Please use a PC Browser to access Register-Tadawul

CorMedix Inc. (NASDAQ:CRMD) Not Doing Enough For Some Investors As Its Shares Slump 35%

CorMedix Inc. CRMD | 7.03 | -0.71% |

The CorMedix Inc. (NASDAQ:CRMD) share price has fared very poorly over the last month, falling by a substantial 35%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 30% share price drop.

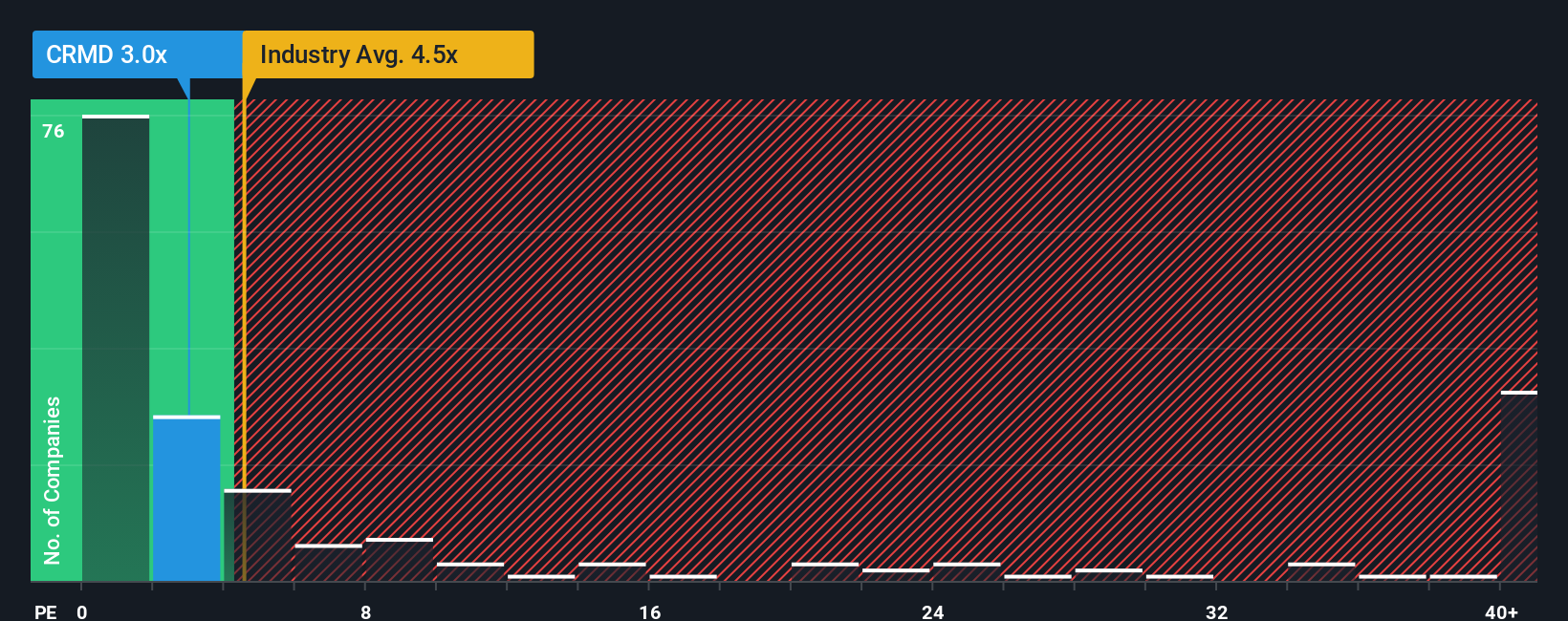

Following the heavy fall in price, CorMedix may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 2.7x, considering almost half of all companies in the Pharmaceuticals industry in the United States have P/S ratios greater than 4.6x and even P/S higher than 23x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

How CorMedix Has Been Performing

With revenue growth that's superior to most other companies of late, CorMedix has been doing relatively well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on CorMedix will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For CorMedix?

CorMedix's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. Spectacularly, three year revenue growth has also set the world alight, thanks to the last 12 months of incredible growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue should grow by 16% per annum over the next three years. That's shaping up to be materially lower than the 29% per annum growth forecast for the broader industry.

In light of this, it's understandable that CorMedix's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

CorMedix's P/S has taken a dip along with its share price. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that CorMedix maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

If you're unsure about the strength of CorMedix's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.