Please use a PC Browser to access Register-Tadawul

Constellation Energy (CEG): Assessing Valuation After Meta Deal and Leadership Change Shape Growth Outlook

Constellation Energy Group Inc. CEG | 361.38 | +1.19% |

Constellation Energy (CEG) is back in the spotlight after a combination of significant news: a strategic partnership with Meta to safeguard the future of its Clinton Clean Energy Center, and a leadership shakeup as Chris Mudrick steps in as chief nuclear officer. For investors weighing their next move, these developments are not just headlines; they might be signals of how the company plans to lead in the next era of energy and data-driven growth. The Meta deal underscores the growing demand for clean electricity, especially as massive data centers, fueled by AI, continue to expand.

Against this backdrop, CEG’s stock performance has kept up its pace, gaining 1.7% even as the wider market softened. Longer term, CEG has delivered a year-to-date return above 33% and a 63% return over the past year, with momentum building on optimism around its clean energy strategy and growing relevance as a power supplier to data center clients. Meanwhile, a fresh round of acquisitions is expanding its generation mix, and supportive federal policies remain tailwinds.

All of this raises the question: after such strong momentum and with the spotlight on its growth narrative, is there still value left to capture in CEG, or has the market already priced in all the upside?

Most Popular Narrative: 7.9% Undervalued

According to the most widely watched narrative, Constellation Energy is trading at a nearly 8% discount to fair value. The consensus is built on optimistic forecasts about growth, margins, and a powerful energy transition tailwind.

Growing demand for carbon-free, reliable power from large-scale customers such as data centers (Meta, Microsoft) and corporates (Comcast), driven by digitalization, electrification, and decarbonization goals, is creating new, longer-term, higher-margin contracts with price premiums. This is likely to result in significant revenue and earnings growth as more transactions close.

Want to know what is fueling this bold price target? The underlying assumptions revolve around rapid future growth, expanding margins, and premium contracts that could reshape the earnings profile for years to come. The consensus is betting big on transformative catalysts. Looking for the exact financial leaps these analysts expect? All the key numbers are revealed in the full narrative.

Result: Fair Value of $351.10 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, heavy reliance on regulated nuclear assets and rapid advances in distributed energy solutions could present challenges to Constellation’s earnings growth and price momentum.

Find out about the key risks to this Constellation Energy narrative.Another View: What Does the Market Multiple Suggest?

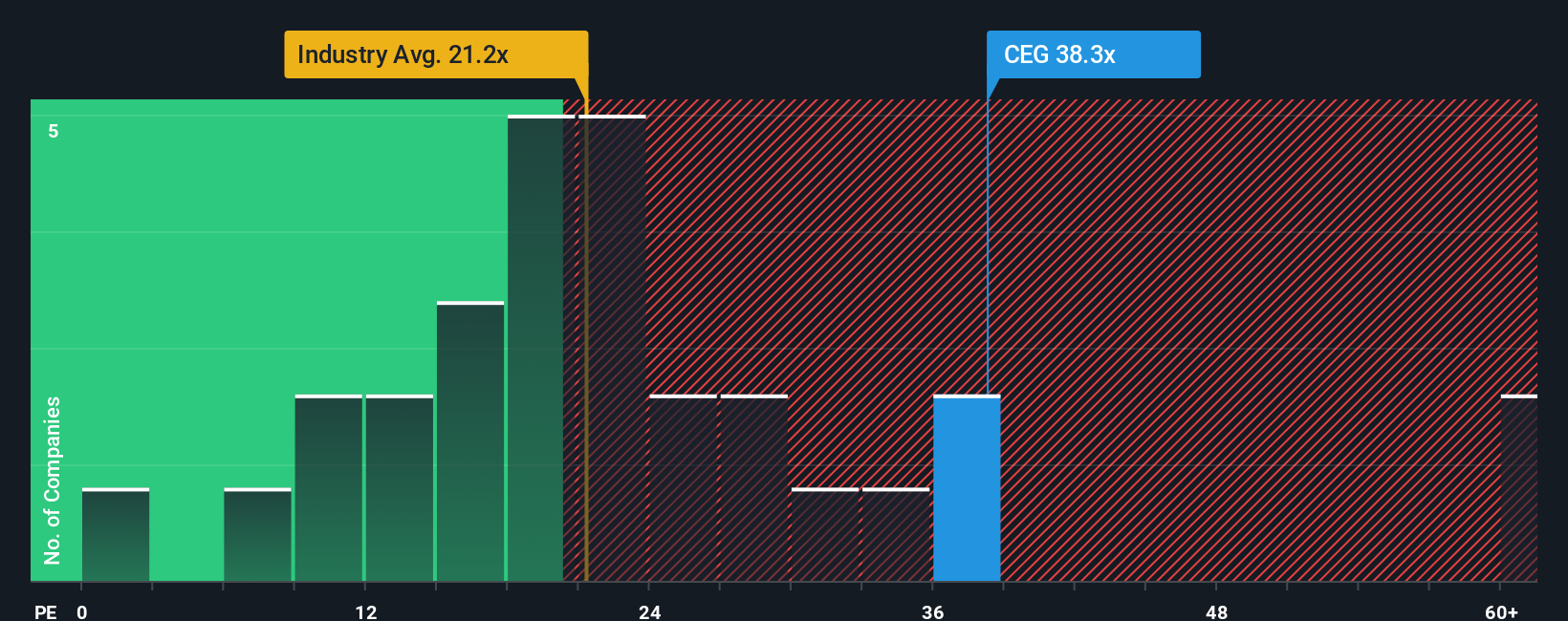

Looking at valuation from a different perspective, Constellation Energy appears expensive compared to the average utility sector benchmark. This approach presents a less optimistic outlook. Which view offers more accuracy for investors at this moment?

Build Your Own Constellation Energy Narrative

If the prevailing analysis does not reflect your perspective, or you prefer hands-on research, you have the freedom to craft your own view in just a few minutes: Do it your way.

A great starting point for your Constellation Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Searching for your next smart move? Accelerate your portfolio growth by tapping into hand-picked opportunities other investors are missing. These unique ideas could set you apart.

- Catch early momentum by targeting value-packed up-and-comers with penny stocks with strong financials offering solid financial foundations.

- Ride the unstoppable wave of next-gen healthcare breakthroughs by scanning opportunities among healthcare AI stocks transforming the medical landscape.

- Secure steady income and long-term resilience by seeking out dividend stocks with yields > 3% that regularly reward shareholders with robust payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.