Please use a PC Browser to access Register-Tadawul

Core Scientific Refocuses On HPC Leasing As Shareholders Block CoreWeave Deal

Core Scientific Inc CORZ | 17.30 | -3.78% |

- Core Scientific (NasdaqGS:CORZ) is shifting its focus from bitcoin mining to high performance computing leasing.

- The company plans to pursue more HPC colocation contracts starting in 2026.

- Shareholders recently rejected a proposed merger with CoreWeave, keeping Core Scientific independent.

Core Scientific, trading at $17.99, is repositioning itself around HPC leasing while still carrying the legacy of its bitcoin mining roots. The stock has returned 23.6% over the past 30 days and 46.6% over the past year, which puts recent news in sharp focus for anyone tracking how the business model is evolving. For shareholders, the rejected CoreWeave deal and the new focus on HPC are now key factors in how they might think about the company.

Looking ahead, management is framing HPC colocation contracts expected in 2026 as a key part of the next phase for the business. For you as an investor, the main questions are how effectively Core Scientific can execute on this shift and what that means for risk, capital needs, and revenue mix compared with its prior, more bitcoin centric profile.

Stay updated on the most important news stories for Core Scientific by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Core Scientific.

Quick Assessment

- ⚖️ Price vs Analyst Target: At US$17.99, the share price is about 33% below the US$26.91 analyst target. It therefore sits at a sizeable discount to the current consensus.

- ⚖️ Simply Wall St Valuation: Simply Wall St's DCF view is currently unknown, so you do not have a clear undervalued or overvalued signal here.

- ✅ Recent Momentum: A 30 day return of roughly 23.6% shows strong short term momentum as the new HPC focus beds in.

Check out Simply Wall St's in depth valuation analysis for Core Scientific.

Key Considerations

- 📊 The pivot from bitcoin mining to high performance computing leasing, together with the rejected CoreWeave deal, leaves you assessing an independent, refocused business model.

- 📊 Keep an eye on progress toward HPC colocation contracts from 2026, the current US$17.99 price versus the US$26.91 target, and how the P/E compares with the wider Software industry.

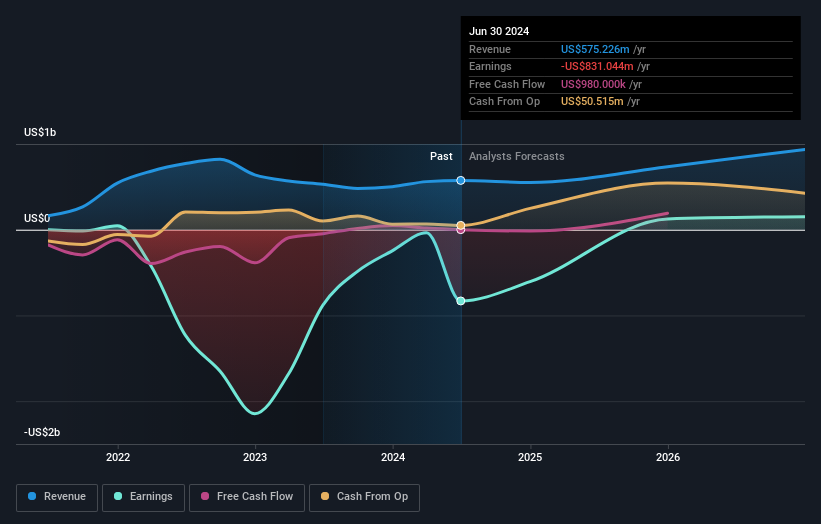

- ⚠️ The company currently carries two major flagged risks, including less than one year of cash runway and negative shareholder equity. This makes funding this shift an important question.

Dig Deeper

For the full picture, including more risks and rewards, check out the complete Core Scientific analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.