Corteva, Inc. (NYSE:CTVA) is largely controlled by institutional shareholders who own 87% of the company

CORTEVA INC CTVA | 0.00 |

Key Insights

- Significantly high institutional ownership implies Corteva's stock price is sensitive to their trading actions

- 51% of the business is held by the top 14 shareholders

A look at the shareholders of Corteva, Inc. (NYSE:CTVA) can tell us which group is most powerful. We can see that institutions own the lion's share in the company with 87% ownership. Put another way, the group faces the maximum upside potential (or downside risk).

Since institutional have access to huge amounts of capital, their market moves tend to receive a lot of scrutiny by retail or individual investors. As a result, a sizeable amount of institutional money invested in a firm is generally viewed as a positive attribute.

Let's delve deeper into each type of owner of Corteva, beginning with the chart below.

What Does The Institutional Ownership Tell Us About Corteva?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

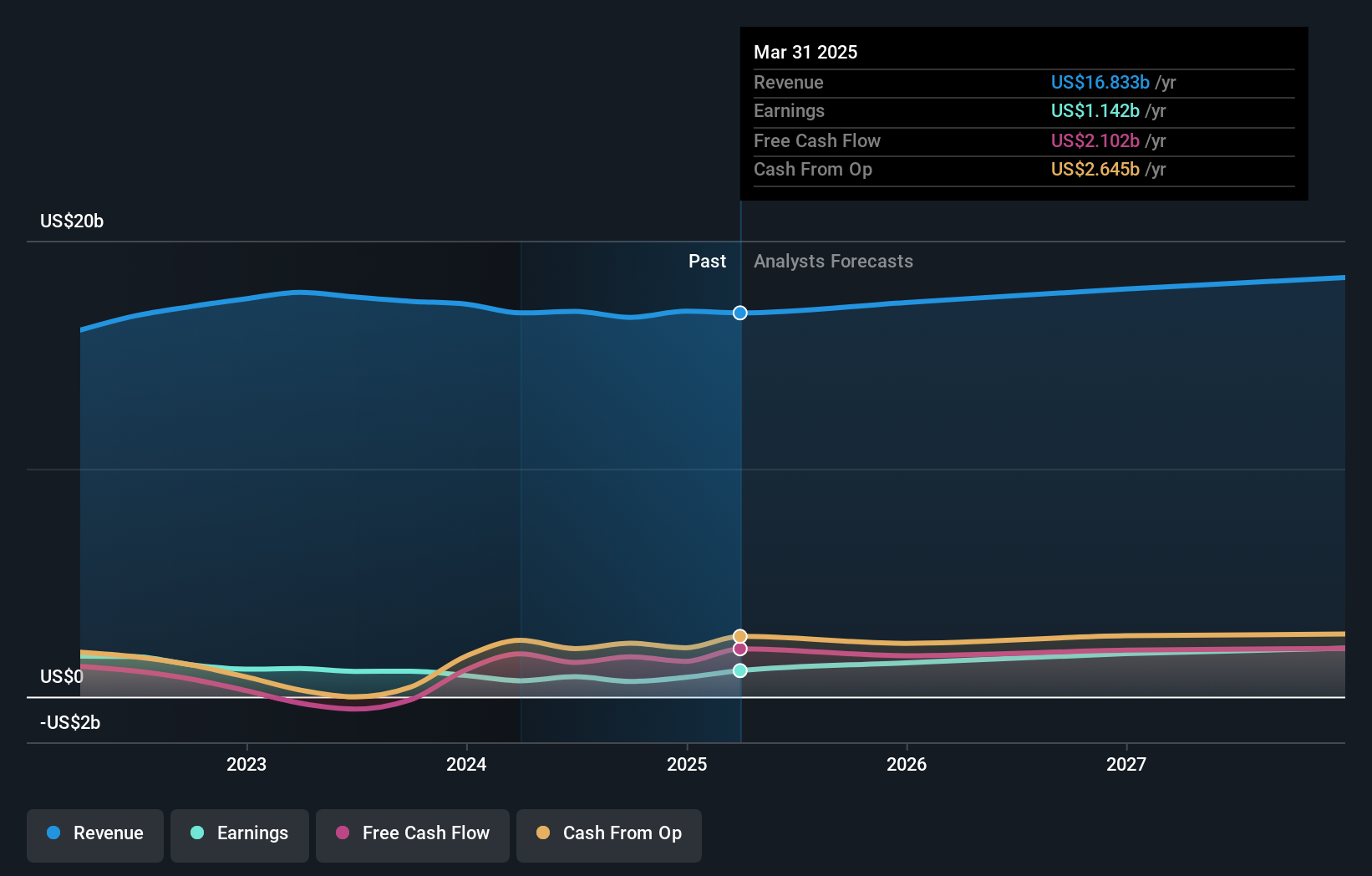

As you can see, institutional investors have a fair amount of stake in Corteva. This implies the analysts working for those institutions have looked at the stock and they like it. But just like anyone else, they could be wrong. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of Corteva, (below). Of course, keep in mind that there are other factors to consider, too.

Institutional investors own over 50% of the company, so together than can probably strongly influence board decisions. We note that hedge funds don't have a meaningful investment in Corteva. The Vanguard Group, Inc. is currently the company's largest shareholder with 12% of shares outstanding. BlackRock, Inc. is the second largest shareholder owning 7.6% of common stock, and Capital Research and Management Company holds about 6.1% of the company stock.

A closer look at our ownership figures suggests that the top 14 shareholders have a combined ownership of 51% implying that no single shareholder has a majority.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. Quite a few analysts cover the stock, so you could look into forecast growth quite easily.

Insider Ownership Of Corteva

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

Our data suggests that insiders own under 1% of Corteva, Inc. in their own names. Being so large, we would not expect insiders to own a large proportion of the stock. Collectively, they own US$63m of stock. It is always good to see at least some insider ownership, but it might be worth checking if those insiders have been selling.

General Public Ownership

With a 13% ownership, the general public, mostly comprising of individual investors, have some degree of sway over Corteva. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too.

If you would prefer discover what analysts are predicting in terms of future growth, do not miss this free report on analyst forecasts.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Recommend

- Insights 18/11 03:00

Barclays Maintains Equal-Weight on Full Truck Alliance Co, Lowers Price Target to $12

Benzinga News 19/11 13:48Astrotech Has Initiated A Review Of Strategic Alternatives In Order To Explore Ways To Maximize Shareholder Value; The Review Will Include A Range Of Potential Actions, Including Raising Equity Capital, Reverse Mergers, Combination Transactions, A...

Benzinga News 19/11 14:18Agroz CFO May Jin Sim Resigns; Nur Elliyana Mahani Appointed Successor

Benzinga News 19/11 19:56Earnings Troubles May Signal Larger Issues for Adecoagro (NYSE:AGRO) Shareholders

Simply Wall St 20/11 10:36Technical analysis of gold, the US dollar, and Bitcoin

Insights Today 09:17Investors Don't See Light At End Of Farmmi, Inc.'s (NASDAQ:FAMI) Tunnel And Push Stock Down 27%

Simply Wall St Today 10:30Assessing Andersons (ANDE) Valuation Following Recent Share Price Gains

Simply Wall St 1h