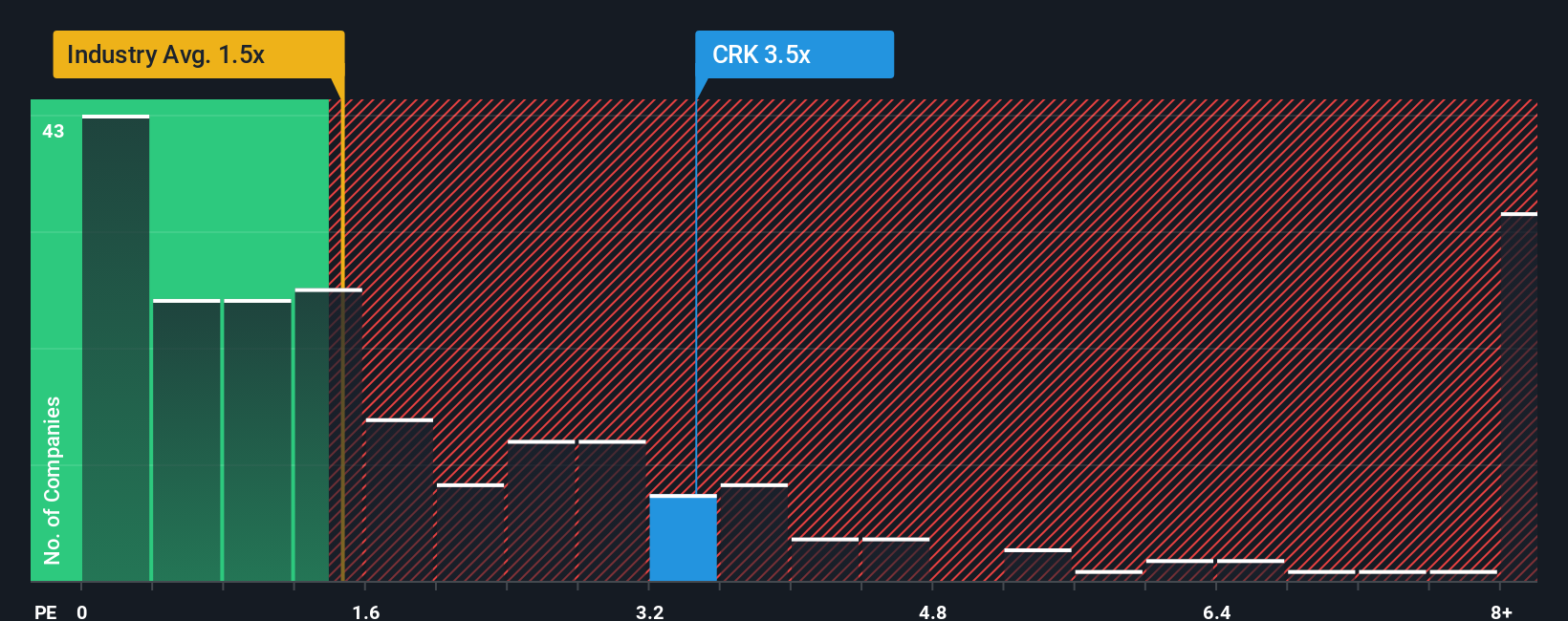

Comstock Resources, Inc.'s (NYSE:CRK) price-to-sales (or "P/S") ratio of 3.5x may not look like an appealing investment opportunity when you consider close to half the companies in the Oil and Gas industry in the United States have P/S ratios below 1.5x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

What Does Comstock Resources' Recent Performance Look Like?

Comstock Resources certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Comstock Resources.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Comstock Resources would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered an exceptional 39% gain to the company's top line. However, this wasn't enough as the latest three year period has seen the company endure a nasty 46% drop in revenue in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to climb by 20% during the coming year according to the seven analysts following the company. That's shaping up to be materially higher than the 2.8% growth forecast for the broader industry.

With this information, we can see why Comstock Resources is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What Does Comstock Resources' P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Comstock Resources' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

If these risks are making you reconsider your opinion on Comstock Resources, explore our interactive list of high quality stocks to get an idea of what else is out there.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.