Please use a PC Browser to access Register-Tadawul

Could Alight's (ALIT) New AI Partnership Reshape Its Competitive Edge in HR Tech?

Alight ALIT | 2.11 | -0.94% |

- In September 2025, Alight, Inc. announced the addition of Sword Health's AI-powered musculoskeletal and mental health care solutions to its Alight Partner Network, further integrating advanced clinical-grade care into the Alight Worklife® platform for employers and their workforces.

- This partnership brings outcome-based pricing, personalized care, and proven healthcare cost savings, distinguishing Alight's employee benefits platform in an increasingly competitive HR technology sector.

- We'll explore how integrating Sword Health's AI-driven clinical solutions may influence Alight's investment narrative and potential for recurring revenue expansion.

Find companies with promising cash flow potential yet trading below their fair value.

Alight Investment Narrative Recap

The investment case for Alight centers on its ability to convert employer demand for integrated, AI-driven HR and healthcare solutions into higher recurring revenue, while overcoming hurdles in signing and expanding major client contracts. The Sword Health partnership has the potential to boost Alight’s appeal and recurring revenue opportunity, but whether it will meaningfully shift the near-term catalyst, accelerating late-stage bookings, or ease concern over sluggish new client growth remains to be seen. The most relevant recent development is Alight’s mid-2025 launch of major enhancements to its Worklife® platform, which is now even more closely aligned with the Sword Health integration and recurring revenue ambitions. By contrast, investors should not overlook the persistent risk that flat participant volumes and signs of core market saturation...

Alight's narrative projects $2.5 billion revenue and $142.2 million earnings by 2028. This requires 3.0% yearly revenue growth and a $1.24 billion increase in earnings from -$1.1 billion today.

Uncover how Alight's forecasts yield a $8.21 fair value, a 147% upside to its current price.

Exploring Other Perspectives

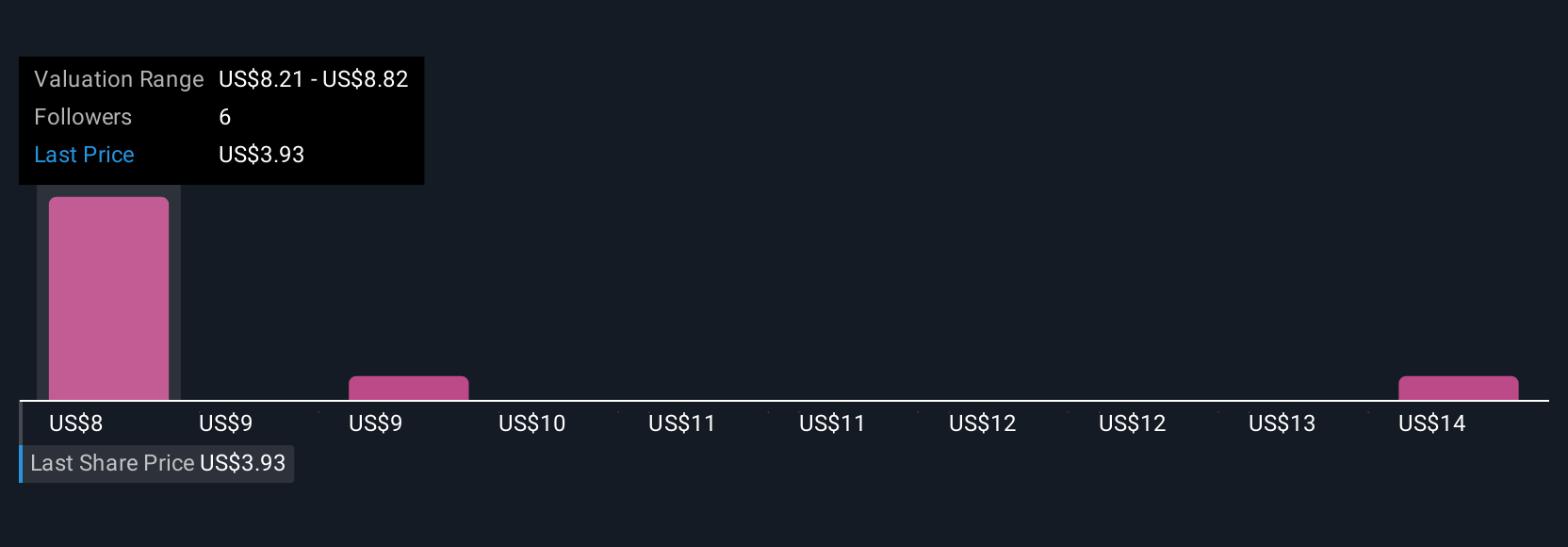

Three members of the Simply Wall St Community place Alight’s fair value between US$8.21 and US$13.38 per share. While recurring revenue innovations receive attention, ongoing challenges with new client signings could have a significant effect on the company's outlook, so check other viewpoints before deciding.

Explore 3 other fair value estimates on Alight - why the stock might be worth over 4x more than the current price!

Build Your Own Alight Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alight research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Alight research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alight's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 30 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.